May 2023 China PP to Slide amid Insipid Demand and Supply Growth

Preamble: Entering Q2, 2023, both China’s PP supply and demand waned. Although the supply decline gave strong support to the PP market, China’s PP prices fluctuated downward, as the overall PP demand remained sluggish. Will the PP price rebound in the late period of Q2, 2023 amid an expectation of supply-demand pattern variation?

China’s PP prices performed poorly in Q1, 2023 with supply increase and slow recovery of demand.

China’s PP capacity continued to expand in Q1, 2023, during which fresh capacity reached 1,850kt/a, up about 34% Y-O-Y. As of end-Q1, China’s PP capacity totaled 34,930kt/a. Therein, capacity expansions were intensive in February, but ample maintenance and abnormal operation of some units eased the supply pressure. In March, unit restart, stable operation of new units and continuous capacity release pushed up PP supply pressure. Newly built units were concentrated in North China and South China in Q1, and they may still be concentrated in South China from Q2 to Q4 of this year.

Capacity expansion also brought output increase in Q1. PP output rose by 3.38% Y-O-Y, despite that output loss soared by 90.68% Y-O-Y amid intensive maintenance, and the overall operating rate hovered at lows. Specifically, PP output and operating rates both increased slightly in January 2023 amid less maintenance. The output loss caused by maintenance was 336.8kt in December 2022 and dropped to 300.1kt in January 2023. In February, PP output and operating rates both went down amid more maintenance. The output loss caused by maintenance was around 358.8kt in February 2023, up 50.2kt from January. Around 16 producers newly arranged overhauls this month, while 13 producers restarted the closed units. 18 producers kept units closed. Besides, PP output and operating rates both rallied in March with fewer output losses and capacity expansions. The output loss caused by maintenance was around 346.1kt in March 2023, down 5.1kt from February. Around 22 producers newly arranged maintenance this month, while 13 producers restarted production. For unit maintenance, it was resulted from both routine maintenance schedule and profit losses.

The actual demand for PP was softer than expected in Q1 of this year. The trading was tepid, and this impaired the PP price. Specifically, the end demand and downstream production resumed normal, but the overall demand for PP was still limited. After the Spring Festival holiday, new orders at downstream plants continued to grow, but the growth was slow. Generally, downstream operating rates performed more weakly than last year. Downstream units resumed production successively between February 10 and 15, and most of the units resumed normal production at the end of February. However, the continuous improvement in operating rates became limited in March, and some downstream enterprises cut back operating rates amid higher inventories of semi-finished and finished products, which resulted from inadequate orders. Therefore, downstream users maintained hand-to-mouth procurement of PP, and their procurement cycle was shortened.

Generally, PP prices performed weakly in Q1, with supply increase amid capacity expansion and slow recovery of demand, in spite of intensive maintenance. Exports of PP downstream products declined, further denting the PP demand.

According to SCI’s data, China’s PP prices fluctuated downward and hovered at lows at the beginning of Q2, 2023, mainly curbed by the lackluster demand. There will probably be notable changes in PP supply and demand in the rest of Q2, 2023, which is worth focusing on.

China’s PP prices remained low.

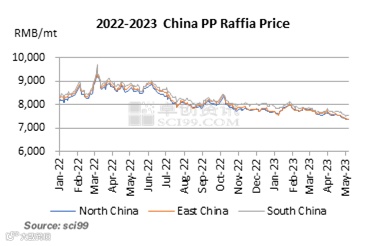

China’s PP prices fluctuated downward in Q2, 2023, and the mainstream PP prices further dropped. Therein, China’s PP prices slightly rebounded at first and then fluctuated downward in April. Entering May, against the backdrop of tepid demand, China’s PP prices further went down after the Labor Day holiday. Taking the PP raffia price in East China as an example, PP raffia prices in East China declined from RMB 7,680-7,830/mt in early April to RMB 7,350-7,450/mt on May 8, down RMB 330-380/mt. Overall, the sluggish demand was the key factor dragging down PP prices.

China’s PP supply shrank, supporting the PP market.

PP supply decline gave strong support to the PP market, underpinning the PP prices somewhat. Although the relatively intensive PP capacity expansion notably hit China’s PP market this year, the supply pressure was alleviated somewhat in April, as there was no newly added PP unit startup.

As for the unit maintenance, PP units took overhauls intensively from April to May. Under the cost and supply pressure, many PP producers shut units down for maintenance or cut unit operating rates. According to SCI’s data, operating rates of PP units averaged 78.62% in April, down 5.13% M-O-M and down 2.97% Y-O-Y. Given the intensive unit maintenance and no fresh capacity in April, the overall supply pressure on China’s PP market alleviated somewhat in Q2, 2023, supporting China’s PP market.

PP inventory saw minor fluctuations, giving thin support to the PP market.

China’s PP inventory at major producers hovered at a medium-to-low level, lending limited support to the PP market. According to SCI’s data, the PP inventory at major producers hovered at 630-890kt in Q2, 2023. Many PP units took overhauls, so the overall PP supply was curtailed, alleviating the inventory pressure on PP producers. The overall PP inventory at producers was relatively rational after the Labor Day holiday, supporting the PP market. Moreover, the decline in PP inventory was limited in the wake of tepid demand. Especially after the Labor Day holiday, the PP inventory at major producers gave minor support to the PP market.

Units will probably take overhauls intensively in May. Although the demand for PP may remain sluggish, intensive unit maintenance will probably alleviate the inventory pressure on PP producers. Besides, market participants are recommended to pay attention to the new unit startup.

PP demand underperformed, impairing the PP market.

China’s PP mainstream prices moved downward, mainly as the demand for PP remained tepid. April is the traditional demand peak season for China’s PP market. However, the export orders shrank dramatically in April 2023, and operating rates at China’s PP downstream enterprises saw notable declines, hindering the demand for PP.

According to SCI’s data, the operating rate of the major downstream industry of PP in April 2023 witnessed M-O-M and Y-O-Y declines. The downstream newly added orders were insufficient, so PP producers cut selling prices to promote sales. Moreover, most downstream users cut unit operating rates under inventory pressure. Accordingly, the overall PP demand performed poorly, hindering the PP price increments.

There will probably be changes in supply-demand pattern amid unit maintenance and capacity expansion.

It is predicted that China’s PP market will witness an oversupply in May. As for the PP supply, PP units will probably take overhauls intensively in May, and the 200kt/a PP unit line 2 at Shandong Chambroad Petrochemicals, the 400kt/a PP unit at Oriental Energy (Maoming) and the 600kt/a PP unit at Grand Resource Phase II may come on stream in May. Accordingly, the overall PP supply is likely to rise. In terms of the PP demand, it is estimated that China’s PP demand will see minor improvements in May. Thus, China’s PP prices will probably decline further in May with sluggish demand and severer supply pressure. Overall, in Q2, 2023, crude oil and propane prices are expected to grow, while steam coal prices may fluctuate downwards slightly. For PP producers, the overall production cost will likely stay high. But insipid market demand and supply growth may impair PP market prices a lot. Generally, SCI holds that China’s PP mainstream prices will go down in Q2.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.