PX Market to Remain Strong in Q4, 2023

The first batch of PX futures contracts listed for trading on September 25, 2023, are PX2405, PX2406, PX2407, PX2408 and PX2409, with the benchmark price of RMB 9,550/mt.

Cost-wise, the supply of crude oil is anticipated to stay constrained in the fourth quarter due to Saudi Arabia’s extended production reduction, and recent market sentiment has been positive, supporting the cost of chemicals.

The PTA and polyester producers are operating at a high operating rate overall during the customary peak demand season, which will firmly support the PX market from a supply and demand standpoint. As a result, the short-term price of PX is more likely to increase than decrease.

PX cost to remain strong in the fourth quarter, but oil prices are uncertain in the medium-to-long term.

A tight supply pattern of crude oil is expected in the fourth quarter, as Saudi Arabia and Russia have announced to prolong the production cut through the end of 2023. Despite the expectation of a mild recession in the US economy, there is still some support for demand in the fourth quarter.

At the macro level, the Federal Reserve’s interest rate hike has come to an end, and overall market liquidity and risk appetite have rebounded. As a result, crude oil prices may continue to remain high in the fourth quarter.

In 2024, the overseas economy may further deteriorate under the influence of high interest rates, and demand growth may slack off. If OPEC stops reducing production, the supply tension will be alleviated, which is projected to diminish the support for the oil price.

PX inventory to pile up in Q4, but the supply-demand pattern may improve in H1, 2024

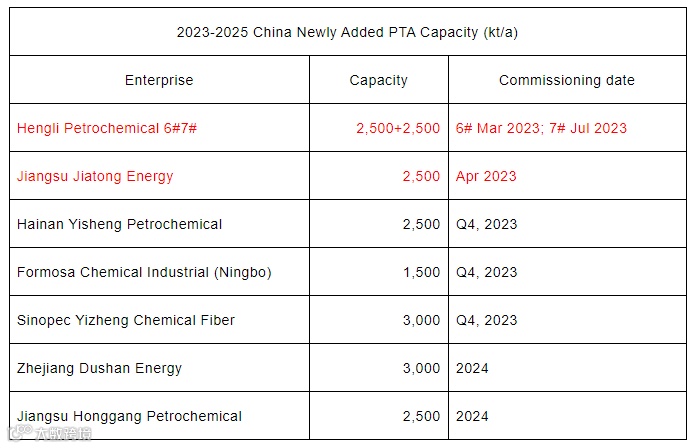

Although PX capacity increment was greater than that of PTA, PX supply pressure was restrained in the second quarter supported by intensive unit turnarounds in Asia and robust oil blending demand in the US. As of September 2023, a total of 7.7 million mt/a of PX capacity and 7.5 million mt/a of PTA capacity have been put into operation this year.

The commissioning of new PX projects is mostly complete, and there are fewer maintenance schedules for PX units in the fourth quarter. What’s more, the processing fee of PX has remained above $400/mt. Therefore, China’s PX supply is projected to stay high in the fourth quarter.

The projected new PTA facilities at Hainan Yisheng Petrochemical, Formosa Chemical Industrial (Ningbo), and Sinopec Yizheng Chemical Fiber are expected to come online intensively at the end of 2023, which will have little effect on the overall supply in the fourth quarter. Low processing costs and a small increase in end demand may also be a constraint on the actual operating rate of PTA units. In light of this, PX inventory may increase in the fourth quarter. Additionally, it is anticipated that as the US’s off-demand season approaches, demand for PX in the oil blending industry will decline, which might lower the cost of PX processing.

The first contract PX2405, however, will not be delivered until May 2024. The traditional maintenance season for PX units in Asia and the busiest time for international oil blending are typically the second quarter. New PTA projects are also anticipated to be put into operation in the second quarter of 2024. PX price drivers are therefore still robust for the medium-to-long term.

Given that the PX2405 contract’s delivery date is still some time off, many factors will affect the price of PX2405. During this period, there will be a switch between downstream peak and off-demand seasons, as well as a shift from a tight to a loose supply of crude oil. Therefore, the absolute price may also change with oil prices and market sentiment.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.