Will China’s PP Price Ramp Up as Expected in Sep?

Preface: China’s PP market prices performed weakly in August amid struggle among sluggish demand, growing supply and high feedstock cost. Therein, PP prices moved downwards in early August but spiraled upwards in the second half of this month with high cost and weak demand in a constant struggle. The downstream demand didn’t improve notably, and market prices were slightly stalemated. In September, PP prices will probably ramp up because the rigid demand for PP is expected to perk up in September, and feedstock cost may stay firm. However, the limited improvement in demand and growth in supply may inhibit the upward range of price.

China’s PP market prices dropped at first but then rebounded in August, while mainstream prices inched lower. Therein, PP prices moved downwards in early August but spiraled upwards in the second half of this month with high cost and weak demand in a constant struggle. The downward range of low-MFR PP copolymer price was wider than that of raffia price, as the former saw abundant supply with higher production shares and limited improvement in demand. Their price spread shrank accordingly to around RMB 110-275/mt.

The overall supply of PP grew notably in August because new units released output steadily after temporary shutdown, and there were fewer maintenance works for PP units. For demand, downstream processors maintained low operating rates amid limited new orders and poor profitability, restricting the consumption of PP. Thus, PP market prices went down due to higher supply and insipid demand. However, crude oil and propane prices gained ground in late August, bolstering the PP price. Besides, the expectation for interest rate reduction by the Fed and increase in PP futures prices boosted the market stance. Generally, PP prices rallied in late August.

Insipid Downstream Demand Weighed Down PP Prices Noticeably

The downstream demand in August was softer than expected. Some downstream plants reduced offers to attract buyers because their fresh orders improved narrowly. Accordingly, their profitability and operating rates remained relatively low. Their purchase of PP was still on a just-needed basis. In previous years, downstream plants usually stocked up before the coming of demand peak in September and October, but they represented poor appetite in buying this year because their sales had not improved effectively. That put a dampener on the PP market price.

PP Producer Inventory Consumption Slowed Down in Aug

The inventory at major PP producers rose notably in August with higher supply and insipid demand. For consumption, first, downstream plants showed soft interest in building the stock because their new orders were deficient. Second, traders were wary about stockpiling, as their sales were slack amid tepid deals. Generally, the producer inventory consumption was limited, and some producers saw an accumulation in inventory, pressuring the players’ confidence.

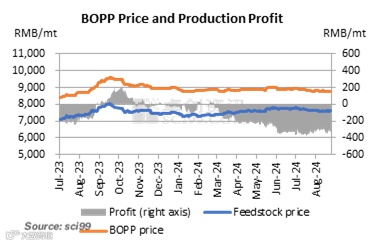

Profit Loss at Producers Cushioned PP Price Declines

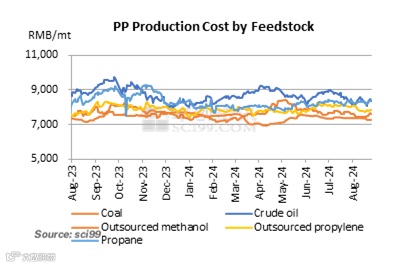

Crude oil prices rose consecutively in August. For feedstock source, except for coal and outsourced methanol, crude oil, propane and outsourced propylene-based PP production costs were far higher than PP prices. Producers were inclined to maintain firm offers to avoid severer profit loss, which alleviated the PP price decline.

In September, PP prices are likely to gain ground due to the improvement in transactions. However, the demand improvement may be limited compared with the same period of last year, which may constrain the price growth rate. In terms of supply, there may be no newly added capacity in September, but scheduled maintenance decreases, so PP supply will possibly climb a little, which may pressure the PP market price. As for cost, crude oil values may be underpinned by the Fed’s interest rate reduction and geopolitical disturbances, suggesting firm cost support for the PP market. In conclusion, PP market prices may ramp up in September, but the growth rate may be dampened by supply growth. It is worth focusing on the Mid-Autumn Festival holiday in mid-September and National Day holiday in end-September, which may push up the PP producer inventory. If the downstream demand is inadequate, the producer inventory consumption will be restricted, further denting the spot PP price in China.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.