Coastal Methanol Market to Fluctuate Under Downward Pressure in Q2 After Notable Rise in Q1

In Q1, 2024, China’s coastal methanol market first rose and then fell somewhat, with an overall large price rise. Up to March 29, the spot price in Taicang of Jiangsu averaged RMB 2,592.62/mt, up 5.9% Q-O-Q. In addition to the upturn in the macro-environment and commodity market, the favorable fundamentals including low supply, low inventory and stable demand, supported the coastal market price to a large extent.

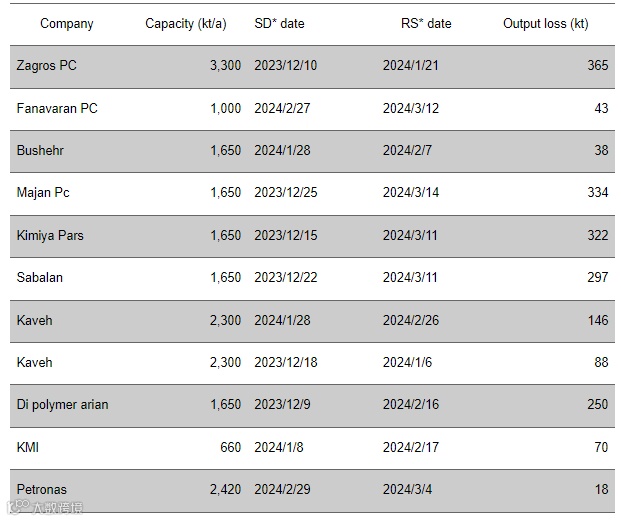

Monthly import volume dropped to lows due to intensive overseas production outages.

Q1, 2024 Some Overseas Methanol Unit Maintenance

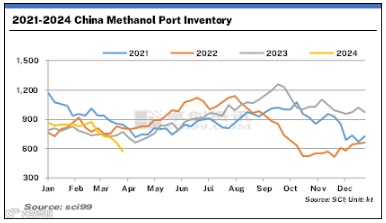

In Q1, the methanol units in the Middle East, Indonesia, Malaysia and the U.S. saw concentrated production outages or reductions. According to SCI, the output loss in a certain country in the Middle East was estimated at 1,883kt in Q1, up 1254.67% Y-O-Y. Consequently, China’s import volume stayed at a low level, with the monthly import volume in February and March below 900kt, a new low since February 2022. In addition, repeated closure of navigation at ports affected the unloading of imported cargoes. Thus, the port inventory dropped constantly. Up to March 28, the methanol inventory in Jiangsu fell to 266kt, a new low in the same period of recent years.

Stable demand and smooth value transmission underpinned methanol price rises.

In Q1, the recovery in the commodity market boosted market confidence, and stable demand was an important factor driving up methanol prices. In the coastal market, the major downstream industries, such as MTO and acetic acid, maintained relatively high operating rates. From January to March, except for the short-time maintenance of a few units, the overall operating rate of MTO units averaged 78.52%, up 12.94 percentage points Y-O-Y. The production of other traditional downstream plants was also largely stable.

Forecast: Coastal methanol market prices may fluctuate under pressure from supply-demand tug-of-war in Q2.

Looking ahead to Q2, the supply-demand fundamentals will remain the important influencing factor besides cost changes.

On the cost side, steam coal prices may fluctuate downwards. For one thing, Q2 is the slack season of coal demand, and users may mainly purchase on a need-to basis. For another, high import volume and high inventory are also drags on coal prices. As for import costs, considering some overseas unit maintenance plans and China’s low prices, import costs may remain higher than domestic market prices in Q2.

On the supply side, China’s domestic market has entered the traditional “Spring Overhaul” since April, with some methanol units scheduled to take maintenance. However, current industrial profits may dampen methanol producers’ willingness to take maintenance. As for imports, with overseas production recovering, the import supply is expected to rise. Overall, the total supply in China may increase in May and June when the port inventory is likely to climb.

On the demand side, with some units resuming production, the overall operating rate of the MTO industry is predicted to rise slightly. And it also needed to pay attention to the influence of crude oil changes on the profitability of the MTO industry, thereby affecting enterprises’ production positivity. As for traditional downstream industries, the production is projected to be largely stable in April and May but may be somewhat influenced by the seasonal factor in June. In addition, it still needed to pay attention to some possible downstream capacity expansion in Q2.

On the whole, the tug of war between supply and demand is still fierce. In the near term, stable rigid and short-covering demand is considered as the main support for the market. However, with methanol prices rising, downstream users will show resistance, and supply pressure may intensify as well, which may drag down the prices again. It is estimated that the mainstream price in the coastal methanol market may fluctuate in the range of RMB 2,450-2,600/mt in Q2.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.