Conventional Tariff Rates Imposed on Synthetic Rubber

According to the PRC Import and Export Tariff Regulations and the Second Amendment to the Asia-Pacific Trade Agreement approved by the State Council, as of July 1, 2018, the conventional tariff rates will be applied to imported goods originating from Bangladesh, India, Laos, South Korea and Sri Lanka.

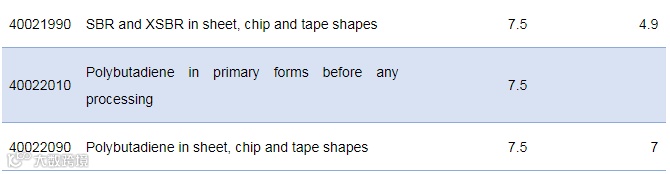

July 1 2018 Latest Conventional Tariff Rates Imposed on Synthetic Rubber

According to the HS code, 40021990 is divided into 40021990.01 (simply processed SBR) and 40021990.90 (others). According to SCI, the proportion of import volume under HS code 40021990 kept increasing. In 2017, that increased to 72.5% of the total import volume of SBR. The products imported under the code contained not only non-oil-extended SBR, but also oil-extended SBR and SSBR.

Major HS code for polybutadiene is 40022090. In the past 5 years, the proportion increased to 73% of the total import volume of polybutadiene.

According to the new tariff rates, the tariff rates for HS code 40021990 and HS code 40022090 will be lowered by 2.6% and 0.5% respectively. As for the HS code 40021990, the import cost will drop by RMB 200-300/mt theoretically based on the average import price of $1,974/mt in March. As for the HS code 40022090, the import cost will drop by RMB 100-200/mt theoretically based on the average import price of $1,880/mt in March.

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6296499