China North-South Benzene Price Disparity Contracts in 2025

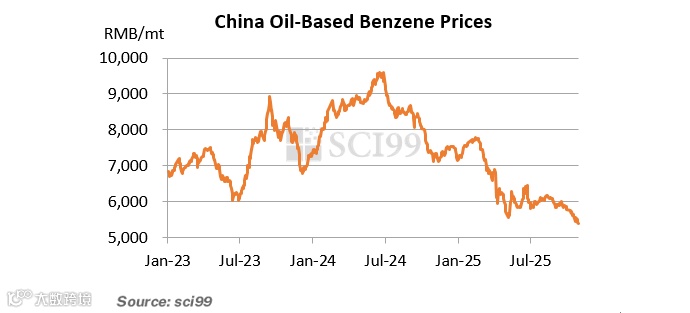

In 2025, influenced by multiple factors such as declining oil prices and shifts in supply-demand dynamics, the domestic benzene market experienced a retreat from high prices followed by wide fluctuations at lower levels. Price disparities between different regional markets continued to evolve.

Benzene prices fell to a new low since February 2021.ory board production profit improved with rising prices

Overall, in 2025, the domestic benzene market showed a slight increase followed by a significant decline, and then wide fluctuations at the bottom. As of October 27, the market price of benzene in East China hit a yearly low of RMB 5,450/mt, reaching its lowest level since February 2021. Many negative factors contributed to the consecutive price drops during the year.

Firstly, benzene import growth was significant in 2025. From January to September, cumulative benzene imports reached 4,114.7kt, a YoY increase of 40.54%, increasing pressure on the domestic supply. Secondly, international crude oil prices fluctuated downward during the year, negatively impacting benzene prices. Thirdly, the tariff policy restricted exports of some end-use products, increasing negative pressure on demand for benzene. Moreover, the direct downstream sectors of benzene continued to face increasing pressure from losses in 2025, strengthening the negative feedback on benzene.

The North-South benzene price disparity continued to narrow in 2025.

According to monitoring data from SCI, as of October 27, 2025, the average price of benzene in East China was RMB 11/mt higher than that in Shandong, narrowing the price difference by RMB 64/mt compared to the full-year average of the previous year. The North-South benzene price differential after 2020 basically showed a yearly narrowing trend. The main reason is that few new benzene production capacities were added in North China in recent years, while the commissioning of large-scale downstream plants was concentrated, leading to a continuously expanding supply gap in Shandong. Consequently, the price differential between Shandong and East China gradually narrowed, and the probability of arbitrage windows opening decreased.

From January to September 2025, the North-South price differential was basically flat. However, after entering October, Shandong market prices became sluggish due to the weakening of the supply-demand pattern, so the price differential with East China significantly widened. As of October 28, the average price of benzene in East China for that month was RMB 195/mt higher than in Shandong. The North-South arbitrage window began to reopen, and some benzene from Shandong started flowing into East China to supplement East China’s supply. Based on the current market structure, the North-South arbitrage window is expected to remain open, and the price differential between the two regions for the whole year of 2025 is projected to widen again from the current level of RMB 11/mt.

Regarding the trend in the fourth quarter, overall demand for domestic benzene is not optimistic. Large downstream plants in North China that were previously shut down have no immediate plans to resume operations. On the supply side, new refineries in the Shandong and Henan regions continued to come online after October. With the ongoing weak supply-demand outlook in North China, the North-South price differential is expected to continue widening. Looking ahead to 2026, downstream plants in North China face flexibility in operations after prolonged losses. Whether the narrowing trends of the North-South benzene price differential can continue still involves significant uncertainty.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.