2017 October C4 Raffinate II Downstream Product Brief Report

In October, the monthly average C4R2 price in China was RMB 4,497/mt, that in Shandong was RMB 4,772/mt. Although the profit of most C4R2 downstream products remained high, the overall profit dropped obviously from last month.

In October, the monthly average LPG price in China was RMB 4,377/mt, up RMB 420/mt or 10.61% from last month. As for C4R2, the monthly average C4R2 price in China was RMB 4,497/mt, up RMB 305/mt or 7.28% from last month, that in Shandong was RMB 4,772/mt, up RMB 241/mt or 5.32% from last month. At the beginning of October, supported by the surged CP October, the cost of imported LPG increased. Besides, as the expressway transportation recovered after the National Day and Mid-Autumn Festival holidays, and end users replenished stocks, China’s LPG prices climbed gradually. However, with the replenishment at downstream enterprises nearing an end, meanwhile, as downstream users showed weaker purchasing interest in high-priced resources, sellers sold goods with discounts, as they intended to promote sales with preferential measures. Later, the supply-demand fundamentals were balanced gradually, and the LPG prices moved sideways.

In October, prices of MEK and blended oil products climbed, while prices other C4R2 downstream products dropped. Hereinto, the alkylated oil prices surged by 2.75% from last month, and the butadiene prices dropped obviously by 15.09% from last month. Besides, prices of most C4R2 downstream products increased from last year, but the prices of butadiene and iso-butylene shrank greatly.

China’s butadiene market fluctuated downwards in October amid tepid trading atmosphere. Prices saw sharp declines in the butadiene imports market, dragging down China’s butadiene market notably. In addition, newly-added units were put into operation in China, and some downstream producers cut down production, thus, the butadiene supply was ample.

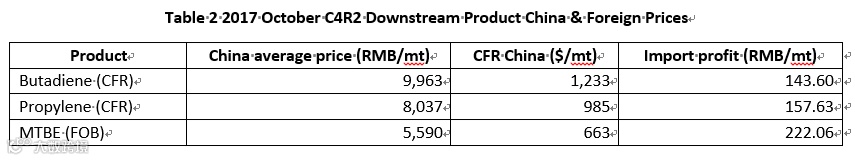

By late October, delivered prices for butadiene in Shandong and East China were RMB 9,200/mt and RMB 9,000–9,200/mt respectively. Offers for imported butadiene were at $1,000/mt roughly, CFR China, equivalent to RMB 7,880 /mt or so (self-delivery price), and that was lower than the current price in the East China market. The supply was passable in the butadiene imports market, yet players adopted thin appetites for purchasing, amid sufficient supply in China’s butadiene market.

As for propylene, the Asian propylene market prices slipped a little in October. After the National Day holiday, the propylene market was soft in East China, giving no support to the Asian propylene market. The foreign propylene producers would rather sell contract goods than sell spot goods. In late October, the PP unit at Mitsubishi Chemical Company was shut down. The supply volume of Japanese propylene increased by about 10,000mt/month. A lot of low-priced resources occurred, impacting the Asian propylene market. It was heard that dealing prices hovered at $935–950/mt. At the end of October, imported goods arrived at ports intensively, and China’s propylene prices dropped, leading to a decrease in the Asian propylene prices. As of October 30, CFR China closed at $977–979/mt, down $16/mt or 1.61% from the beginning of October.

In terms of MTBE, the average cost of Singapore imported MTBE was around RMB 5,819/mt, down RMB 114/mt from last month. In October, the trading activity of MTBE in South China was tepid, and the negotiation prices hovered at RMB 5,800–5,900/mt. In the meantime, the average price of MTBE in Singapore kept dipping, and the Singapore-China import arbitrage window opened again in H2 October. Traders showed stronger interest in their operations. As the overall China’s refined oil market remained weak, there were risks in the import market.

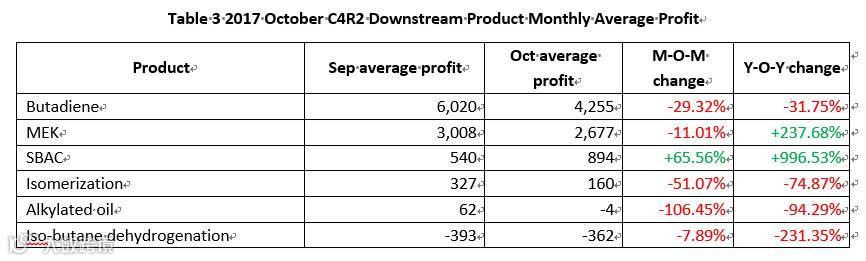

According to table 3, the monthly average profit of butadiene in October was the highest. Currently, butene oxidative dehydrogenation based units started up at Zibo Qixiang Tengda Chemical and Jiangsu Sailboat Petrochemical. The profitability of producers was not favorable and the butadiene resources were mainly self-used and given to downstream producers who had signed the contract. Theoretical profits for butadiene producers with integrated ethylene units were around RMB 4,255/mt in October, down from last month. In October, the highest and lowest profits of MEK were RMB 2,800/mt and RMB 2,700/mt respectively, and the average profit was around RMB 2,677/mt. Meanwhile, the average profit of SBAC was RMB 893.6/mt. The overall output at major enterprises was low, while downstream users showed strong interest in replenishing stocks. Suppliers maintained firm offers, and the negotiation prices kept rising. Therefore, the profits of enterprises grew quickly. Later, influenced by the stagnant market atmosphere, the sales of high-end resources were tough, and the dealing prices dropped somewhat. Besides, the average profit of iso-butane dehydrogenation unit in Shandong was RMB -362/mt, and these units suffered great profit losses. Considering that most iso-butane dehydrogenation plants in Shandong own n-butane isomerization units, it is predicted that the profit of iso-butane dehydrogenation plants was around RMB -347/mt.

For more information please contact us at

overseas.sales@sci99.com

+86-533-6296499