SWP Market Likely Stay High Backed by Supply Side Disruptions

In April, the imported SWP spot market price rose by 2.08% M-O-M, which went against the traditional seasonality. It is advised to pay attention to changes in market supply, demand, cost, ramp-up of new pulp and paper capacity as well as market sentiment changes. It is estimated that the supply and cost factor will lend clear support to the pulp market, but poor paper profitability and weaker seasonality may restrict the price rise.

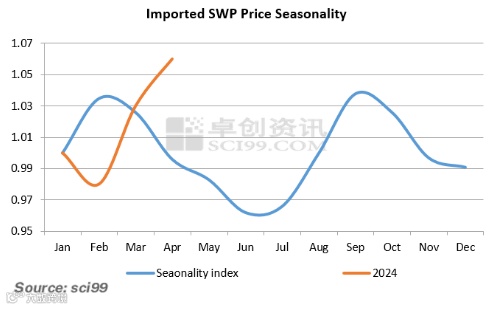

Imported SWP price rose beyond normal seasonality

In April, the monthly average spot market price of imported SWP was RMB 6,322.26/mt, up 2.08% M-O-M and 17.10% Y-O-Y. The current SWP price has risen above the historical average level mainly due to anticipated supply tightness from unexpected supply disruptions, concerns over rising costs from constantly rising import offers and the bullish BSK futures market. The SWP spot market price remained at a level throughout April, and the seasonal index rose to 1.06, which deviated from the traditional seasonality.

For the upcoming months, it is advised to pay attention to the following aspects.

Market supply: The capacity and production status of domestic and overseas pulp mills will affect the market supply. The tightened supply from overseas pulp suppliers has been a key factor supporting the SWP price. Due to the gas explosion at the Kemi mill, the import volume of China is expected to decrease in May. Rail workers of two Canadian railway companies voted for a strike on May 22. Besides, Canfor announced the planned indefinite curtailment of a pulp line due to fiber shortage, which may lead to a 300kt supply reduction of market pulp annually. Therefore, the market supply status is the key focus for pulp price adjustments.

The offer adjustments by large-sized tissue mills will affect the market sentiment and guide the market price. Currently, overseas suppliers still remain bullish. For example, the May offer for Arauco BSK has been raised to $820/mt from $780/mt in April. In addition to constant price hikes of related HWP and fluctuations in exchange rates, the cost pressure on players in the Chinese market may continue to rise in the future, which will support the bottom price of the spot market.

Demand: The paper industry has entered a traditional slack season of the year, but the demand is expected to remain somewhat resilient on the back of capacity expansion, restocking before the mid-year shopping fest and fulfillment of text-book printing orders. In general, the overall pulp demand in May is likely to rise marginally by 1.02% M-O-M. The actual demand release in May will likely determine the range of pulp price adjustments.

Industry profitability: Due to the high wood pulp import and spot prices, the profitability of paper production has been relatively low. In May, the gross profit rates of downstream paper industries may drop by 0.03pp to 2.47pp, restricting the sales of high-priced pulp.

Sentiment: The price fluctuation of the dominant futures contract at SHFE will have a clear influence on the sentiment of the pulp spot market. The co-movement changes between the futures and spot prices will mutually affect the trends in the futures and spot markets.

SCI reckons that the SWP spot price is still expected to rise in May backed by rising import costs and a narrowing supply-demand balance. However, as the paper industry enters a traditional slack season, and the low profitability of downstream paper production restricts sales of high-priced pulp, the pulp price rise may be restricted. It is also advised to pay attention to the cost optimization of paper mills, pulp market supply changes, changes in the futures market and sentiment on pulp prices.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.