Preliminary Ruling of Anti-dumping Investigation against Imports of NBR Originating in South Korea and Japan

On November 9, 2017, the Ministry of Commerce (hereinafter referred to as the “Investigation Authority”) issued Announcement No.74 of 2017, deciding to carry out anti-dumping investigation against imports of NBR (hereinafter referred to as the “Products under Investigation”) originating in South Korea and Japan.

On July 16, 2018, after more than 8 months of investigation, the Investigation Authority preliminarily ruled that there was dumping of NBR originating in South Korea and Japan, and the domestic industry of NBR was substantially damaged, and there was causal relationship between the dumping and the substantive damage.

The Investigation Authority decides to carry out interim anti-dumping measures by levying margin according to the Anti-dumping Regulations. As of July 16, 2018, import operators shall pay relevant margin to the Customs of the People’s Republic of China at the rate determined by this ruling for each company when importing the Products under Investigation. Rates of margin imposed on Kumho Petrochemical Co., Ltd., LG Chem, Ltd., Zeon Corporation and JSR Corporation are 12.0%, 15.0%, 30.0% and 18.1% respectively.

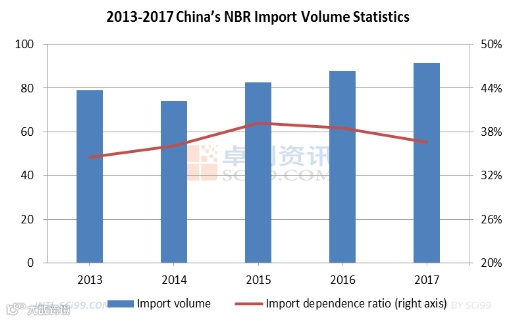

As seen from the above chart, the import volume of NBR inched down in 2014 and then moved up year by year. Although the NBR capacity increased in recent years and the utilization rate of the NBR units improved, the import dependence ratio was still above 35%. China still needs to import large amounts of NBR of established brands and high-end grades.

In 2017, the top three import origins of NBR were South Korea, Japan and Russia. The import volume from South Korea was 39kt, taking up 43% of the total. The import volume from Japan was 20kt, accounting for 22% of the total. The imports of NBR originating in South Korea and Japan accounted for more than half of the total import volume. The anti-dumping measures may influence the NBR market greatly. The levying margin will increase the import cost, and the domestic market price of NBR will rise accordingly. If the price spread between domestic NBR price and imported NBR price continues to expand, there is a possibility that some downstream demand for imported NBR may divert to Chinese-made NBR.

Due to the announcement of the preliminary ruling, the NBR market is immersed in a wait-and-see atmosphere now. Traders withhold their offers for NBR originating in South Korea and Japan for the time Beijing, waiting for clear indicators. ARLAXSEO TSRC (Nantong) Chemical Industrial stopped providing new offers and stayed on the sidelines. In view of the preliminary ruling of the anti-dumping investigation and the limited NBR resources at PetroChina Lanzhou Petrochemical, some players expect that the market price of NBR will go upwards in the short run. Most players still adopt a cautious stance, waiting for the market trend to become clearer.

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6296499