2024-2025 China SBR Capacity Analysis

Introduction: From 2020 to 2024, the SBR capacity saw a structural increase. In 2024, it may reach 1,875kt/a, and the newly added capacity in the past five years totaled 135kt/a. In 2025, China’s SBR capacity is expected to reach 2,185kt/a, up 310kt/a or 16.53% YoY.

The SSBR capacity expanded intensively driven by the carbon peaking and carbon neutrality goal.

From 2020 to 2024, the ESBR capacity saw a structural increase. In 2024, the SBR capacity is expected to reach 1,875kt/a. A total of 135kt/a SBR capacity was newly added from 2020 to 2024. The SBR capacity remained stable at 1,740kt/a from 2020 to 2021. The main reason was that SBR producers showed a thinner willingness to produce SBR with unstable marginal contribution against the intense homogenized competition and relative overcapacity in China’s SBR industry. Starting in 2022, driven by the policy of carbon peaking and carbon neutrality and the increase in the new energy vehicle output, the demand for the SSBR increased. Thus, investors were more inclined towards planning for green and environmentally friendly high-end feedstock. In 2023, the capacity of SBR increased to 1,850kt/a, up 3.35% YoY, which saw the largest YoY growth in the recent five years. In 2024, the ESBR capacity remained at 1,460kt/a, while the SSBR capacity increased to 415kt/a.

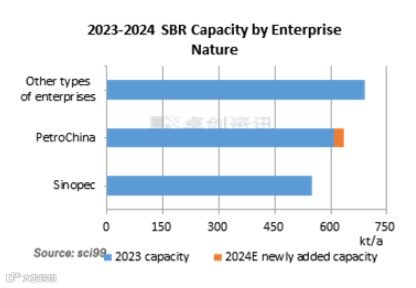

In 2024, the SBR capacity rose to 1,875kt/a, up 1.35% YoY, mainly due to the 25kt/a SSBR capacity at PetroChina Dushanzi Petrochemical going into production successfully. The products of the capacity are functionalized SSBR, which is produced by the enterprises in some periods. As for the nature of the enterprises, in 2024, the total capacity at other types of enterprises (including private enterprises, joint ventures, and foreign-invested enterprises) was stable at 690kt/a, with its share of the total capacity falling by 0.03 percentage points to 37%, ranking first. PetroChina’s total capacity was 635kt/a, accounting for 33.9%; Sinopec’s total capacity was 550kt/a, accounting for 29.3%. The main reason for the large share of the capacity at other types of enterprises was that there was some profitability in the SBR industry theoretically in certain periods.

The SBR capacity in East China ranked first.

In 2024, the SBR capacity is expected to total 1,875kt/a, with 18 SBR producers. Therein, there were 11 ESBR producers and 7 SSBR producers. China’s SBR capacity was mainly concentrated in East China, North China, South China, Northwest China, Northeast China and Central China. Therein, the capacity in North China, East China and South China took up 74.67% of the total, and that in East China, North China and Northeast China took up 34.67%, 20.27% and 19.73% respectively. In 2024, the capacity proportion of Northeast China increased, mainly as PetroChina Dushanzi Petrochemical expanded SSBR capacity by 25kt/a. The release of the capacity in Northeast China resulted in a rise in the SBR supply in East China, leading to an oversupply. Thus, the SBR resources needed to flow into other regions.

In 2025, China’s SBR capacity is expected to be 2,185kt/a, up 310kt/a or 16.53% YoY. A newly added SSBR unit with a capacity of 60kt/a at Shandong Yulong Petrochemical is scheduled to go into production in January 2025. Shen Hua Chemical Industrial may expand the ESBR capacity by 50kt/a after its ESBR unit is relocated at the end of 2024. At that time, the ESBR capacity at Shen Hua Chemical Industrial is expected to reach 220kt/a, which may come on stream in January 2025. In Q4 of 2025, there is expected to be 200kt/a newly added SSBR capacity.

The main reason for the rapid rise in the SSBR capacity may be as follows. The sales share of new energy vehicles is likely to expand, and the demand for high-performance tires may continue to rise. Thus, the SBR capacity structure is expected to be further optimized. In terms of the SSBR capacity structure, the proportion of functionalized SSBR capacity may continue to increase from 6.02% in 2024. In 2025, two SBR units are scheduled to go into production at the end of January. After the optimization, new units are expected to conduct mass production.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.