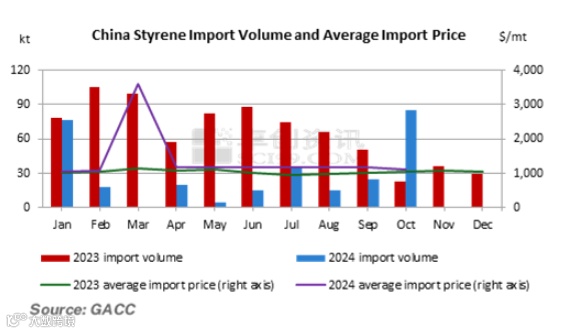

Oct Styrene Import Volume Hit the Highest in 2024

From October to November 2024, some styrene units were under maintenance. Under the expectation of a supply gap in November, the import negotiation of styrene increased from September. According to GACC, the domestic styrene import volume was 85.3kt in October, hitting the highest point of 2024.

The domestic styrene import volume was 85.3kt in October, increasing 245.96% MoM and 272.80% YoY. The average import price was $1,113.21/mt, down 4.78% MoM. The main reason for the increase in import volume was the market’s expectation of a domestic supply gap in November. From October to November, there were maintenance plans for several production units, including Zhejiang Petroleum & Chemical, CNOOC Ningbo Daxie Petrochemical and Huatai Shengfu, etc. Therefore, the maintenance loss concentrated in November. Driven by profits, the main downstream industries are expected to increase their operating rates. Some downstream factories and import traders began to actively increase import negotiations in September to ensure the supply of feedstock. From January to October 2024, China’s cumulative styrene import volume was 294.7kt, a decrease of 59.31% YoY.

October imports primarily from Asia, mainly arriving in East China.

According to GACC, China’s styrene imports in October primarily originated from Asia, with imports from Singapore amounting to 45.1kt, accounting for 52.85% of the total, an increase of 23.14% MoM. This was mainly due to the restart of a 300kt/a styrene unit in Singapore in September, which led to an increase in supply and also had a geographical advantage in terms of shipping distance. Following Singapore, imports from Saudi Arabia totaled 19.6kt, making up 22.96% of the total, a decrease of 22.92% MoM. This volume was primarily based on feedstock contracts with downstream factories. Additionally, imports from Japan, Kuwait, Malaysia, and Taiwan were 9kt, 5.7kt, 3kt, and 2.9kt, respectively.

In October, China’s styrene imports, divided by shipping regions, were concentrated in East China. Jiangsu Province received the largest volume, approximately 48.2kt, accounting for 56.45% of the total imports, an increase of 32.05% MoM. Shanghai followed with an import volume of 30.1kt, constituting 35.32% of the total imports, an increase of 5.6% MoM. Additionally, Zhejiang Province imported 7kt, accounting for 8.23% of the total, a decrease of 37.65% MoM. The concentration of domestic maintenance units in East China led to a supply gap in the area.

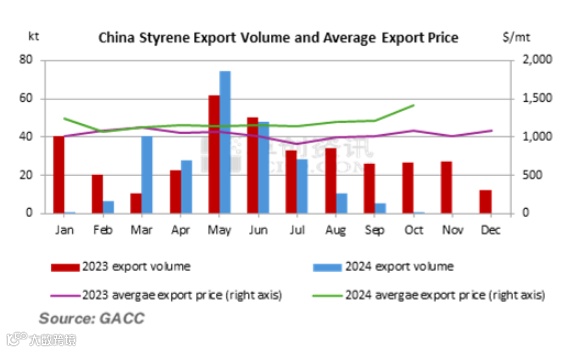

The styrene export volume fell while the price rose in October.

In October, China’s styrene export volume decreased both MoM and YoY. The export volume was 9kt, a decrease of 85.00% MoM and 96.78% YoY. The average export price was $1,417.63/mt, an increase of 17.04% MoM. In terms of trade partners, styrene was mainly exported to South America and Africa in October, with Ecuador accounting for the highest proportion at 52.94%, followed by Peru at 14.65%, and then Guatemala at 12.83%. The cumulative export volume from January to October was 243.8kt, a decrease of 25.37% YoY. The reduction in exports was due in part to large domestic units entering maintenance in October, so players anticipated a supply gap in November. On the other hand, the reduction in overseas maintenance units, coupled with weak demand and limited price differences between domestic and international markets, made it difficult to have export arbitrage opportunities.

In November, styrene import volume are expected to decrease MoM, while exports remain low. Although the maintenance loss of several domestic units was concentrated in November, the restart of the 1,800kt/a unit at Zhejiang Petroleum & Chemical and the 300kt/a unit at Tangshan Risun Aromatic Hydrocarbon was slightly ahead of schedule, slightly narrowing the domestic supply gap. Additionally, some import negotiations had already arrived in October, and there were limited new import negotiations in November, with styrene imports still primarily based on feedstock contracts with downstream factories and the import negotiations from October arriving at the port. The expected import volume for November is around 60kt, a decrease of 29.58% from October. In terms of exports, as overseas maintenance units are gradually restarting, the increased supply is putting downward pressure on international prices, leaving no opportunity for export arbitrage. As of now, there have been no reports of new export negotiations for November and December.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.