LDPE Market Growth Falters in Mar

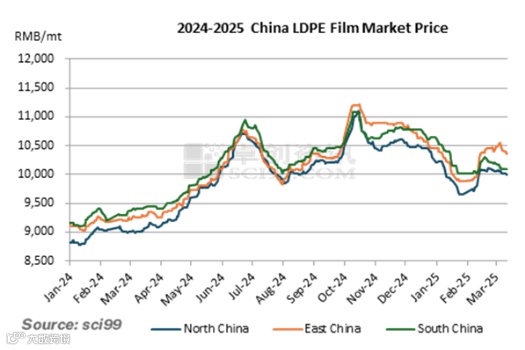

Introduction: China’s LDPE market price has shown a downward trend since the beginning of March. Looking ahead, the abundant supply and the mild improvement in demand may constrain the LDPE market growth.

In March, China’s LDPE market went down, with North China seeing a relatively smaller drop due to increased demand for agricultural film. As of March 11, the market price of LDPE in North China settled at RMB 10,000/mt, falling by 0.6% compared to the end of February. The price in East China was RMB 10,350/mt, down 1.19%. In South China, the price closed at RMB 10,090/mt, representing a drop of 0.98% from the end of February.

Looking ahead, March marks a peak season for spring ploughing, but the manufacturing of mulch film provides limited support to the demand for LDPE. What’s more, the supply of LDPE is sufficient. Therefore, there is limited upward room for LDPE market prices.

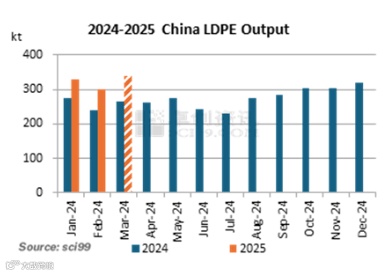

Supply: Supply Rises Along with Lower Output Loss Due to Maintenance

In mid-to-late March, Sinopec Yanshan Petrochemical’s old LDPE line 2 is scheduled for maintenance, which is estimated to last for 5-6 natural days, while other LDPE units are expected to operate normally without planned shutdowns. Based on this, China’s LDPE output loss due to maintenance in March is estimated to drop to 0.9kt, a MoM decrease of 12kt. Although Ningxia Baofeng Energy’s integrated LDPE/EVA unit is not producing LDPE at present, the number of natural days in March increases when compared to February. Hence, the estimated domestic LDPE output for March is 340kt, an increase of 13.11% from February.

Demand: Downstream producers adopt a cautious stance amid sluggish order growth

The film industry occupies approximately 70% of downstream applications of LDPE, mainly covering agricultural film and packaging. In the agricultural film industry, March sees a minor peak season for spring farming, and demand for mulch film is expected to rise notably, with some leading producers operating at full load. However, the use of LDPE in mulch film is limited, which does not provide strong support to the LDPE market. In terms of greenhouse film, Shandong and Henan provinces are major watermelon cultivation areas, where greenhouse film orders are expected to increase significantly. Besides, most greenhouse film producers keep their feedstock inventory at a medium-to-low level, so rising orders may lead to purchasing needs for feedstock. In the packaging industry, it is expected to see a contraction in export orders for March, mainly due to most Arab countries entering Ramadan between March 1 and March 30. China’s domestic market redirection of manufactured goods impeded from export is accelerated by entities relying on integrated supply chain advantages and capital barriers. By adopting intensive production methods to lower costs, along with enhancing infiltration of end-user channels, large-scale enterprises manage to offset the export slowdown, while small and medium-sized enterprises are experiencing a slowdown in order growth. Overall, the packaging industry is expected to maintain relatively stable operating rates, and producers in this industry may purchase feedstock based on rigid demand.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.