Feb PBR Supply to Rise After Falling in Jan

Introduction: In January, the PBR price trended up, with the monthly average price rising MoM. The PBR price lingered at RMB 13,000-14,700/mt in January, with the spread between the highest and lowest point at RMB 1,700/mt. This article analyzes the reason based on the fundamentals.

In January, the PBR price moved up.

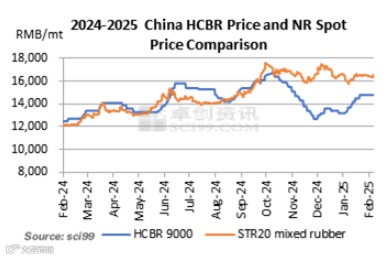

According to SCI, up to January 27, the average price of HCBR 9000 in North China was RMB 14,086.84/mt, up around RMB 764/mt or 5.74% MoM, and up 17.35% YoY.

In January, the PBR market price trended up. In early January, the natural rubber price dropped slightly, so the price spread between natural rubber and PBR narrowed marginally. Yet, the natural rubber price remained higher than the PBR price, bolstering the PBR market. The recovery in the butadiene output underperformed, and the downstream replenishment of butadiene began ahead of time, so the butadiene price moved up, putting higher pressure on the PBR cost, thereby accelerating the production cuts and unit shutdowns at PBR producers. However, downstream enterprises gradually cut or suspend production with the Spring Festival holiday approaching. The fall in the rigid demand offset part of the bullish influence of the decline in supply. Thus, the PBR price rose steadily.

The operating rate of the PBR industry dropped against profit losses.

In January, the PBR industry faced higher profit losses, curbing the operating rate of the PBR industry. Up to January 27 (before the Spring Festival), the average gross profit of the PBR industry was around RMB -136.84/mt, down 614.59% MoM. The average operating rate of China’s HCBR industry was around 67% in January, down 10 percentage points MoM.

From Q1 to Q3 2024, China’s PBR industry faced profit losses for a long time. In Q4 2024, the gross profits recovered slightly, resulting in a rise in the operating rate. In January 2025, the butadiene price advanced rapidly, and the end industries began to take holidays, so the operating rate of the PBR industry dropped notably. Among state-owned enterprises, the PBR unit at Sinopec Qilu Company ran at a slightly lower load. The operating rate at PetroChina Dushanzi Petrochemical was relatively low. The other units mainly ran normally. As for private enterprises, the units at Zhenhua New Materials, and Shandong Wintter Chemical were shut down in early January. Heze Kexin Chemical and Zibo Qixiang Tengda Chemical ran their units at lower loads. The unit at Hipro New Material Technology ran at a lower load in early January and was shut down in late January. On the whole, the average operating rate of China’s HCBR industry in January moved down MoM. Except for the units under long-term shutdown, unit shutdowns involved a total of 210kt/a PBR capacity in January, with output losses of around 11,640mt.

In February, there are fewer natural days compared to other months, but the PBR unit at Shandong Yulong Petrochemical is expected to run normally. Thus, the PBR output in February is likely to edge up. As for state-owned producers, Sinopec Qilu Company may resume two-line production, and Sinopec Beijing Yanshan Company will possibly operate normally. PetroChina Dushanzi Petrochemical is expected to run its unit at a low load. In terms of private producers, Zibo Qixiang Tengda Chemical may maintain two-line production. The unit at Hipro New Material Technology is expected to be restarted in the short term. The PBR units at Zhenhua New Materials and Shandong Wintter Chemical are likely to remain offline, and the restart time is undetermined. Heze Kexin Chemical is expected to operate its unit mainly at a low load. The operating rate of China’s HCBR units is predicted to rise to around 71%, up 4 percentage points MoM.

The natural rubber price remained higher than the PBR price for a long time, driving up the PBR price.

In January, the average market price of RMB-denominated natural rubber headed down MoM. In January, the natural rubber market first fell, then rallied, and finally trended sideways, with the monthly average price going lower MoM. In early January, due to the normal climate in overseas producing areas, the output of new field latex was sufficient. Players expected that the output would ramp up, weighing down the natural rubber price. However, in mid-to-late January, affected by an exchange for physicals of warehouse receipts, the inventory of natural rubber remained low. Thus, the spot circulation was tight, pulling up the natural rubber price from the bottom. Yet, in end-January, with the Spring Festival holiday drawing near, the trading atmosphere turned insipid in the spot market. The overall dealing was limited, and the natural rubber price mainly moved sideways. Although the natural rubber price edged down, it remained higher than the PBR price, and the price spread fluctuated within the range of RMB 1,650-3,300/mt in January. As downstream product industries gradually change formulas, the demand to replace natural rubber with synthetic rubber is expected to rise.

In February, the PBR price is expected to mainly hover at highs. After the Spring Festival holiday, the downstream demand is likely to rebound, boosting market confidence in dealings on rigid demand. Thus, the market activity may rise notably, driving up the prices of PBR futures and spot PBR. Yet, with the profits recovering, the operating rates at PBR producers may gradually recover, weakening the support from the fundamentals. Overall, the PBR price is likely to rise slightly. Yet, players are advised to pay attention to the bearish influence of the inventory pileup caused by the mismatched supply and demand around the Spring Festival holiday. Attention should be also paid to the implementation of international trade tariff policies and the influence of China’s expected macro environment on the futures prices.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.