Uncoated Woodfree Paper Price Turns Bullish Amidst Better Supply-Demand Conditions

Preview: The uncoated woodfree paper market supply has tightened slightly due to downtimes at a major integrated player. Besides, publishers started picking up volumes ordered previously, and the market supply-demand conditions improved. Paper mills posted price increase notices constantly from late November to early December, and the market price rebounded as sentiment improved. Currently, downstream players purchase essential volumes, and the demand is modest. Distributors intend to maintain a rational inventory. Therefore, the uncoated woodfree paper market is expected to remain stable for the rest of December.

Price hikes partly implemented despite bullish attitudes at paper mills

In H1 of December, the paper price first rose and then stabilized. From late November to early December, paper mills posted price increase notices cumulatively by RMB 300/mt, which bolstered the market sentiment. Distributors became reluctant to sell at lows, but downstream buyers still resisted high prices. In general, the uncoated woodfree paper market price gradually increased in H1 of December starting from southern China to northern China, but the market price stabilized during the middle of the month. According to SCI, as of December 19, the 70g uncoated woodfree paper average market price was RMB 5,363/mt, up 3.13% from late November but down 11.73% YoY.

Market supply-demand conditions improve

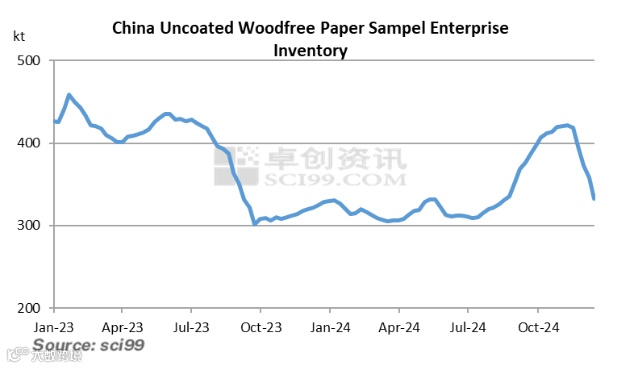

Paper lines of a major integrated player have been shut down since late November, and restarts are not seen yet. The tightening market supply provides support for the rebound in market prices. Some orders are dispersed to other paper mills, and they reflect decent order status and lowered paper inventory. As of December 19, the inventory at uncoated woodfree paper producers dropped about 16% from late November.

The paper price is expected to remain stable for the rest of December

Demand: As the printing of textbooks starts, the inventory of downstream players may be consumed, but the purchase demand for uncoated woodfree paper may be relatively limited ahead of the Spring Festival holiday. The demand support may soften slightly.

Supply: The market supply is expected to see limited changes in December as the paper lines of a major integrated player tend to remain shut. A 450kt/a new capacity is expected to be launched at the end of the month, but since production ramp-up will take some time, the influence will be minor in December.

Cost: The wood pulp import offers are held firm, but spot market prices still face downward pressure. Besides, the current paper profits are still low, and paper mills may still attempt to press down the purchase price for pulp. Overall, the cost factor may offer limited support to the uncoated woodfree paper price.

Sentiment: Some paper mills still intend to raise prices, but downstream players are cautious about purchasing near the end of the year.

On the whole, the uncoated woodfree paper supply and demand are expected to remain stable, and the cost factor may lend limited support. The uncoated woodfree paper price is likely to remain largely stable despite price hike attempts by some paper mills.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.