Dec All-Steel Tire Inventory to Continue Uptrend Against Weak Supply and Demand

Introduction: In December, the total all-steel tire inventory is expected to continue to pile up, mainly because the supply pressure remains and the domestic demand weakens continuously, despite the slowdown in the capacity release.

The all-steel tire inventory continued to increase against weak supply and demand.

According to SCI, the total inventory at sample all-steel tire enterprises is expected to continue to rise at the end of December, mainly due to the supply-demand imbalance caused by the demand falling. At first, entering winter, the influence of the demand slack season is more obvious, when the end demand is weakening continuously, dampening the tire sales and transfer. Second, based on the survey on the production arrangement, there may be some differences in the capacity adjustments at different tire enterprises. Some enterprises adjust their production based on orders and inventory, easing the overall supply pressure to some extent. However, as most tire enterprises maintain normal operating rates, the overall tire supply may remain high. Third, with the demand weakening, sales at tire enterprises slow down, so the consumption of tire inventory may be slower than the rise in output, thereby resulting in a rise in the inventory.

The supply pressure remains high despite the slowdown in capacity release.

Based on the production arrangement, the all-steel tire output in December is expected to drop MoM, which may be in line with the seasonal characteristics. At first, some tire enterprises may suspend production for the New Year’s Day holiday at the end of December, dragging down the overall output. Second, with the domestic weakening, the support from the newly added orders is expected to be insufficient. Thus, tire enterprises may adjust the capacity release under inventory pressure and slower sales. Third, the prices of feedstock rubber are likely to hover at highs, weighing on the tire production cost, which is the main reason affecting the production willingness of tire enterprises. In summary, the all-steel tire output is expected to trend down in December under the influence of multiple factors.

The demand for replacement tires is likely to weaken, hampering the inventory transfer.

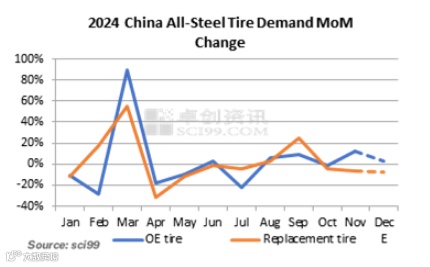

Regarding the expected demand, the replacement all-steel tire market is expected to be in the demand slack season in December. In winter, the end demand may further weaken. It snows frequently in Northwest and Northeast China, affecting the outdoor projects and the freight market. Thus, the willingness to replace tires may wane notably. Tire trading and transporting are likely to be hampered. Thus, the tire inventory may be consumed slowly, and the overall sales volume will possibly trend down. At the same time, the exports may hardly rise. The commercial vehicle market is in the production peak season, driving up the demand for OE tires, but China’s replacement tire market is expected to continue to weaken. Besides, the decline in exports is likely to curb the consumption of tire inventory.

Therefore, based on the supply-demand analysis, SCI reckons that the total tire inventory at sample enterprises is likely to continue to pile up in December, mainly due to supply pressure and weak demand despite the slowdown in the tire capacity release.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.