Reasons Behind Global Methanol Price Slump

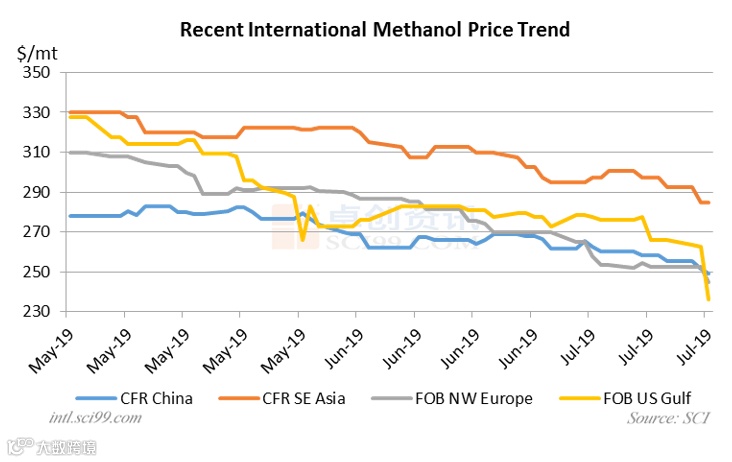

The global methanol prices kept slipping since May. In the U.S., the methanol prices suddenly collapsed to $266.08/mt at the end of May, lower than those in China and SE Asia. Afterwards, the prices rebounded slightly. However, on July 17, the FOB U.S. Gulf fell quickly again to below CFR China. For the European market, the methanol prices also dropped constantly since May, and the prices in most Asian regions also followed suit. So what are the reasons behind this obvious price downtrend in the global methanol market?

A supply and demand imbalance is widely considered to be behind the drop in the global methanol prices.

Influenced by the U.S. sanctions and the large-scale power blackout, the three methanol units with the capacity of 2,500kt/a in Venezuela were shut down for maintenance in March, and the overall operating rate was not high from March to May. Thus, its supply to Europe and the U.S. was tight during this period, supporting the methanol prices to go up.

In addition, the logistical headaches in the U.S. intensified at the end of the first quarter when a fire broke out at one of the important liquid terminals for methanol trading, Intercontinental Terminals' petrochemical tank farm in Deer Park, Texas. In the days following the ITC fire, the FOB US gulf reached the highest level in H1, 2019.

However, the terminal reopened in mid-May, and from end-May to early June, the seven methanol units in Venezuela with the total capacity of 6,650kt/a gradually recovered to high-load operations. Meanwhile, the 1,750kt/a methanol unit in the U.S. starting operation in H2, 2018 also maintained a high operating rate. In addition, large amounts of cargoes from the Middle East and non-Iranian areas flowed into Europe and the U.S. for arbitrage, attracting by local high methanol prices.

The supply was sufficient, while the demand remained sluggish. In H1, 2019, the demand from the downstream industries was weak in Europe and the U.S., such as acetic acid, MTBE, MMA, etc. Some acetic acid units were shut down for a long time.

Moreover, with the launch of Russian Shchekinoazot's new 450kt/a methanol unit in Q3, 2018, their aim for greater European market share also added to the supply and demand imbalance.

In H1 May, most players in Europe and the U.S. reckoned that $290-300/mt had been close to the complete cost of some units, while the prices continued falling to $225-230/mt. Consequently, the market sentiment worsened, especially in Europe.

In China, the high market inventory and slow methanol consumption at ports laid the groundwork for recent price declines.

In the coastal market, both Chinese-made resources and imported arrivals have caused great supply pressure. However, the demand is in the off season. In addition, influenced by the explosion accident in Henan and the upcoming 70th anniversary for the founding of the People's Republic of China, some inland methanol and downstream plants have shut down units or cut operating rates by different extents.

Moreover, some olefin units are also scheduled to be shut down or cut loads in Q3 and Q4. Thus, the rigid demand for methanol may continue to shrink. Although the methanol output has inched down in some inland areas recently, the import volume is still expected to increase in August and September, as many cargoes will be squeezed into China due to the supply overhang and low prices in Europe and the U.S. Therefore, SCI predicts that China’s methanol market could hardly improve in the near term. The market players should continue to pay attention to the restocking demand, inventory consumption and tank space at ports.

.......

More detailed information, please click "Read more".

For more information please contact us at

overseas.sales@sci99.com

overseas.info@sci99.com

+86-533-6090596