Can Ethanol Export Volume Continue to Rise in Q2, 2020?

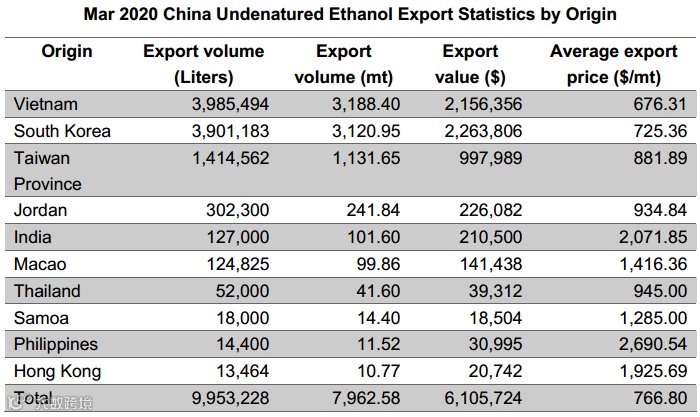

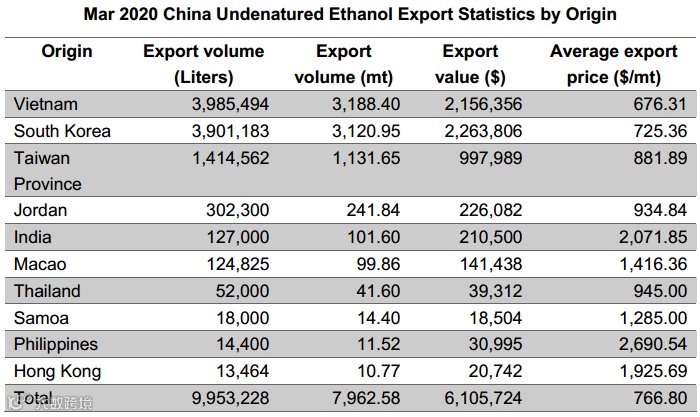

According to the customs data, China’s undenatured ethanol export volume was 9,953,228 Liters (7,962.58mt) in March 2020, hitting the highest level from October 2017. However, the export volume accounted for a small part of China’s ethanol total output.

In April, China’s ethanol prices and export volume continued to increase, and more small plants shut down their units, giving support to China’s ethanol market. According to the customs data, China’s edible ethanol and industrial ethanol monthly average output is around 500kt. In March, the export volume reached 7,962.58mt, only accounting for below 2% of the monthly average output. However, affected by the global public health event and favorable information, the export volume of ethanol in April and May cannot be underestimated.

Chart 1 2012-2020 (Jan-Mar) China Undenatured Ethanol Monthly Export Volume Statistics

As for the export destination, the export ethanol was not all edible ethanol and industrial ethanol, and 3,188mt of fuel ethanol was exported to Vietnam in March. Except for fuel ethanol, the export volume of edible and industrial ethanol was scarce, obviously lower than market expectations. In March, taking 95% ethanol as an example, its prices in northern Jiangsu declined from RMB 5,350/mt to RMB 5,025/mt, and the domestic demand and foreign demand was also sluggish. Therefore, the export volume of ethanol was in line with China’s ethanol price trend.

In terms of the product grade, most exported ethanol are anhydrous ethanol and premium-grade ethanol. Driven by foreign trade and domestic demand replenishment, China’s anhydrous ethanol prices trended up rapidly. At present, the profits at anhydrous ethanol enterprises were profitable, and most ethanol plants maintained the anhydrous ethanol production. It is estimated that China’s anhydrous ethanol monthly output will rise form 66.7kt in March to 92kt in April. Restricted by environmental protection, safety supervision and capitals, some units failed to start up this year. Although the output of anhydrous ethanol was lower than that in 2018 and 2019, most units operating rate were at a high level.

Chart 2 China Anhydrous Ethanol Monthly Output Statistics

Most participants pay more attention to China’s ethanol export statistics in April. On the one hand, the prices of ethanol continued to rise from early April to end-April, and the increment exceeded the market expectations. On the other hand, the active export inquiries led more participants to focus on the export market. Despite the obvious gap between the inquiry volume and transaction volume, most market participants believe that the export volume of ethanol in April and May are expected to reach a record high. However, there is a time difference between order receiving and order delivery in foreign trade, so there is a possibility that some contracts in April are not completed delivery until May. Therefore, SCI reckons that in April, the export volume of ethanol will be not too high.

As for China’s ethanol industry, the supply will be relatively limited before the May Day holiday. In Northeast China, some large plants will raise the output of anhydrous ethanol and premium-grade ethanol, resulting in the decline in ethanol output. SCI estimates that in H1 May, the prices of ethanol will stay at highs.

Please click "Read more" for more information

For more information please contact us at