Price Co-Movement Between Ivory Board and Pulp Diminished

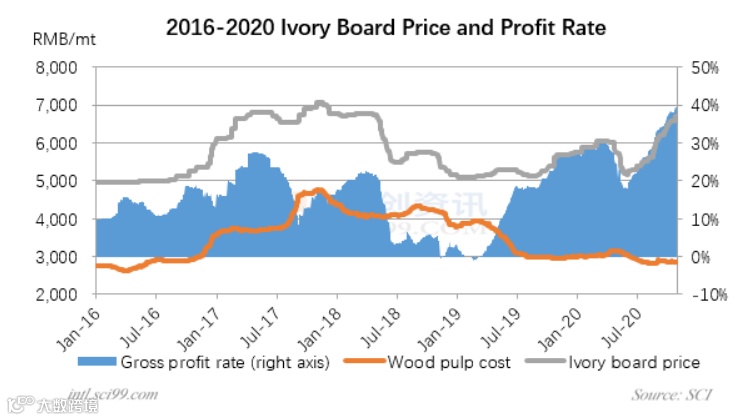

As shown in the chart above, the price of ivory board fluctuated upwards from 2017 to 2018, and it began to decline in Q2 of 2018. In the Q1 of 2019, pulp prices rose slightly, while paper prices went down, and paper mills suffered losses. From H2 of 2019, pulp prices continue to decline, the ivory board market performed well, leading to rising profitability. In the H2 of 2020, the ivory board market entered a bullish market cycle. In addition, the industry concentration ratio will be further enhanced, granting paper mills with higher pricing power and profit. SCI predicts that the price of ivory board will continue to rise in 2021. However, against the background of global economic recovery in 2021, there is no proposed SWP capacity addition in the next three years, and the SWP price will start to trend up. However, it is estimated that the SWP price will not increase notably affected by the low HWP price. Currently, the HWP supply has exceeded the demand, and there will be new capacity expansion next year, so the price rise may be very limited. SCI believes that most of the ivory board mills have integrated capacity, and will primarily consume captive CMP. It is estimated that there will be no new capacity addition before Q3 of 2021, and the profit of ivory board producers will continue to increase.