China Cracking C5 Price Gained by 30% Y-O-Y

China’s cracking C5 price presented a sharp increase in H1, 2022, buoyed by strong cost and growing demand. In H2, 2022, the overall supply of goods in the market is expected to increase with the units at PetroChina Guangdong Petrochemical, Shenghong Petrochemical and Hainan Petrochemical being put into operation. In terms of downstream market, Zhanjiang Zhonghe Chemical and Fujian Fuhua Luhua New Material plan to bring new units on line, so the overall demand will improve compared with H1, 2022. Specific attention should still be paid to the crude oil market and downstream demand.

Prices in the C5 industrial chain were mostly on the rise.

In H1, 2022, the prices of upstream and downstream products of cracking C5 mostly showed an upward trend. The prices of crude oil, naphtha and other feedstocks increased significantly Y-O-Y, forming a cost support for cracking C5. The price of DCPD, a downstream derivative of cracking C5 also increased significantly and continuously, and there was a stable support from the demand side on the back of newly added and proposed units, which was conducive to the cracking C5 market.

Note: the average price is up to June 29, 2022.

H1, 2022 cracking C5 price rose by 30% Y-O-Y.

The average prevailing EXW price of cracking C5 was RMB 5,800.29/mt in H1, 2022, an increase of 28.31% over that in the same period last year. The highest price read RMB 6,742.5/mt, and the lowest read RMB 4,640/mt.

In the first half of 2022, the mainstream EXW price of cracking C5 gained first on the back of climbing crude oil, and then declined. The low price appeared in January and the high price appeared in April.

Cracking C5 prices rose from January to March. During this period, the prices of crude oil and naphtha both showed a rising trend, lending increased cost support to cracking C5 market. From February to March, units at Sinopec Maoming Petrochemical and Sinopec Yangzi Petrochemical were overhauled, leading to low inventory at producers and tight resources on the market. With the increase in downstream total demand, cracking C5 price showed an upward trend.

From April to May, cracking C5 price mainly descended. Crude oil price showed a downward trend, and the mentality of market players was pessimistic. The overhauled units resumed operation, and the supply of goods gradually increased. The market transactions were sluggish and were mainly concluded based on rigid demand. Therefore, the mainstream EXW price showed a downward trend.

Cracking C5 price climbed in the June. The unexpected shutdown of a plant in East China and a plant in South China reduced the overall supply in the market. In addition, the prices of piperylene and isoprene rose under tight supply, which supported the price of cracking C5.

As of June 28, mainstream EXW prices of cracking C5 at PetroChina and Sinopec were RMB 5,800/mt and RMB 6,200-6,250/mt respectively.

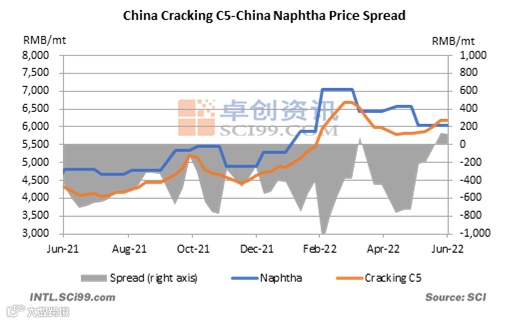

Naphtha-C5 price spread turned negative in H1, 2022.

In the first half of 2022, the price of naphtha supplied within Sinopec Group showed a significant rise. The average price of naphtha at Sinopec Yanshan Petrochemical was RMB 6,210/mt, up 53.45%Y-O-Y. From January to June 2022, the highest price was RMB 7,060/mt, up 60.45% from the highest price of 4,400 RMB/mt in 2021, and the lowest price was RMB 5,280/mt, an increase of 74.26% over the lowest price of RMB 3,030/mt in 2021. The average price of naphtha at PetroChina Jilin Petrochemical was RMB 5,721/mt, up 54.62% Y-O-Y. As the price of feedstock ran at a high level, the cost pressure on C5 manufacturers increased significantly.

In the first half of 2022, the price spread between cracking C5 and its feedstock naphtha has been negative, mainly due to the overall high price of naphtha and the weak downward transmission capacity of cracking C5. In the first half of 2022, the average price spread between the two was RMB -484/mt, while in the same period of 2021, the spread was RMB 504/mt.

Both supply and demand of cracking C5 showed continuous growth.

Output: In the first half of 2022, cracking C5 output showed a Y-O-Y growth trend. The cumulative output from January to June is expected to be 1,583.2kt, an increase of 14.79% over the same period last year. In the first half of the year, Sinopec Yangzi Petrochemical, Sinopec Shanghai Petrochemical and Sinopec Maoming Petrochemical took maintenance at their units. From January to June, the output of all months increased Y-O-Y. The lowest monthly output appeared in February and the highest in March. The continuous release of new capacity of cracking C5 has played a great role in promoting the growth of C5 output.

Demand: The demand for cracking C5 in the first half of 2022 also grew Y-O-Y. The cumulative demand from January to June is expected to be 1,589.4kt, an increase of 15.82% over the same period last year. In the first half of the year, a total of two new units at Ningbo Jinhai Chenguang Chemical phase II and Zhejiang Derong Chemicals were put into operation. From January to June, the demand of all months increased Y-O-Y. The lowest monthly demand appeared in February and the highest in March.

The downward transmission capacity of the industrial chain has declined.

In the first half of 2022, the price spreads between main downstream separation products and feedstock cracking C5 showed obvious differences, among which the price spread between petroleum resin and cracking C5 and that between piperylene and cracking C5 showed a declining trend, and that between DCPD and cracking C5 changed from negative to positive. The price spread between petroleum resin and piperylene with cracking C5 decreased by 38% and 57% Y-O-Y respectively; that between DCPD and cracking C5 was RMB 460/mt (price spread in the same period last year was RMB -24/mt).

The growth in cracking C5 price will be slow in H2, 2022.

In the second half of the year, the macro pressure on crude oil will continue to exist, and the summer demand in the United States will gradually reduce. In terms of supply, the units at PetroChina Guangdong Petrochemical, Shenghong Petrochemical and Hainan Petrochemical are expected to be put into operation in the second half of the year, and the overall supply in the market is expected to increase. In terms of downstream market, Zhanjiang Zhonghe Chemical and Fujian Fuhua Luhua New Material plan to bring new units on line, so the overall demand will improve compared with H1, 2022. Specific attention should still be paid to the crude oil market and downstream demand.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.