H1, 2022 DMC Price Dented After Hiking amid Fresh Silicone Monomer Capacity

Snapshot: In H1, 2022, China’s DMC price first rallied and then slid against the backdrop of the intensive release of silicone monomer capacity and increment in foreign demand. In H2, 2022, China’s silicone monomer capacity will be released at a slow pace. Many uncertainties intertwine in the demand market. Yet, players are still confident in the silicone market after August, and the stock-up activities are expected to be conducted ahead of schedule. SCI reckons that China’s DMC price may show a reverse V-shaped trend in H2, 2022.

In H1, 2022, China’s DMC price first rose and then fell, among which Q1 and Q2 saw diverse performance. As of June 31, the DMC market price in China reached RMB 19,500/mt, down RMB 7,800/mt or 28.57% from early 2022. The average market price of DMC in H1 was RMB 28,568/mt, up RMB 2,875/mt or 11.19% Y-O-Y. In Q1, 2022, China’s DMC supply and demand relationship performed well, bolstered by rising costs and export. Thus, the DMC price notched a historical high. In Q2, the imbalance between supply and demand intensified, affected by onstream fresh capacity and dented demand in China and overseas countries. Therefore, the DMC price fell back from a high level. Yet, due to high cost, the monthly average price in 2022 was still above the historical 10-year average. SCI deciphers the underlying key drivers to analyze the price fluctuation.

Supply: China’s silicone market faced a supply glut along with the intensive release of new capacity.

Most of the new silicone monomer capacity kicked off in Q1, 2022, amid bullish expectations from enterprises in end-2021. According to SCI, in H1, 2022, 900kt/a fresh silicone monomer capacity came online successively in China. At present, the total effective capacity of silicone monomer reached 4,830kt/a, up 18.63% from end-2021. Therein, 700kt/a silicone monomer units came on stream in Q1.

In Q1, the output of most new silicone monomer units was released slowly at the beginning of commissioning. In Q2, as most new silicone monomer units ran normally, the output ramped up quickly. In H1, 2022, the output of silicone monomer in China reached around 2,228kt (rough conversion from DMC), up 648.6kt or 41.07% Y-O-Y. In June, the output hiked to a historical high at 418.1kt, up 108.7kt from January and 132.8kt Y-O-Y. In Q2, a rapid increase in output led to the deepening of oversupply. The DMC price slid along with competitive pricing among enterprises.

Demand: Incremental foreign demand will hedge oversupply.

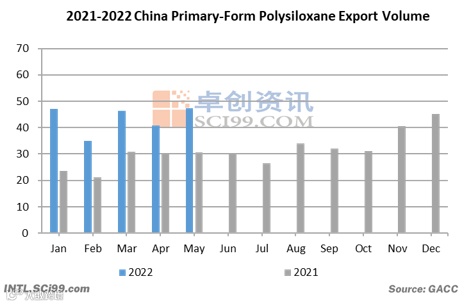

In H1, 2022, the export volume of primary-form polysiloxane in China surged, driving up the demand for upstream feedstock. Against the backdrop of slow growth in domestic demand, the oversupply pressure brought by new capacity release was eased by the export demand in foreign countries. In Q1, China’s newly added capacity warmed up slowly. Yet, the DMC price jumped up due to the increment in foreign demand. In Q2, as the output hit a new high, the DMC price remained in a downswing despite foreign demand. According to SCI, from January to May 2022, the total export volume of primary-form polysiloxane in China reached 216.6kt, and the export volume of silicone monomer (rough conversion) was around 460.9kt, up 59.26% Y-O-Y.

Cost: Non-integrated DMC enterprises faced high-cost pressure along with rising feedstock prices.

In H1, 2022, the DMC cost in China first climbed and then dropped, in the wake of changing feedstock prices. Strongly bolstered by cost prices such as energy, prices of silicon metal 421 in H1 saw notable Y-O-Y growth. Taking the price of silicon metal 421 at Huangpu Port as an example, its price in H1 averaged RMB 21,659/mt, up 50.33% Y-O-Y. Besides, based on optimizing the supply and demand relationship, prices of methane chloride fluctuated at highs. Taking the synthetic chloromethane price in Shandong as an example, the price of methane chloride in H1 was RMB 6,251/mt. up 101.06% Y-O-Y. Supposing all chloromethane was for captive use, the average production cost of DMC in China was around RMB 20,059/mt, up 25.12% Y-O-Y. Supposing 60% of chloromethane was for captive use and 40% was available from the market, the cost of DMC in H1 reached RMB 22,618/mt, up 36.13% Y-O-Y. Enterprises that purchased a large amount of feedstock from the market faced high-cost pressure, so they suffered losses in June. In H1, 2022, the DMC price is generally above the historical average level due to robust cost. In H1, 2022, the gross profit of DMC (all chloromethane for captive use) dropped to RMB 7,851/mt, down 18.73% Y-O-Y.

In H2, 2022, China’s DMC price may show a reverse V-shaped trend along with the slowdown in silicone monomer capacity growth.

In H2, 2022, only a 400kt/a silicone monomer unit at Hoshine Silicon Industry is planned to come online at the end of the year. There will be no other new capacity scheduled to be released in H2. The supply growth is expected to slow down. However, in H1, China’s silicone market suffered a supply glut due to the intensive capacity release. Enterprises face a risk of price competition in a bid to promote more sales. As seen from the demand, due to the changeable external environment, there will be uncertainties in demand recovery in H2. Yet, downstream users are projected to stock up ahead of time amid expected favorable factors in August. SCI reckons that downstream demand and market confidence recovery may improve the supply and demand of DMC and downstream products along with the economy ramping up in H2, and the DMC price in H2 will first climb and then dent.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.