Indonesia Natural Rubber Exports Saw 9.48% Decrease in H1, 2022

Introduction: Indonesia’s natural rubber output took up 23% or so of the global total in 2021. Indonesia’s customs showed that Indonesia’s natural rubber export volume in H1, 2022 dropped by 9.48% Y-O-Y, mainly as the rubber tapping rate was not high in H1, 2022 and some orders flew into Thailand. Thus, Indonesia’s natural rubber output dwindled, and the export volume declined somewhat. Indonesia’s annual export volume of natural rubber is likely to show a Y-O-Y decrease in 2022.

Indonesia’s natural rubber export volume fell by 9.48% Y-O-Y in H1, 2022.

Source: Badan Pusat Statistik

Indonesia’s customs showed that Indonesia’s natural rubber export volume in H1, 2022 totaled 1,135.9kt, down 9.48% Y-O-Y, and it was slightly higher from H1, 2020 but significantly dropped from H1, 2019 and H1, 2021. In 2022, Indonesia’s aging tree structure and good palm yield led to labor transfer, which caused Indonesia’s natural rubber output to decline. At the same time, due to the poor efficiency of natural rubber processing, the production enthusiasm of processing plants was not high, and some orders were diverted to Thailand, resulting in a decline in export volume.

Indonesia’s standard rubber export volume took up 95% of the total in H1, 2022 and dropped by 9.14% Y-O-Y.

Source: Badan Pusat Statistik

In H1, 2022, Indonesia’s export volume of standard rubber was 1,085.1kt, down 109.1kt or 9.14% Y-O-Y, and it was the main reason for a decrease in Indonesia’s natural rubber export volume.

Standard rubber export analysis – export volume to most destinations showed a Y-O-Y decline

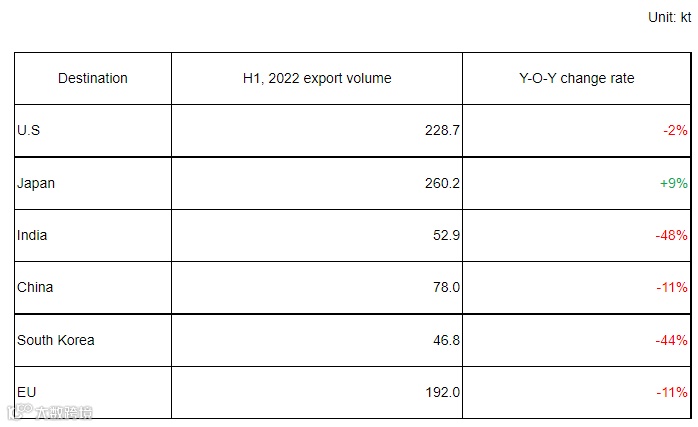

Indonesia HS Code 40012220 Export Volume by Destination

Indonesia mainly exported standard rubber to Japan, the U.S., the EU, China, India and South Korea. Taking HS code 40012220 as an example, its export volume to the above countries and regions took up 84% of the total in H1, 2022. Therein, the export volume to Japan reached 260.2kt, up 9% Y-O-Y, taking up 26% of the total and ranking first. The export volume to other countries and regions showed Y-O-Y decreases. Specifically, the export volume to India and South Korea fell by over 40% Y-O-Y, and that to China and the EU dropped about 11% Y-O-Y. In H1, 2022, Indonesia’s natural rubber export volume to China hit a new low as overseas demand rallied and high-priced Indonesia-origin natural rubber resources due to an output decrease were not well accepted in the Chinese market.

Larger probability of Y-O-Y decrease in Indonesia’s 2022 annual export volume

Indonesia has two rubber production seasons without absolute peak production. From the perspective of Indonesia’s tree age structure and labor diversion, it is expected that there will be no obvious growth in natural rubber output in H2, 2022. From a seasonal perspective, the export volume in H2, 2022 may maintain the trend of first increasing and then decreasing. The global economic recovery was hindered in H1, 2022, and the global economy will probably face greater challenges in the second half of the year. It is expected that overseas demand growth will hardly have a breakthrough. Therefore, on the whole, it is expected that Indonesia’s annual export volume of natural rubber is likely to decline Y-O-Y.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.