Differences Lie in Jul China Tire Sales

In July, there were differences in the trading environment of tire markets between the north and the south, and the market transmission showed certain regional differences. The proportions of agents who had better sales compared with that of last month and worse sales were almost equal. The sales of tires may be improved in August.

Differences lie in sales environment

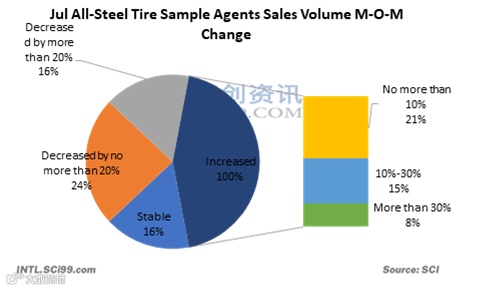

According to the survey results, proportions of agents who had sales volume increase and decrease saw limited differences.

Increased or stable sales volume: First, the sales environment in the survey area was relatively stable. As the weather turned hot, the end consumption of tires increased. Second, there were more promotion policies during the month. Prices of many brands were lowered via discounts and present and order meetings, which had certain support for the tire sales in the short term. Third, with the end of the rainy season in the south, the sales of tires saw a small boom.

Decreased sales volume: First, the available sales space and time for sales in the survey area were limited, and the normal transaction was temporarily suspended. Second, there was more rain in the north, and many projects and infrastructure were affected to a certain extent. The market activity slowed down slightly, which had a drag on tire sales. Third, the sales rhythm is controlled differently. The overall sales base was improved last month, and the momentum of the continuous sales increase was insufficient. Most of the agents were in the process of slow adjustment after the sales volume rose. Fourth, due to the difference in policy support, some brands had no promotion policies this month, lacking price advantage.

Survey samples cover 14 provinces

As for China’s domestic all-steel tire sales volume, SCI has surveyed a total of 62 domestic first-level and second-level agents, including 39 first-level agents and 23 second-level agents. The areas covered by the survey include Shandong, East China (Jiangsu, Shanghai, Fujian, Anhui), Northeast China (Liaoning, Jilin, Heilongjiang), North China (Shanxi, Hebei, Inner Mongolia), South China (Guangxi, Guangdong) and Central China (Hunan, Henan). 14 provinces (municipalities and autonomous regions) are covered.

Due to the different regions of the samples selected in the survey, different local road conditions, and different agents’ recognition of tire brands, the product brands represented by the agents in the survey samples are different, and these brands are at different levels. Foreign brands include Goodyear, Bridgestone, Michelin, etc.; brands with three guarantees include Celimo, Westlake, Yartu, Chaoyang, Double Coin, Aeolus, etc.; brands without three guarantees include Santai, Hengfeng, Huasheng, Jinlipu and some OEM brands, etc.

Aug domestic sales to be improved

SCI holds that in the short term, the operating rate at tire producers may remain weak affected by the production and sales environment and relatively sufficient inventory. What’s more, with production cuts in the traditional slack season of production, the supply of a few grades may be relatively tight.

In terms of the market, the hot weather accelerates the wear and tear of tires, and the new demand for tire replacement is expected to increase. In addition, various promotional policies such as trade meetings and roadshows may boost the actual transaction. At the same time, the prosperity of logistics and transportation and the operation of infrastructure construction and other outdoor projects is expected to recover slowly, which is beneficial to the demand for the replacement of all-steel tires.

Besides, as feedstock price turns weak, the pre-production cost born by tire producers may be reduced. Next month, prices of feedstock may show a weak trend, and it may be difficult to change the weakness of tire market sales, so new promotion policies may be implemented, which may boost buying sentiment to a certain extent.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.