China PE Price Likely to Fall Amid Misaligned Supply & Demand

In May, operating rates at producers changed limitedly and China’s supply was stable. Meanwhile, downstream users showed tepid buying appetites amid the demand slack season with a wait-and-see sentiment. In June, the downstream demand will remain sluggish, and uncertainties will be seen in the overseas market. Therefore, SCI reckons that China’s PE price will be more likely to fall.

In May, profits from producing PE via different technologies were limited, and some producers shut their units down for maintenance, dragging down the operating rate slightly M-O-M. According to SCI, China’s PE operating rate was 80.84% in May, down 0.51% from April. The total capacity involved in unit maintenance was 7,895kt/a, and the output loss was 346.1kt, up 73.3kt M-O-M. The output loss increased notably in May and was at a high level.

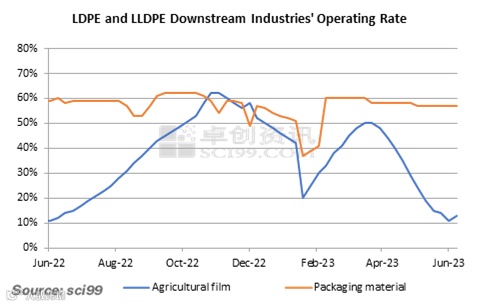

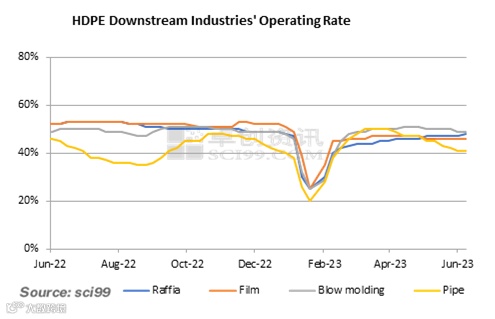

In May, operating rates of PE downstream industries saw more falls than rises. Therein, the operating rate of agricultural film declined from 21% to 14%, and that of the packaging industry, film industry and blow molding industry dropped by 1% each to 57%, 46% and 50% respectively. That of the raffia industry rose by 1% to 47%, and that of the injection industry and the pipe industry went down by 7% and 5% to 46% and 42% respectively. The mainstream operating rates were 14%-57%.

On the whole, the overall demand for agricultural film remained weak with limited orders and deal doldrums. A few greenhouse film enterprises ran their units at low loads while most enterprises shut down their units temporarily, so the industrial operating rate stayed at a low level. As for the pipe industry, the operating rate kept falling affected by the slowdown of the infrastructure projects, and newly added orders were limited. In addition, the inventory of finished products piled up, dampening the buying appetites. Most pipe enterprises purchased on a need-to basis, giving thin support to the spot market. In June, the demand for agricultural film may remain sluggish. Some users may replenish their stocks amid the demand slack season, while most will hold a wait-and-see sentiment, which will give limited support to the PE market.

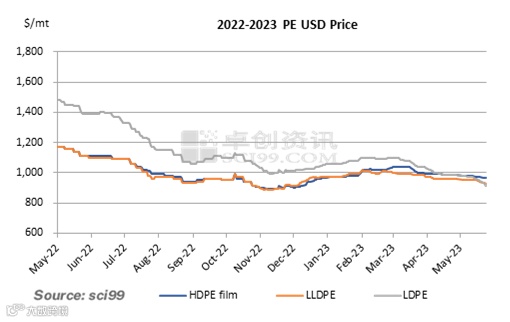

In June, both the prices of crude oil and coal may trend down, so the production cost will further decline. As for the supply, it’s estimated that the output loss caused by unit maintenance will be 349.2kt, so the supply of Chinese-made PE is expected to decline. As for imports, the arrival of imported resources will be average affected by low PE prices in China’s domestic market. However, with the arrival of deep-sea cargoes, it’s estimated that the import volume may inch up in H2 of June. As for the demand, agricultural film enterprises will run their units at lows and purchase at low prices. In addition, multiple uncertainties in the overseas market will reinforce the cautious sentiment. Therefore, SCI reckons that China’s PE prices will likely show a downtrend in June.

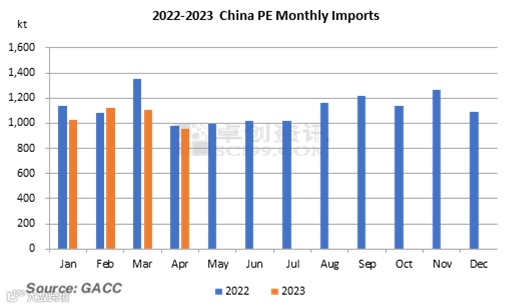

From January to April, China’s total PE import volume reached 4,212.2kt, down 7.44% Y-O-Y. The PE demand was lower than expectations in Q2, and the overall PE price trended down. As of May 31, offers from overseas producers kept falling from last week, with offers for LLDPE ranging $890-960/mt (RMB 7,735-8,330/mt) in the Middle East, indicating that import arbitrage opportunities were emerging.

In May, prices of various PE products fluctuated downwards despite unit maintenance at Sabic’s Petrokemay and Jam Petrochemicals. Meanwhile, downstream industries were in a demand slack season, and the USD exchange rate went up, dampening the trading atmosphere. On the whole, the demand didn’t see improvements and China’s PE market price was at a low level, so offers from overseas producers kept falling.

This week, PE offers from overseas producers kept falling from last week, with the LLDPE offer in the Middle East ranging $890-960/mt (RMB 7,735-8,330/mt). Although PE import arbitrage opportunities are seen, the PE imports may not improve in the short term due to the overall weak demand for PE.

According to GACC, from January to April, China’s total PE import volume was 4,212.2kt, down 7.44% Y-O-Y. The import volume in April was 957kt, down 13.57% M-O-M and 2.39% Y-O-Y. In the future, despite import arbitrage opportunities, China’s traders will show tepid importing appetites due to low PE prices in China’s domestic market and rising USD exchange rate. However, as the overseas unit maintenance will come to an end and the demand in Europe and the U.S. will underperform, overseas producers may increase their exports to China. Therefore, the arrival of deep-sea cargoes at China’s ports will likely gradually improve.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.