Jun 2023 China PVC Powder Market Brief Analysis

Preface: China’s PVC powder prices fluctuated downward in May affected by weak fundamentals and negative macro market atmospheres. SCI reckons that PVC powder fundamentals will remain soft in June. In addition, as there are uncertainties in the macro market, market participants are cautious about the PVC powder market. Unless new positive factors appear in the macro market, China’s PVC powder prices will fluctuate at lows in June.

PVC powder supply may change slightly M-O-M in June.

Many plans about unit maintenance in June have been heard, so it is expected that PVC powder output loss due to maintenance will be relatively high and rise to around 280kt in June.

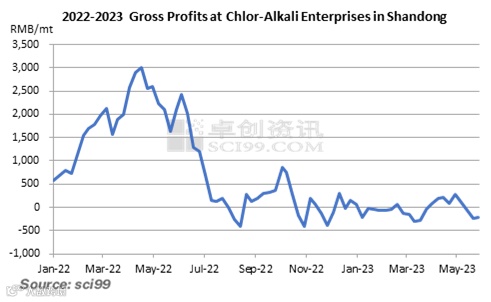

The calcium carbide market price climbed, propping up the cost of PVC, while caustic soda and PVC prices moved down. Thus, profits at calcium carbide-based PVC enterprises were in the doldrums in May. PVC enterprises that shut units down affected by profit losses at an earlier stage show weak interest in resuming production. In addition, many plans about unit maintenance in June have been heard, so PVC supply may remain relatively low in June. However, market supply is still ample at present amid high PVC social inventory and plant inventory. Therefore, the PVC powder spot supply can hardly tighten significantly in June.

PVC demand is expected to weaken.

China’s domestic demand for PVC powder will possibly be tepid in June. As the real estate industry enters the slack season, end demand can hardly improve notably. At present, downstream enterprises show weak appetites in purchasing feedstock amid underperformed orders and register soft speculation demand. Moreover, as India and Southeast Asia enter the rainy season in June, the demand for PVC is expected to weaken. In addition, the international PVC powder price is relatively low at present, so SCI forecasts that export orders will fail to improve significantly in June. On the whole, the demand for PVC in June is expected to weaken.

The cost support is likely to decline.

At present, the cost gives cost support to the calcium carbide-based PVC powder prices from the bottom line. In June, the calcium carbide supply may remain unchanged, while the demand may shrink. In addition, semi-coke prices are likely to move down, dragging down the cost of calcium carbide. Thus, the calcium carbide prices may see a downward trend in June, giving thinner cost support to the PVC powder market price.

There are uncertainties in the macro market.

The PMI in China in May saw an M-O-M drop, and China’s domestic demand was lukewarm. However, the improvement in PMI may be limited in June with the shortage of positive factors in the macro market.

The international crude oil price will possibly be range-bound, giving limited influence on market players’ sentiments. In early June, the Fed’s interest rate is expected to change greatly. At present, the Fed may halt interest rate hikes. However, there are uncertainties in macro atmospheres with the U.S. debt ceiling risk existing.

On the whole, PVC powder market prices will be influenced by weak fundamentals in June. Changes in the macro market and players’ sentiments should be noticed.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.