SBS Market Semi-Annual Review

H1, 2023 SBS Price Fell After Rising, and H2 to slide

Keywords: SBS, Price, Operating rate, Imports, Increase, Butadiene, Demand

Snapshot: In H1, 2023, the SBS market prices fell after rising. The price trend and recovery in fundamentals underperformed. Curbed by the expected growth rate of exports, the real estate industry and infrastructure investment, the demand for SBS is expected to be soft in H2, 2023. Besides, the butadiene price may change limitedly. It is projected that the average SBS prices are predicted to be lower from H1, 2023.

In H1, 2023, the SBS market prices rose first and then fell. The price trend was in line with the forecast of Q1 in SCI’s 2022-2023 China SBS Market Annual Report, but different from the forecast of Q2. Before and after the period when the butadiene units took maintenance intensively, the butadiene price trended down, which was the main reason why the SBS prices went beyond expectations. By June 28, the dry SBS 792 in Jiangsu market, the road bitumen modification-used SBS 791-H in Shandong market and the oil-extended SBS F875 in Fujian market closed at RMB 10,800-10,900/mt, RMB 10,400-10,500 and RMB 10,600-10,700 respectively, down 13.89%, down 12.55% and down 13.41% from the beginning of 2023 respectively. The average prices of them in H1, 2023 were RMB 13,300/mt, RMB 12,540/mt and RMB 12,138/mt respectively, down 5.97%, down 8.00% and down 10.29% Y-O-Y respectively.

The major feedstock butadiene price rose in January and February, bolstering the rise in the SBS prices in China. However, the frequency of butadiene unit maintenance was lower Y-O-Y, and imported resources increased notably. Thus, the butadiene supply saw a large increment. However, the overall demand was tepid. The consumption in the waterproof roll industry and modified bitumen industry was slow. The export trade was insipid, so the recovery in shoe material orders underperformed. In addition, the butadiene price began to fall in March, dragging down the SBS prices. Major SBS units took maintenance, and the butadiene price inched up in mid- and late April, leading to a slight increase in the SBS prices. But the duration of the rise was short. Curbed by the fall in the butadiene price and the tepid demand, the SBS market prices slid again in May.

In H1, 2023, the SBS market basically conformed to the market characteristics of "strong expectations and weak reality" for most chemical products. The major drivers of the market price trend were as follows.

The feedstock butadiene price crashed, strongly affecting the SBS prices.

With China’s SBS capacity expanding in recent years, the SBS market competition intensified. Besides, some imported resources increased significantly, weighing on the supply-demand relation. In 2023, the demand for SBS in China’s market underperformed. Amid the oversupply, the marginal profit at most SBS producers was low, despite the recovery in the marginal profit Y-O-Y. The change in feedstock prices leads to a change in the average cost, so the feedstock price trend strongly affects the SBS market price.

In H2, 2023, China’s butadiene market price rose first and then fell, which was in line with the SBS prices trend. By June 28, the delivered price of butadiene in Jiangsu-Zhejiang market was RMB 6,250/mt, down 17% from the beginning of 2023. The average price in Jiangsu-Zhejiang market was RMB 8,432/mt, down 5.64% Y-O-Y. The average price of butadiene dragged down the SBS prices. From the beginning of 2023, the butadiene price fluctuated upwards, underpinning the SBS market prices. Thus, the SBS market prices rebounded. From March, the butadiene market trended down. The newly added butadiene capacity was released constantly, leading to tepid demand. Besides, the bullish influence of the expected unit maintenance in Q2 ebbed ahead of time in January and February, so the butadiene price trended down when the units took maintenance. The butadiene price strongly affected the SBS market prices.

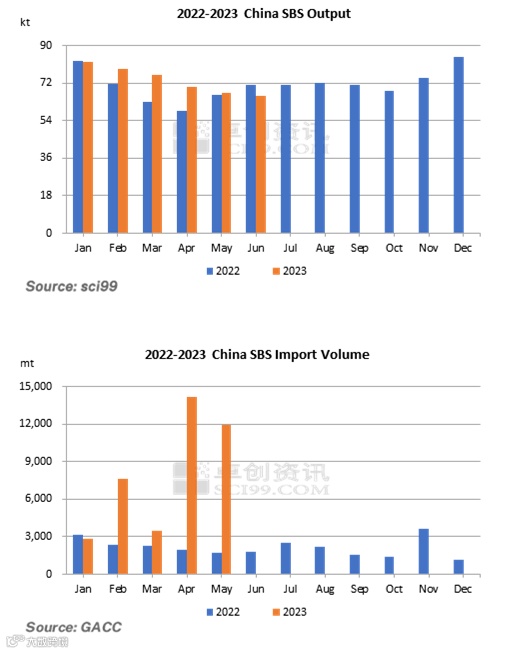

In H1, 2023, the SBS supply rose notably, especially for the import volume.

In H1, 2023, the operating rate of the SBS industry was 52.77%, up 3.87% Y-O-Y. In H1, 2023, China’s SBS output was 439.5kt, up 6.36% Y-O-Y. There were fewer SBS units under maintenance in H1, 2023, and additives and other accidental factors failed to affect the operating rate. Thus, the supply increased notably. However, the newly added 120kt/a unit at Hainan Baling Chemical New Material ran at a low load, and some production lines remained offline. Besides, the unit at Sinopec Baling Company took overhauls in H1, 2023, weighing on the rise in the operating rate in H1, 2023.

In H1, 2023, China’s SBS import volume increased notably. From January to May, China’s total SBS import volume was 40.064kt or so, up 248.24% Y-O-Y. The reasons why China’s imports surged were as follows. The sales channels of the SBS products in a certain European country were obstructed, so China’s market was regarded as its major consumption market. Other imported SBS changed slightly. Besides, players held a bullish stance in China’s 2023 SBS market amid the expected global deflation. Thus, some suppliers increased their products flowing to China. In April and May, China’s SBS import volume hit a semi-annual high.

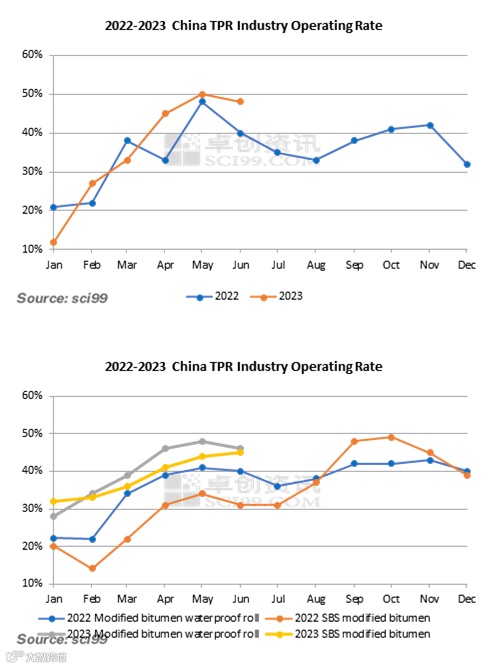

In H1, 2023, the downstream demand for SBS recovered limitedly. Imports and the industrial environment curbed the downstream industries.

……

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.