Positive Supply-Demand Structure Expected to Boost the PX Market in 2024

2023 was a year of rapid expansion in China’s PX industry. Throughout the year, PX demonstrated two cycles of “first rising and then falling” tendencies, with the average price in the second half of the year greater than in the first half. In 2024, demand is predicted to expand faster than supply, and the PX market will likely retain a tight supply-demand balance. When combined with the predicted recovery in the crude oil market, the price of PX is likely to climb in 2024.

The Y-O-Y decrease in PX prices is smaller than that of crude oil.

Against the backdrop of the reduction in crude oil prices in 2023, the yearly average price of PX also fell, but the decline was rather gentle, aided by a tight supply-demand balance at times. The annual average price of PX in 2023 was $1,036.45/mt CFR China, representing a 6.11% drop Y-O-Y.

During the Spring Festival, the Middle East crisis outweighed the impact of US inflation and the likelihood of a slowdown in demand growth this year, sending WTI to its highest level since November 6, 2022. The increase in crude oil prices has pushed up negotiation prices in the Asian PX market. During the holiday, negotiation prices in the Asian market were centered in the area of $1,028-1,041/mt, up more than $20/mt from before the vacation. However, players are increasingly concerned about future supply and demand. On the one hand, the PX producers in China run at a pretty high operating rate, and some PX plants in Asia are likely to resume production. In contrast, China’s PTA factories have a relatively concentrated maintenance schedule. As a result, post-holiday price rises are expected to be more conservative.

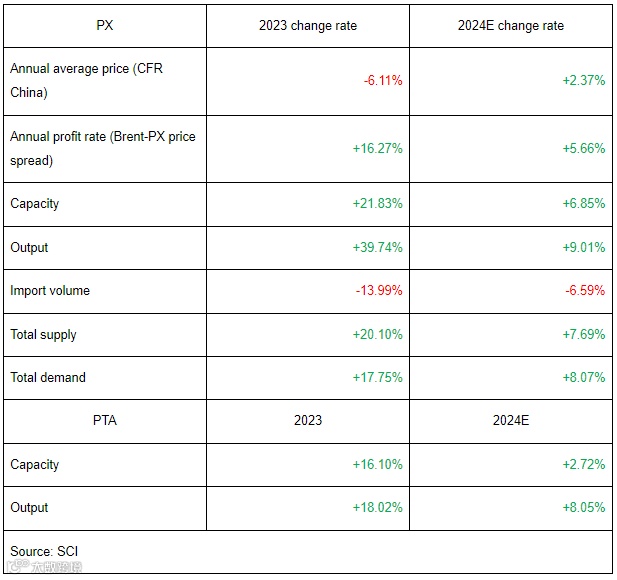

2024 PX Industry Data Change Rate Forecast

Remarks: The above change rates are Y-O-Y change rates.

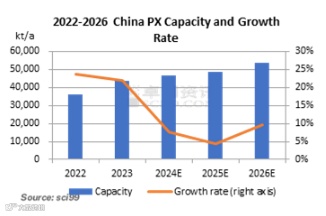

The slowdown in supply growth supports the PX market price.

In 2024, the PX market will continue to have a tight supply-demand balance, so it may perform quite well in the industry chain. According to SCI, the rise of PX’s new capacity will decelerate from 2024 to 2026, with 9.7 million mt/a of new PX capacity expected in China. Only one unit at Yantai Yulong Island Petrochemical (3 million mt/a) may be newly added in 2024, but construction is slow, and the likelihood of attaining output within the year is low. Furthermore, with the ongoing start-up of additional PTA units, it is expected that around 700kt of imported PX will be required every month to maintain market stability and meet actual demand. Thus, the supply growth rate is expected to be 7.69% in 2024. It is envisaged that there will be some temporary tightness in the total PX supply, which will continue to support PX prices.

Overall, PX output and import volume are predicted to total 44.8 million mt in 2024, representing a 5.66% Y-O-Y rise. Several PX units that had been shut down for a long time have resumed operation, and the units that came online in 2023 are running stably. As a result, China’s domestic PX has become even more self-sufficient. In addition, the start of the maintenance season in the second quarter will provide some support to the PX price.

The steady increase in downstream demand improves supply-demand contradiction.

The demand for PX will steadily increase in 2024. According to monitoring data from SCI, the demand for PX in China is expected to hit new highs from 2024 to 2026. The consumption increase caused by the second round of the rapid expansion cycle in the PTA industry will be fully unleashed at this stage, with PX demand estimated to rise by 3.35 million mt in 2024. The increase in demand will continue to support the PX market price in 2024. In 2024, the main downstream PTA industry is projected to see a capacity addition of 4.5 million mt/a, and 2.325 million mt/a of outdated capacity will be phased out. It is estimated that the PTA capacity will reach 82.15 million mt/a in 2024, with a capacity growth rate of 2.72%.

It is expected that the total demand for PX in China will be 44.87 million mt in 2024, with an average annual growth rate of 8.05%. Two new PTA units at Sinopec Yizheng Chemical Fiber and Formosa Chemical Industrial (Ningbo) are planned to begin operations in 2024, with start-ups in March and the second quarter, respectively. Considering factors such as early procurement of feedstock for new projects and limited effective days in February, it is expected that there will be a significant increase in PX demand in March.

A positive macro environment and strong expectations for crude oil provide PX cost support.

The positive prognosis for crude oil prices and macroeconomic expectations in 2024 gives effective cost impetus to the PX market. The economies of Europe and America are currently in the transitional stage from late stagflation to early recession, but China is already in recovery mode. Crude oil prices are predicted to remain at a mid-to-high level in 2024, with the trend in the second half of the year stronger than in the first half, providing a positive driving force for the domestic chemical market.

Taking into account various factors such as current costs, supply and demand structure, macro and value chain transmission, it is expected that the PX price may exhibit an upward trend under the tight supply-demand balance pattern for the whole year of 2024.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.