April Chemical Market Likely to Fluctuate Downwards

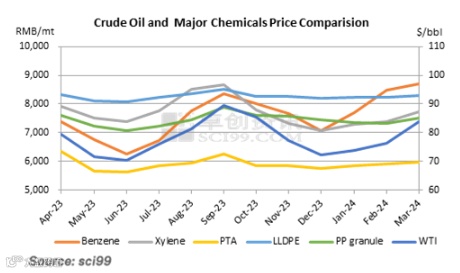

Preface: China’s chemical market prices rose slightly in March 2024. Crude oil prices fluctuated upwards in March, providing cost support to chemicals. Market demand recovered gradually, but the overall supply kept loose. The inventory of most chemicals remained high, curbing the price rise extent. In April, crude oil prices may fluctuate downwards, and the support from supply-demand fundamentals may be relatively weak. Thus, the prices of chemicals may fluctuate under downwards pressure in April.

In March, among the 41 major chemicals that SCI monitors, 26 products saw rises in their monthly average prices, taking up 63.41% of the total, while 16 products saw price drops, accounting for 39.02% of the total. As for products with price rises, the top three were MTBE (+6%), WTI (+6%) and ABS (+5%). As for products with price declines, the top three were 2-EH (-11%), NBA (-9%) and BPA (-5%).

The major influencing factors for the chemical market in March are as follows: 1. International crude oil prices fluctuated upwards amid frequent geopolitical disturbances and supply reductions. The WTI monthly average price rose by 4.96%, providing cost support to the prices of chemicals. 2. Market demand recovered gradually, but the inventory of most chemicals was still high, and the overall supply kept loose, curbing the price rise extent.

In March, the number of chemicals with negative profits increased slightly, affecting enterprises’ production positivity to some extent. International crude oil prices went up, pushing up the cost of most chemicals. However, the supply and demand fundamentals were relatively weak, and the cost transmission was slow. Most chemicals saw limited price rises in spite of larger feedstock price growth, so their profits were further cut accordingly.

April forecast: The chemical market may fluctuate downwards on the whole. Crude oil prices may see some downward corrections in April due to strong US dollar and the mediocre implementation of OPEC+ output cuts. Although the demand for chemicals is recovering slowly, the supply of most feedstock is stable, and the inventory is at a relatively high level, so the overall fundamentals are still relatively weak.

International crude oil prices rebounded, and the expectation of Fed’s interest rate cut in June weakened. International crude oil prices continued to rally, with Brent prices further rebounding to $84/bbl. Affected by geopolitical factors, the possibility of crude oil prices fluctuating upwards has increased. The US employment data performed better, inflation showed signs of further heating up, and interest rate cut expectations continued to be “suppressed”. The manufacturing prosperity of the world’s major developed countries was not good.

China’s economy has shown signs of improvement, and the domestic chemical market operation environment has slowly recovered. In March 2024, China’s manufacturing PMI was 50.8%, up 1.7 percentage points M-O-M. The PMI in March stood on the threshold, and the data performance exceeded expectations. From the perspective of enterprise size, the pressure faced by small and medium-sized enterprises was still relatively large. From the perspective of industry, the production index recorded 52.2%, which played a larger role in driving the manufacturing PMI. In terms of industry, 15 of the 21 industries surveyed were in expansion territory, an increase of 10 from February. The restoration of the construction industry is weak, and high-end and intelligent new quality productivity is playing an increasingly important role. Overall, there are signs of improvement in the Chinese economy.

It is estimated that international crude oil prices may fluctuate downward in April, but the price decline may be limited. The Fed’s interest rate cuts may be postponed to June or even later. Accordingly, the relatively strong USD may hinder the international crude oil price increment. Moreover, the actual crude oil production cuts may be lower than expected, so the support for the international crude oil market may weaken. In addition, if the European situation is under control, international crude oil prices may fluctuate downward.

The operating rate of the chemical industry rose in March. According to SCI’s monitoring of 50 major chemicals, the monthly average operating rate was 66.51% in February, up 7.76 percentage points M-O-M and up 0.57 percentage points Y-O-Y. The operating rate rise of downstream products was larger, signifying the improvement of market demand.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.