China BD Market: Surging in Q1, to Fall from Highs in Q2

Snapshot: In Q1, 2024, China’s butadiene market price perked up, spurred by supply cuts and intensive unit maintenance. The market price of butadiene surged to a 2-year high. Yet, downstream demand gained slightly, so China’s butadiene price fluctuated at highs in March. In Q2, prices of downstream products are expected to advance limitedly. Coupled with rising supply, the market price of butadiene may trend down from highs in Q2.

In Q1, 2024, China’s butadiene market price surged greatly, and its average price ramped up M-O-M. According to SCI, in Q1, 2024, the average price of butadiene in the Jiangsu-Zhejiang market stood at RMB 10,280/mt, up 14.8% M-O-M. The overall butadiene price fluctuated within RMB 8,550-11,800/mt, peaking on March 18 and bottoming on January 9. From January to February, China’s butadiene market price trended up notably, mainly due to dip in domestic supply and unexpected units’ shutdown. Besides, from March, China’s butadiene units began to take maintenance intensively. Expected unit turnarounds greatly pushed up the domestic trading atmosphere. Moreover, affected by transportation problems, limited deep-sea cargoes were replenished to the Asian market. In February, some butadiene units in Southeast Asia were shut down briefly. Downstream enterprises in South Korea and China’s Taiwan needed to purchase spot butadiene. Thus, batches of Chinese-made butadiene resources were exported for arbitrage. The spot availability of butadiene in China pared back notably. The robust Asian butadiene market pushed up China’s domestic price.

The supply underpinned China’s butadiene market greatly.

In Q1, 2024, China’s butadiene output stayed low. According to SCI, in Q1, China’s butadiene output totaled 1,089.2kt, down 2.42% Q-O-Q. In Q1, some butadiene units were shut down at Sinopec Shanghai Petrochemical (one set), Sinopec Qilu Company (one set), BASF-YPC, Sinopec Beijing Yanshan Company, Liaoning Bora Petrochemical, Sinopec Maoming Company, Sinopec Guangzhou Company, Shenhua Ningxia Coal Industry, Sinopec & SK (Wuhan) Petrochemical, Shandong Wintter Chemical, Shenghong Petrochemical, Sinopec Zhongke (Guangdong) Refinery, PetroChina Liaoyang Petrochemical and Zhejiang Petroleum & Chemical Phase II. Besides, the overall profitability of crackers underperformed, so the operating rate changed slightly. Moreover, expected intensive unit maintenance in April strongly bolstered China’s market.

Constant exports drove up the butadiene price in China.

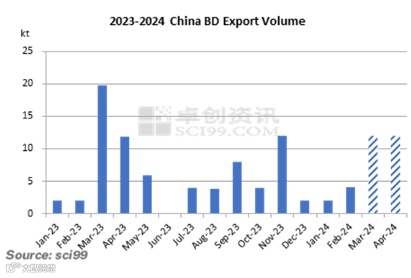

In Q1, butadiene exports strongly boosted the trading atmosphere in China’s market. According to SCI, in Q1, 2024, the export volume of butadiene in China was expected to reach over 20kt, up from Q4, 2023. In early February, the butadiene unit at Shell in the U.S. was shut down unexpectedly, so the delivery time of some deep-sea cargoes shipped in end-February was delayed. In mid-February, the new butadiene unit in Vietnam saw an unplanned shutdown. Besides, the cracker at PRefChem was shut down unexpectedly, leading to a low availability of off-shore resources. Yet, there was certain spot demand for butadiene in South Korea, so inquiries for China’s resources ramped up. According to SCI, from February to March, more than 10 ships of resources for March and April were concluded and mainly flowed to South Korea. In Q1, constant exports greatly drove up the trading atmosphere, with the export price rising to $1,500/mt (CFR South Korea). The robust Asian butadiene market pushed up China’s domestic butadiene prices.

Remarks: The export volume of butadiene in March and April refers to the forecast value.

Downstream consumption volume dragged down the butadiene market.

After rising prices in January and February, China’s butadiene market in March hardly saw a further rise, mainly affected by lukewarm demand. In Q1, the demand for butadiene continued to decline. According to SCI, in Q1, the consumption volume of butadiene in China stood at 1,115.3kt, down 5.62% Q-O-Q. As butadiene prices remained in an uptrend, most downstream enterprises were pressured by high costs. In Q1, most downstream industries were trapped in profit losses, curbing the overall operating rate. Some private synthetic rubber, SBS and ABS enterprises cut the operating rate or even shut down units, so the consumption volume of butadiene continued to descend. Some downstream users showed resistance to high-priced butadiene. The dip in demand dragged down the butadiene price.

In Q2, China’s butadiene price may face headwinds in rising amid weakened support from supply.

In Q2, China’s butadiene market price may fall from highs, so the support from supply may ebb from Q1. Meanwhile, prices of downstream products may hardly gain, affecting the butadiene market as well.

As seen from domestic output, in Q2, butadiene units under maintenance will dwindle. In mid-April, Shenghong Petrochemical and PetroChina Liaoyang Petrochemical plan to restart their butadiene units. In Q2, some butadiene units may still take turnarounds such as Zhejiang Petroleum & Chemical Phase II, Sinopec Zhongke (Guangdong) Refinery, Zhejiang Satellite Petrochemical, Sinopec Shanghai Petrochemical (one set), Sinopec Beijing Yanshan Company (one set), North Huajin Chemical Industries and PetroChina Dushanzi Petrochemical. The output losses under maintenance may whittle down from Q1. As seen from the new butadiene unit, in Q2, the new 100kt/a butadiene unit at Shandong Jincheng Petrochemical will go into production, replenishing the spot market. On the whole, the support from the supply may weaken compared with Q1.

As seen from downstream consumption, in Q2, downstream units may see sparse planned maintenance. For the synthetic rubber sector, in Q2, the SBR unit at Huizhou LCY Elastomers plans to take maintenance for around 7 days from end-June. Some SBR units with lower loads in Q1 may resume normal operation. It is estimated that China’s SBR output may rise by 1.28% from Q1. For the PBR sector, the PBR units under maintenance may slide notably. Besides, Zhejiang Transfar Synthetic Materials plans to put its new 120kt/a PBR unit in June, driving up the overall PBR output. On the whole, the demand increase may give certain support to the butadiene price in Q2.

As seen from the import and export markets, there are some export negotiations on butadiene for May, bolstering China’s butadiene market somewhat. However, in June, some deep-sea cargoes will arrive at East China port gradually. Coupled with the restart of some units in Southeast Asia, the support from the export may weaken. Against high Asian butadiene prices, imported butadiene resources may mainly be for contract and hardly replenish China’s domestic market.

On the whole, in Q2, China’s butadiene market may fall from high levels for lack of more favorable factors. However, due to limited imports and demand recovery, the decrement in butadiene price is likely to be minor. Considering the current butadiene price, it is estimated that the average price of butadiene in Q2 may be slightly higher than that in Q1.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.