Containerboard Market Sustains Bullish Trend in Nov

Entering November, the containerboard market maintained an uptrend supported by low inventory at producers. However, the purchasing interest of downstream players has decelerated slightly, and the market trading was stable. Some large-sized paper mills have announced price hikes scheduled this week, and the market is more likely to remain bullish. However, weaker demand and accumulating inventory at downstream packaging plants may restrict the price rise.

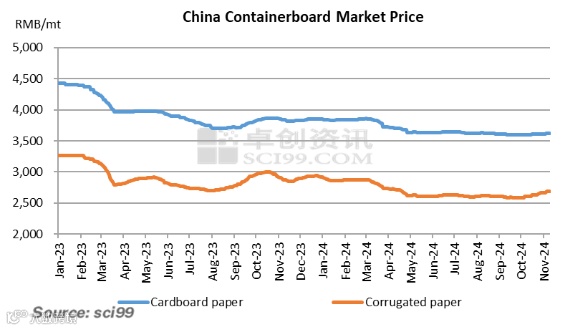

In November, the containerboard market has been bullish overall, with large-sized players raising prices for 2-3 rounds and cumulatively by RMB 30-60/mt. Medium and small-sized players also followed suit, bolstering the market price. The order status at paper mills is passable, and the low inventory level is the major factor supporting the price hike. However, the order status at downstream packaging plants is mediocre, and they start to show lower purchasing interest. According to SCI, as of November 12, the market price of AA grade corrugated paper price in China is RMB 2,689/mt, up 0.99% from that in late October, and that of cardboard paper is RMB 3,621/mt, up 0.20%.

Low inventory supports price hikes

The market demand has improved after October, and bolstered by active downstream purchases, the inventory went down smoothly at paper mills, which supported price hikes in November. According to SCI, as of November 7, the inventory at sample corrugated mills was 382.5kt, down 2.97% WoW, and that at sample cardboard paper mills was 1,036.5kt, down 2.34% WoW.

Profitability improves despite rising costs

OCC is the main upstream material of corrugated paper and cardboard paper, accounting for over 85% in proportion. The supply of OCC has been relatively tight since the start of November, and the delivery volume is low. The rising production cost lends some support to the price hikes in the containerboard market. From the industrial chain perspective, the pass-down of price hikes is relatively smooth, and the price rise of containerboard is greater than that of raw materials, so the profits improve. According to SCI, as of November 11, the gross profit rate of corrugated paper increased by 0.47pp compared to that in late October, while that of cardboard paper increased by 0.15pp.

Containerboard market may remain bearish with further price hike attempts

Most paper mills of the leading players have announced price hike plans, and the inventory is at a relatively low level, which will support the price hike. However, considering weakening order status at downstream packaging plants that may restrict procurement, smaller paper mills may be reluctant to follow the price hike. Thus, the containerboard market may still be bullish in the short term, but the price rise may become mild.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.