China PE Industry Competitive Landscape Analysis

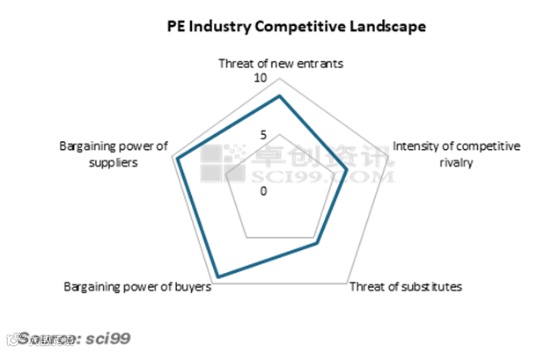

Introduction: With the release of new capacity, the supply and demand in the PE market are expected to maintain a growth trend. Despite China’s considerable dependence on imported resources for certain special materials, the potential for an oversupply of some general-purpose materials may grow. The greatest competition facing China’s PE industry in the future is anticipated to stem from the upstream and downstream sectors, including petrochemical enterprises and downstream producers. Petrochemical enterprises are actively seeking breakthroughs, moving toward the production of high-end and specialty products with likely stronger pricing power in terms of high-quality feedstock. Downstream producers are striving to develop more high-value-added products to meet the increasingly diverse needs of the residents.

There are over 50 petrochemical enterprises in China’s PE industry. With numerous new entrants in recent years, the industry concentration ratio remains low. The market supply and demand may continue to show a growth trend. Despite China’s high dependence on imported resources for certain special materials, the potential for an oversupply of some general-purpose materials may grow. The regional distribution of PE capacity is imbalanced with mismatches in supply and demand across regions. As PE capacity expansion tilts toward consumption areas, the allocation of resources between producers and consumption regions is expected to rationalize. The investment entities in PE are diversifying, and the share held by the two major petrochemical enterprises is being encroached upon by private enterprises and joint ventures. Diversification is also seen in the source of feedstock, and the proportion of naphtha-based PE is being pressured by other sources such as coal-based and light ends-derived products. The downstream industries of PE are mostly characterized by numerous enterprises of varying sizes and low industry concentration ratios. In traditional downstream industries, the gross profits gradually narrow, and there is often price competition. The profitability of downstream product processing enterprises is concentrated in some more niche areas of special materials.

China’s PE industry remains in a capacity expansion phase, with a continued influx of upstream entrants, numerous newly added integration units, and a relative concentration of HDPE and FDPE unit startups. Entry barriers are low, while exit barriers are higher. With the improvement of China’s self-sufficiency in PE, new entrants often significantly impact the surrounding markets. Traders and downstream producers are moving towards large-scale, group-based development. In a fiercely competitive environment, the survival of small and medium-sized enterprises is relatively difficult.

In terms of substitutes, products made from recycled PE cannot achieve the same quality as virgin PE, which confines their potential as substitutes. Some PP products may somewhat replace PE, but weaker low-temperature resistance limits their substitutability, keeping the dominant position of PE in the plastics industry steady.

The bargaining power of suppliers is gradually weakening. With the continuous growth of domestic supply, the negotiating power of sellers, namely petrochemical enterprises, is declining, compressing their gross profits. This has resulted in losses for some petrochemical enterprises and an increase in operational shutdowns. Suppliers of general-purpose materials typically have weaker bargaining power, except when there is a shortage, while those of special and high-end materials possess relatively stronger bargaining power.

Regarding the bargaining power of buyers, due to the severe homogenization of general-purpose PE products and a wider choice of producers, the market often faces an oversupply situation. With prevalent price competition compressing margins in downstream industries, these buyers wield stronger negotiating power. However, some special materials still depend on imports or limited domestic production, which results in scarce supply, giving buyers less leverage over high-end products.

Overall, the greatest competitive challenges in China’s PE industry arise from the upstream and downstream sectors, namely petrochemical enterprises and downstream producers. With the increase of new entrants in the petrochemical industry, the concentration ratio may continue to decline. As general-purpose material supply becomes increasingly excessive and competition intensifies among petrochemical enterprises, the bargaining power of downstream producers is expected to further strengthen. Meanwhile, petrochemical enterprises are actively seeking to break through by developing high-end, specialty products, continuously enhancing their competitive edges to overturn a disadvantaged position, and likely attaining strong pricing power for high-quality materials. On top of maintaining their current market shares, downstream producers are determined to research and develop more high-value-added products to fulfill the growing needs of consumers.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.