China Methanol Demand Structure Analysis and Forecast

Downstream demand is one of the important factors that determine the price trend of industrial products. Methanol, as a raw material chemical product relatively close to the upstream, its demand fields are relatively stable in recent years, but the performance of specific downstream industries is different.

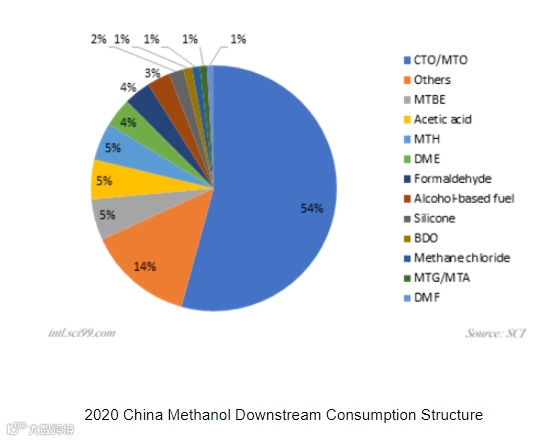

The CTO/MTO industry remained as the largest downstream field in recent five years. In 2020, the methanol consumption volume from the CTO/MTO industry took up about 54% of the total, up over 14% from 2016. The increasing methanol consumption from the olefin industry is the result of the continuous development of China's coal chemical industry and the successful practice of exploring the non-petroleum route to produce low carbon olefin and other fine downstream products. According to SCI, there will still be newly added olefin units put into production successively in the next few years.

However, SCI also noted that after the capacity expansion peak in 2014 and 2015, the olefin capacity growth has slowed down. On the one hand, the number of newly added projects is limited after the commissioning of former approved projects. On the other hand, crude oil prices kept dropping, dampening the cost advantage of CTO/MTO projects. Moreover, wide fluctuations in methanol prices and Low profits weakened the production positivity of olefin plants. But overall, olefin capacity will remain still on the rise in the next few years, although the growth rate has slowed down.