Oct PP Prices to Grow Before Drops on Strong Macro Environment

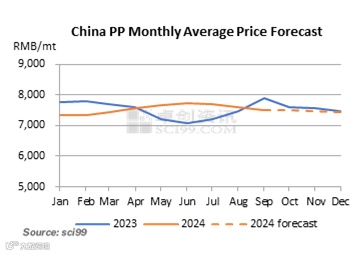

Highlights: China’s PP market prices declined at first but then rebounded in September, while mainstream prices inched down. China’s PP prices are likely to spiral upwards at first but then lose ground in October, with the demand slack season coming in November.

China’s PP market prices declined at first but then rebounded in September, while mainstream prices inched down. Therein, PP prices went down in early September because of softer-than-expected demand and lower feedstock costs, while prices rallied slightly in late September due to the eased supply pressure and positive macro-environment policy. Prices of crude oil and propylene declined, reflecting softer production cost for PP. PP downstream users maintained basic purchases, leading to fewer orders for PP compared with the same period of 2023. That dented PP market prices. In the second half of September, the Fed curtailed interest rate, and China reduced deposit reserve ratio and interest rate, boosting the stock market and commodity market. The PP futures prices also rebounded, and players held an optimistic stance. Besides, more PP units experienced maintenance in late September, and traders and downstream plants stockpiled near the National Day holiday in China, propelling the PP price growth. However, the upward range was narrower than the futures price, as the downstream demand improvement was temporary.

China’s PP output is supposed to climb to around 3,015kt in October, but the daily output may register a MOM dip. INEOS Sinopec Tianjin Nangang and Inner Mongolia Baofeng Coal-Based New Materials plan to put new projects into use in October, and there will be more working days, which may lead to PP output growth. However, there may be scheduled maintenance of PP units, which may ease the PP supply somewhat. The output loss caused by maintenance is estimated to rise by 6.31% MOM to 564.5kt in October. As for imports, they are supposed to rise slightly, as import deals may be driven by seasonal rigid demand and appreciation of RMB value against USD. Generally, the overall supply pressure may be marginally lower than that in September.

The positive macro policy buoys the PP markets currently and may propel some demand release in October, even though the demand peak season will come to an end. Hence, the domestic downstream demand for PP is likely to brighten. In terms of export market, the overseas demand may perform poorly, and overseas supply may be ample, so PP export volume is predicted to decline significantly in China. In conclusion, the overall demand for PP may grow limitedly in October.

China’s PP prices are likely to spiral upwards at first but then lose ground in October. The news that crude oil output will be lifted hinder the oil market, but propane prices are expected to ramp up with the combustion peak season drawing near, so PP production costs based on diversified feedstock sources will be different. In terms of fundamentals, PP supply pressure may be alleviated to a certain degree in October due to the intensive unit turnarounds, despite newly added capacity. The downstream demand for PP may witness a slight improvement. After China’s National Day holiday, positive macro policy and optimistic sentiment may bolster the PP price, even though the producer inventory will pile up. Generally, the PP market will get support from fundamentals and macro environment. However, downstream users will probably slow down procurement because their profit will be compressed with PP prices climbing. In addition, the crude oil-based PP production costs may further ratchet down. As a result, the PP market prices may face downward risks.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.