2024 China BD Market Swung Up in H1, Likely to Inch Down in H2

Snapshot: In H1, 2024, China’s butadiene market price fluctuated upwards, mainly backed by supply crunch and intensive exports of domestic resources. Besides, the price of PBR futures surged, greatly pushing up the butadiene market. In June, the market price of butadiene hit a 3-year high. In H2, 2024, looser supply may give weakened support to the butadiene price. Yet, some new downstream capacity is scheduled to kick off. Thus, the decrement in butadiene price may be limited.

China’s butadiene market price swung up, strongly bolstered by supply.

In H1, 2024, China’s butadiene market fluctuated upwards, and the price nearly notched a 3-year high. The overall price trend deviated from what SCI’s forecast in the 2023-2024 China Butadiene Market Annual Report. It was mainly because of the limited replenishment of deep-sea cargoes to the Asian market and the delay in the restart time of the new butadiene unit. In Q2, the market price of butadiene in China went higher notably, as new capacity was not released as scheduled and PBR futures price soared. As of June 25, the butadiene price in the Jiangsu-Zhejiang market averaged RMB 11,162/mt in H1, 2024, up 35% Y-O-Y. On June 25, the butadiene price in the Jiangsu-Zhejiang market closed at RMB 13,450/mt, up 52% from early 2024.

In Q1, 2024, China’s butadiene market price surged greatly, and its average price ramped up M-O-M. According to SCI, in Q1, 2024, the average price of butadiene in the Jiangsu-Zhejiang market stood at RMB 10,280/mt, up 14.8% M-O-M. The overall butadiene price fluctuated within RMB 8,550-11,800/mt, peaking on March 18 and bottoming on January 9. From January to February, China’s butadiene market price trended up notably, mainly due to dip in domestic supply and unexpected units’ shutdown. Besides, from March, China’s butadiene units began to take maintenance intensively. Expected unit turnarounds greatly pushed up the domestic trading atmosphere. Moreover, affected by transportation problems, limited deep-sea cargoes were replenished to the Asian market. In February, some butadiene units in Southeast Asia were shut down briefly. Downstream enterprises in South Korea and China’s Taiwan needed to purchase spot butadiene. Thus, batches of Chinese-made butadiene resources were exported for arbitrage. The spot availability of butadiene in China pared back notably. The robust Asian butadiene market pushed up China’s domestic price. From April to May, the market price of butadiene trended flat. Due to low spot volume and loads of downstream sectors, China’s butadiene market price remained at a high level. In late May, affected by low dealing prices in the Asian market, the butadiene price saw a downtick. Yet, traders bought for cover in late May, and from end-May, the price of PBR futures floated up greatly, driving up the trading atmosphere in China’s market. In June, the market price of butadiene soared to nearly a 3-year high. In Q2, the market price of butadiene in China fluctuated within RMB 10,900-13,850/mt, with an average price of RMB 12,074/mt, up 17.45% Q-O-Q.

In H1, 2024, China’s butadiene market spiked up, beyond most players’ expectations. The butadiene output was curtailed, and the export volume leveled up notably. Besides, the commissioning time of the new unit was postponed.

The tight supply of butadiene underpinned China’s market greatly.

In H1, 2024, China’s butadiene output declined Y-O-Y. Due to profit losses, China’s and overseas enterprises faced constant losses in their crackers, registering thin enthusiasm for production. Besides, in H1, 2024, parts of China’s butadiene units saw planned or unplanned shutdown. Some small ethylene crackers also remained shut for a long period on account of profit problems. Therefore, in H1, 2024, China’s butadiene output trended down Y-O-Y. According to SCI, in H1, 2024, the total output of butadiene in China stood at 2,120kt, down 1.85% Y-O-Y. In terms of new units, no new butadiene units came on stream in H1, 2024. Most new butadiene units are planned to kick off in Q4, 2024, hardly replenishing the domestic butadiene market in H2, 2024.

Surging PBR futures market pushed up the butadiene price to a new level.

According to SCI, in H1, 2024, the total consumption volume of butadiene in China stood at 2,150kt, almost unchanged Y-O-Y. In 2024, most downstream industries were trapped in profit losses. Yet, the overall butadiene consumption didn’t show notable declines, in tandem with the release of some new capacity and rigid demand. Therein, the consumption volume from the synthetic rubber sector moved up. Orders in the synthetic latex industry were passable, so the rigid demand still propped the butadiene price from the bottom. In H1, 2024, due to severe profit losses, SBS enterprises showed weak interest in production, dragging down the demand for butadiene. The butadiene consumption in other industries changed slightly.

In H1, 2024, the export volume of butadiene in China ramped up Y-O-Y. In 2024, due to transportation problems, the replenishment volume of deep-sea cargoes to Northeast Asia diminished. Some butadiene units in Southeast Asia ran unsteadily, so its resources flowing to Northeast Asia remained limited as well. Yet, some downstream enterprises in South Korea needed to purchase feedstock butadiene. Thus, batches of Chinese-made butadiene resources were exported for arbitrage. Against a drop in domestic output, the butadiene export volume trended up notably. Accordingly, available spot resources in China crashed, propping up domestic prices. According to SCI, from January to May 2024, China’s butadiene export volume reached 72kt, up 74% Y-O-Y.

With the listing of PBR futures, some products along with the butadiene industrial chain embrace certain financial attributes. From end-May, the spot supply of PBR was curtailed. In early June, the PBR futures price surged. As of June 13, the dominant contract PBR futures 2407 closed at RMB 16,555/mt, up RMB 840/mt. Rising futures prices pulled up the butadiene price notably.

In H2, 2024, the market price of butadiene may be mainly affected by its own supply and demand. Players should eye on the commissioning time of new butadiene and downstream units.

In 2024, the commodity market may show an upward trend. H1, 2024 has witnessed demand recovery, and H2 may be in the replenishment cycle where prices rise most smoothly. Thus, changes in fundamentals may mostly affect the butadiene price.

In H2, 2024, the butadiene supply is likely to resume, so its support for price may ebb.

In H2, 2024, the number of butadiene units under maintenance may decline compared to H1. Besides, in Q4, some new butadiene units are scheduled to kick off, replenishing China’s domestic market. Therefore, the support for price may weaken from supply. At present, some butadiene units are planned to take maintenance such as North Huajin Chemical Industries (120kt/a), Zhejiang Petroleum & Chemical Phase III (250kt/a), Sinopec & SK (Wuhan) Petrochemical (130kt/a), Fujian Refining & Petrochemical (180kt/a) and PetroChina Jilin Petrochemical (190kt/a). Thus, the number of units under turnarounds may level down. China’s butadiene supply is likely to perk up. What’s more, in Q4, new butadiene units at Sinopec Tianjin Nangang, Shandong Jincheng Petrochemical Group and Shandong Yulong Petrochemical may conduct trial run. China’s butadiene supply may ramp up. Thus, in H2, 2024, the support for butadiene price from the supply may weaken from H1.

In terms of imports, the butadiene price in Northeast Asia remains high, attracting some deep-sea cargoes for arbitrage. From August, parts of Europe and the U.S.-origin butadiene resources may be replenished to the Asian market. Besides, some resources in Southeast Asia are also under negotiation, replenishing the Northeast Asia market. Yet, due to transportation cost problems, it’s still uncertain for the sustainability of imported resources.

The demand may bolster the butadiene price, in the wake of expected commissioning of new downstream units.

In H2, 2024, some new downstream units may be put into operation, mainly covering ABS, PBR, SBR, SCI and SBL. According to theoretical calculation, the increment in consumption volume will be possibly larger than that in butadiene output. Thus, the demand may lend certain support to the butadiene price. Especially, the consumption volume of butadiene from the PBR and ABS sectors may warm up notably. In terms of the macro environment, in H2, 2024, the commodity market may show an upward trend. The growth rate of infrastructure investment may remain positive. Stimulus measures in the fields of automobiles, home furnishings and home appliances may boost the consumption recovery. Therefore, end demand is expected to improve, which may bolster the upstream feedstock market.

In H2, 2024, China’s butadiene market price may fall from highs, but the overall average price may be higher from H1.

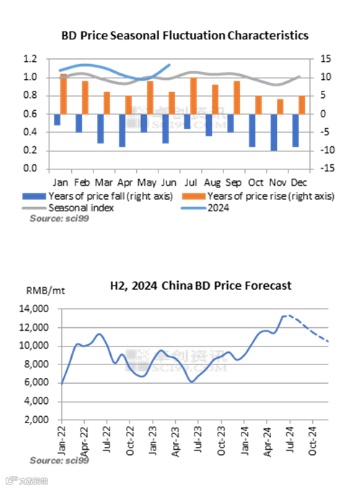

As seen from historical data, the market price of butadiene in Q3 is likely to advance. Generally, Q2 and Q3 witness intensive units’ maintenance. Besides, China’s butadiene industry may usher in a high-incidence season in summer such as delays in shipping time and unexpected unit shutdown. Coupled with fairish demand in September and October, the butadiene price is predicted to heat up. In Q4, with supply resuming normal, the butadiene price is possible to drop. In 2024, boosted by supply crunch, high exports and rising prices of PBR futures, China’s butadiene market price has surged to a 3-year high. In Q3, the support from supply may weaken. Some deep-sea cargoes may be replenished to Northeast Asia, hindering the further rise in butadiene price. Thus, high butadiene prices may ratchet down somewhat. However, considering that some downstream units may kick off in Q3, restraining the decrement in butadiene price. In Q4, with the commissioning of new units, the butadiene supply is projected to gear up. Thus, the price decrement in Q4 may be larger than that in Q3.

In H2, 2024, with the gradual recovery of end demand and expected commissioning of new downstream units, the demand for butadiene is expected to perk up from H1, 2024. However, in H1, 2024, China’s butadiene supply is likely to ramp up Y-O-Y, and the recovery status of demand is still to be determined. Thus, it may be hard to see a new high in butadiene price in H2. Yet, on the whole, the average price of butadiene in H2 may be higher than that in H1. The decrement in butadiene price in H2 may be limited. Therefore, SCI has revised SCI’s forecast trend in H2, 2024 in the 2023-2024 China Butadiene Market Annual Report, mainly affected by the delay in the commissioning time of new units. It is projected that the market price of butadiene may peak in July, lingering within RMB 10,000-13,500/mt. Players should pay attention to the replenishment status of imports as well as the commissioning time of new downstream units.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.