In H1 of 2021, IIR prices rose first and then fell. Earlier, supported by the high cost, high demand and the shortage of imported resources, IIR prices were rising. However, starting from H2 of April, IIR prices went down due to the sufficient supply and weak demand. The demand for IIR weakened as the operating rates at downstream tire enterprises declined.

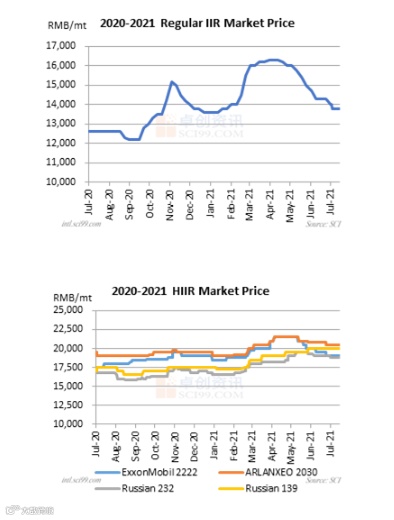

In H1 of 2021, IIR prices rose first and then declined. Earlier, supported by the high cost, high demand and the shortage of imported resources, IIR prices were rising. The prices of regular IIR 1675N rose to RMB 16,500/mt, and the prices of ExxonMobil HIIR 2222 soared to RMB 21,000/mt. However, starting from H2 of April, IIR prices went down due to the sufficient supply and weak demand. The demand for IIR weakened as the operating rates at downstream tire enterprises declined. By the end of June, the prices of regular IIR 1675N were RMB 14,000/mt, the prices of 1675T were RMB 12,800/mt, and the prices of ExxonMobil HIIR 2222 soared to RMB 19,000/mt. Specifically:

The prices of feedstock fluctuated upwards, so the cost of producing IIR was high. In terms of MTBE, China’s MTBE prices rose strongly in H1 of 2021. According to SCI’s statistics, in H1, the average price of China’s MTBE was RMB 5,435/mt, up RMB 1,364/mt or 33.51% Y-O-Y. In H1 of 2021, with the strong recovery of international oil price, the price of MTBE rose all the way. The highest price once reached RMB 6,400/mt. By the end of June, the price of MTBE was about RMB 6,200/mt. In terms of bromine, China’s domestic price of bromine showed an upward trend in H1 of 2021. Especially after April, the bromine price rose significantly. The market supply was insufficient and the demand was favorable, which supported the rising market price. The average price of bromine from January to June was RMB 37,608/mt, up 28% Y-O-Y. By the end of June, the price of bromine reached RMB 45,000/mt.

...

Please click "Read more" for more information