China Butadiene Market to Be Lackluster

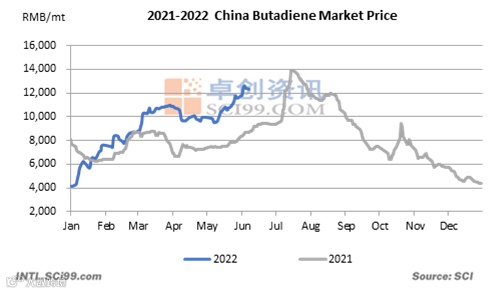

Snapshot: In early June, China’s butadiene market price notched a fresh high, and the highest price of butadiene in Jiangsu and Zhejiang market reached RMB 12,650/mt, up 29% M-O-M. However, as downstream industries failed to accept such high prices, the market price of butadiene fell back slightly at the end of mid-Jun.

China’s butadiene market price began to level up from mid-May and hiked to a new high in early June.

From mid-May, boosted by domestic fundamentals and the export of Chinese-made butadiene, China’s butadiene market price remained in an upswing. Till early June, the market price of butadiene in China surged to a new high. On June 7, the butadiene price in Shandong market and Jiangsu-Zhejiang market reached RMB 12,750/mt and RMB 12,650/mt respectively, up notably from early May. Compared with the same period last year, the market price trend of butadiene was relatively consistent, but the increment in price was notably greater. From the perspective of seasonality characteristics, the recent trend of butadiene price was also in line with the market operation characteristics of previous years, but it was still below the average price level of the past decade.

China’s butadiene market price moved sideways in early May when the supply and demand were relatively stable. However, from mid-May, negotiations on the export of Chinese-made butadiene became more active, and China’s supply and demand in May improved M-O-M. Thus, the market price of butadiene began to rise and hiked to an annual high in early June. As the market price of butadiene climbed quickly, downstream sectors faced high cost pressure. Besides, China’s butadiene supply was expected to widen. Hence, the high butadiene price began to fall back at the end of early June.

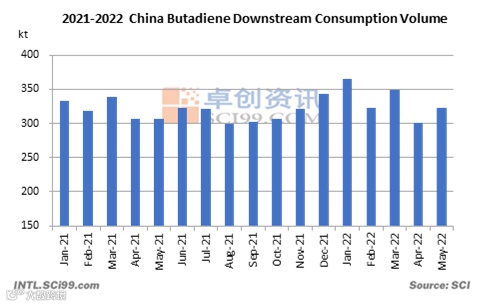

In May, the consumption volume of butadiene warmed up.

According to SCI, the consumption volume of butadiene in May reached 328.8kt, up 9.1% from April. The butadiene consumption leveled up due to the following aspects. In May, the number of domestic downstream units under maintenance descended from April. Besides, the number of downstream units which cut loads also saw declines from April. Therefore, the overall consumption volume of butadiene ramped up M-O-M. Especially in PBR, ABS and SBS industries, the operating rate climbed notably, so the demand lent certain support to the butadiene price.

From May to June, the export volume of Chinese-made butadiene picked up notably.

Remarks: The export volume of butadiene in May and June refers to the estimated value.

According to SCI, the export negotiations for May and June resources will be relatively active, and the total export volume may reach more than 30kt. The crude oil price remained high recently, but the ethylene and propylene prices hardly advanced, so the crackers faced high cost pressure. Against the backdrop that crackers in Japan and South Korea didn’t resume normal operation, there was a certain supply gap in these two countries. Asian butadiene price was higher than China’s butadiene price. Thus, some Chinese-made butadiene was exported for arbitrage, so available spot butadiene in China pared down notably. Strong support bolstered China’s butadiene market price.

China’s butadiene market is expected to slide due to falling downstream production and rising butadiene supply.

From mid-May, the market price of butadiene remained in an upswing, and downstream users faced rising cost pressure. Especially from end-May to early June, the cost pressure was high on most of the downstream sectors. Except that the profit of the NBR industry was passable, the theoretical profit of main downstream industries suffered losses, especially in the SBR industry. Downstream users showed thin production enthusiasm, and the operating rate declined. Thus, the consumption volume of butadiene dipped accordingly. The demand lent ebbing support to the butadiene price. Most downstream users stayed on the sideline, and the dealing of high-priced butadiene was limited. They mainly purchased butadiene for rigid demand. Overall, the demand dragged down the butadiene price.

As seen from the supply, China’s butadiene supply will warm up somewhat from mid-June. In June, PetroChina Fushun Petrochemical plans to increase over 1kt of merchantable butadiene from May. The butadiene units at Jiangsu Sailboat Petrochemical, Nanjing Chengzhi Yongqing Energy Technology and BASF-YPC have been restarted, replenishing China’s butadiene supply notably. Although the butadiene units at Sinopec Maoming Company remain shut, it has a limited impact on the butadiene market due to the concurrent shutdown of its downstream units. On the whole, from mid-June, China’s butadiene supply will rally. Besides, there will be some butadiene resources for pre-sales at Zhejiang Satellite Petrochemical, so the overall support from the supply will ebb.

At present, China’s butadiene market price has no obvious advantage over the Asian butadiene market price. The negotiations on exports weaken from the early days. Besides, in the coming days, the butadiene resources are projected to level up in foreign countries. Thus, the export will lend weaker support to the butadiene market. China’s butadiene fundamentals may soften. Affected by that, China’s butadiene market will remain lukewarm. In the future, players should pay close attention to the test run status of downstream units and the procurement status of downstream users in the process of butadiene price dropping.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.