July BOPET Market Price Extended Decreases

This month, the BOPET price extended losses. As of July 28, the average market price of 12μ BOPET was RMB 9,002/mt, down RMB 772/mt or 7.90% from last month and down RMB 1,568/mt or 14.94% from last year.

1. BOPET Price Trend

In July, BOPET market prices extended declines and hit a new low. Crude oil prices fluctuated downward in the month, and prices of PTA and MEG dropped consecutively. Prices of PET chip followed the downtrend in the feedstock markets. Therefore, the cost side weighed on the BOPET market. In addition, newly added units went into production in the month, and units that were shut down for maintenance in the previous stages were restated. There was an increase in supply. However, the downstream demand underperformed, in line with the low operating rate of 30%-50%. The buying sentiment of users was low, which further dampened the BOPET market. Downstream users only replenished because of the rigid demand in some periods, and the dealing prices were low. The overall trading volume was below 30kt, which cannot support the BOPET prices.

According to SCI, as of July 28, the offers for 12μ general-purpose BOPET in East China were about RMB 8610-9010/mt, and the negotiation price was about RMB 8,210-8,510/mt, down RMB 1,300/mt from last month and down RMB 2,400/mt from last year. The monthly average price was about RMB 9,002/mt, down RMB 772/mt or 7.90% from last month.

Other price references: Offers for 20μ above BOPET were about RMB 8,210-8,410/mt. The negotiation prices of 6μ BOPET were about RMB 12,300-12,500/mt. The offer for substrate, which is used for release film and protective film, was RMB 10,500/mt. Offers for hot stamping film were about RMB 8,800-9,200/mt

2. China BOPET Industry Operation Analysis

According to the research data of SCI, the operating rate of China’s BOPET industry was estimated at 68.85% in July, down 1.17% from last month and down 11.18% from last year. The output was estimated at 307.2kt in July, up 2.26% from last month. One production line was put into use in July

The downstream demand seemed hard to improve in the month. The delivery of goods slowed down. The inventory of finished BOPET increased in July, which was estimated to be 128.3kt by late July, up 27.7kt or 28% from last month.

3. BOPET Market Detailed Operation Data

In July, 7 production lines were shut down for maintenance, so the industry operating rate went down. The demand tended to be insipid. The inventory at producers built up as the delivery of goods slowed down. The inventory rose to a five-year high.

In July, the BOPET profits mounted up. The international crude oil price fluctuated downward, and feedstock PTA and MEG prices dropped accordingly.

By July 28, the negotiation price of PTA in East China was RMB 6,050/mt, down RMB 865/mt from last month. The negotiation price of MEG spot resources in Zhangjiagang was RMB 4,260/mt, down RMB 160/mt from last month. The negotiation prices of the bright chip in Jiangsu and Zhejiang were RMB 7,125/mt, down RMB 700/mt from last month.

In July, the BOPET mainstream negotiation price moved down. By July 28, the negotiation prices of general-purpose BOPET in East China were about RMB 8,610-9,010/mt, and the negotiation prices were about RMB 8,210-8,510/mt, down RMB 1,200/mt from last month. On the whole, the average profit at BOPET enterprises was RMB -39/mt, up RMB 157/mt from last month.

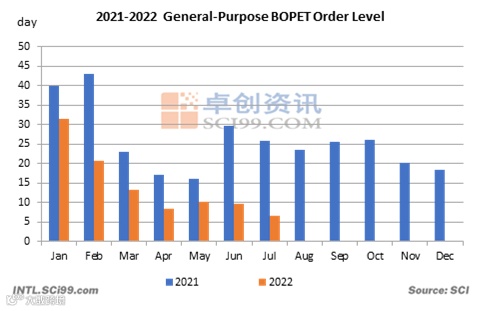

According to the order situation of 14 general-purpose film producers researched by SCI, as of late July, the average order level for general-purpose BOPET was 6.5 days, which was 3.07 days lower than last month and 19.27 days lower than the same month last year.

4. BOPET Market Outlook

In the next three months, 4-5 production lines will still be put into use, and 4 production lines are expected to be restarted. The supply is expected to increase continuously, which may weigh on the prices. On the demand side, the peak demand will come in September and October. The demand from the soft packaging field may increase, and users may replenish stocks intensively. However, the replenishment amount may be limited due to the ample resources in circulation. As for orders, the order cycle is short, so the support is limited. It is predicted that the average price of BOPET will rebound after the drop in August. SCI predicts that the prices of general-purpose 12μ BOPET in East China will be RMB 8,510-9,010/mt, and the negotiation price will be RMB 8,010-8,510/mt. From September to October, the price of BOPET may rise first and then move down. If the order increases during this period, it may facilitate the price of BOPET to rebound.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.