Brief Analysis of PVC Market in Mar

Preface: The PVC powder market price showed an N-shaped trend in February with fixed factors tangling, and the monthly average price inched down M-O-M. In March, there will be both positive and negative factors in the PVC powder market. PVC fundamentals may improve, while macro markets saw some uncertainties. It is expected that the PVC market price will fluctuate upward in March, and the average price will move up.

Some factors in fundamentals that recommend to concern:

1. Whether supply can be maintained at current levels

Few new units’ startups in March are heard at present. In previous years, there were few maintenance units in March. In addition, the new capacity of 400kt/a at Guangxi Huayi New Material has been released gradually. Thus, the PVC industrial operating rate may be high in March.

In addition, the profit of chlor-alkali producers should be concerned. Though profit losses in the PVC industry were eased with the continuous decline in calcium carbide prices, the profit of chlor-alkali producers remained underperformed as the caustic soda price saw a notable drop. Thus, the PVC industrial operating rate may drop amid profit losses at chlor-alkali producers.

2. Whether demand can improve notably.

Downstream producers resumed production gradually in February. Most large-sized pipe producers hold operating rates at 60%-80% at present, while small and medium-sized producers hold low operating rates. A couple of downstream producers mainly consumed previous orders. As PMI was 52.6%, which overpassed than expected, market players hold positive attitudes that the PVC market may enter the traditional demand peak season. Thus, SCI reckons that the PVC demand will improve in March.

In addition, some producers received export orders in January and February. Some export orders will be delivered in March, so the net export volume may remain high in March, which is expected to consume China’s domestic PVC resources. However, weakened export orders at the end of February may drag down the market sentiment to some extent.

3. Whether social inventory can usher in an inflection point.

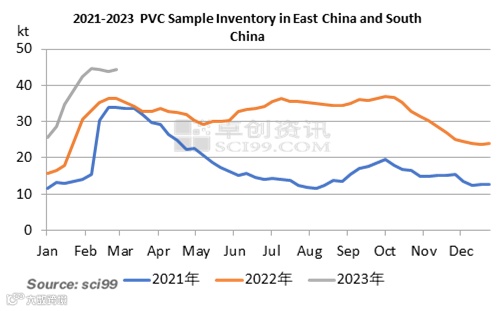

The sample inventory in East China and South China stays high at present, which increases notably Y-O-Y. According to the regular inventory changes, in H2 March, PVC inventory saw a downtrend most time. However, the social and producer inventory remains high at present. In addition, newly-added units are likely to be put into operation recently. Thus, SCI reckons that the drop in social inventory will be slower than that in previous years. The appearance of the inflection point may be delayed.

On the whole, SCI estimates that PVC fundamentals may see a limited improvement in March. Market players are recommended to focus on the recovery of downstream demand. In addition, market participants should focus on the changes in related policies and market sentiments.

Some players held bullish sentiments about the recovery of the real estate industry, supporting the increment in the PVC powder price in H2 February. In early March, it was issued that PMI overpassed expected, which gave support to the market sentiment. Market players hold positive expectations for consumption restoration. Some players reckon that there will be more beneficial policies related to the real estate industry.

In foreign countries, the Fed raised interest rates recently, which dragged down the macro atmosphere.

To sum up, there will possibly be negative and positive factors in March. The recovery of downstream demand and the real estate industry and the implementation of the policy should be concerned.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.