BOPET Market Went down in May 2023

The monthly average price of BOPET went down in May. As of May 29, the average BOPET price was RMB 8,071/mt, down RMB 319/mt or 3.81% M-O-M and down 16.37% Y-O-Y.

1. BOPET Price Trend

China BOPET Monthly Closing Price

Unit: RMB/mt

Type |

Grade |

Apr 26, 2023 |

May 29, 2023 |

M-O-M change |

Aluminized base film |

6μ |

9,700 |

9,400 |

-300 |

Printing film |

12μ |

8,260 |

7,860 |

-400 |

Hot stamping film |

12μ |

8,700 |

8,300 |

-400 |

Transfer film |

15μ |

10,800 |

10,800 |

0 |

In May, the BOPET price fell from highs. Prices of PTA and PET chip dropped, weakening the support to the BOPET market. The operational pressure on producers was eased somewhat with the production profit recovering. The supply of BOPET continued to go up, in the wake of newly added capacity commissioning and unit restarts. However, the downstream demand did not improve. The BOPET price trended down amid the deteriorated contradiction between supply and demand. With the price falling, the bearish sentiment of downstream users turned flat. Transactions at low prices picked up in H2 May, and the order level at producers extended.

According to SCI, as of May 29, the negotiation price for 12μ general-purpose BOPET in East China was about RMB 7,710-,8010/mt, down RMB 400/mt from last month and down RMB 1,900/mt from last year. As of May 29, the average price of BOPET was RMB 8,071/mt, down RMB 319/mt or 3.81% from last month and down 16.37% from last year.

2. China BOPET Industry Operation Analysis

China BOPET Industry Operation (Sampling Survey) |

||||

Index |

Apr |

May |

M-O-M change rate |

Y-O-Y change rate |

Operating rate |

68.72% |

66.53% |

-2.19% |

-6.47% |

Profit rate |

1.74% |

3.21% |

+1.47% |

-4.57% |

Feedstock inventory (day) |

9.53 |

8.77 |

-0.76 |

-0.13 |

Finished product inventory (day) |

14.65 |

16.30 |

+1.65 |

5.77 |

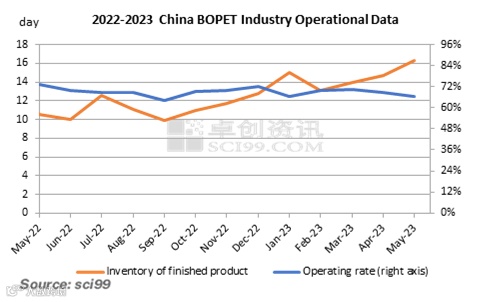

In May, the output of BOPET slightly increased, while the downstream demand did not see obvious improvement. The inventory of finished products at producers accumulated amid the slow delivery of goods. It was estimated that the BOPET inventory was around 16.30 days’ worth by late May, up 1.65 days from last month and up 5.77 days from last year.

3. BOPET Market Detailed Operation Data

In May, one production line was added. 3 producion lines restated. 3 production lines underwent maintenance for 5-20 days. The overall industry operating rate declined. However, the downstream consumption was slow, pushing up the inventory of BOPET.

May 2023 China BOPET Feedstock Price and Gross Profit |

||

Item |

Data (RMB/mt) |

M-O-M |

PTA price |

5,588 |

-547 |

MEG price |

4,003 |

-84 |

PET chip price |

6,775 |

-325 |

BOPET price |

7,710-8,010 |

-400 |

Gross profit |

-478 |

+164 |

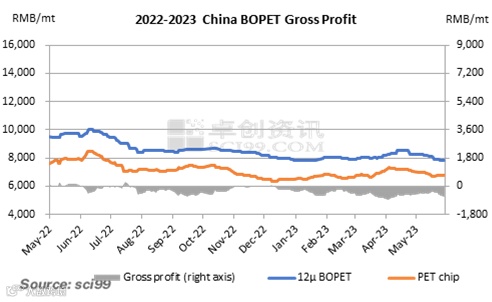

The monthly average gross profit of BOPET producers mounted up in May. The feedstock PTA and MEG prices decreased amid the wide adjustment of crude oil prices. The BOPET price also went down, but the price decline was smaller than that in the feedstock market.

As of May 29, the negotiation price of general BOPET was around RMB 7,710-8,010/mt, down RMB 400/mt from last month. On the whole, the average profit at BOPET enterprises was RMB -478/mt, up RMB 164/mt from last month.

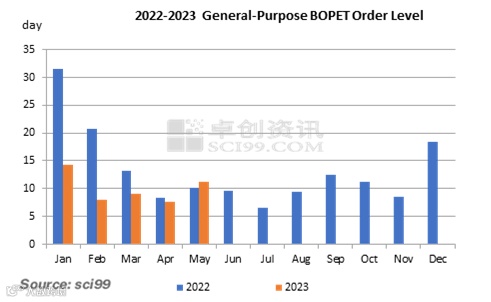

According to the 14 sample companies, it was estimated that the order level for general BOPET was around 11.14 days by late May, up 3.50 days from last month and up 0.93 day from last year.

4. BOPET Market Outlook

Forecast: SCI reckons that the BOPET market will trend down in June, and transactions at low prices may increase. In June, the cost support may weaken. The inventory pressure stemming from the continuous capacity release will probably weigh down the BOPET market. With the prices falling, speculative demand may pick up, underpinning the BOPET market. SCI predicts that the negotiation price for general-purpose 12μ BOPET in East China will be RMB 7,510-7,910/mt next month. It is predicted that the overall BOPET price will inch down first and then climb in the next three months. The monthly average price of BOPET from June to August 2023 is estimated at RMB 7,800/mt, RMB 8,000/mt and RMB 8,200/mt respectively.

Cost: The prices of PET chip may trend down first and then rebound in the next three months. In June, the PET chip price is likely to fluctuate downward due to the weakened cost support, slight inventory accumulation and slow demand season for the textile industry. From July to August, the traditional peak demand season is upcoming. By then, the winter orders in the textile industry may start, which may drive up the domestic demand for PET chip. In addition, the feedstock price is also anticipated to increase, supporting the PET chip prices. The monthly average price of semi-gloss PET chip from June to August 2023 is estimated to be RMB 6,800/mt, RMB 6,750/mt and RMB 6,800/mt respectively

Supply: In the next three months, 5 new production lines will still be put into use. 4 production lines will be restarted. Meanwhile, 3 production lines may be shut down for maintenance. The supply is expected to increase as the overall increase in output is estimated to be larger than the output loss. The supply increase may put a damper on the market prices.

Demand: With the price falling, the speculative demand may increase. It will be the traditional peak demand season in Q3, which is expected to drive up the demand. As for orders, the overall order level is at more than 11 days’ worth, and that at some enterprises is more than 20 days’ worth.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.