2022 China Cracking C5 Annual Data At-a-Glance

In the past five years, the supply and demand pattern of China's cracking C5 market maintained a weak balance. The capacity of cracking C5, a by-product of large refining and chemical integration unit, maintained a sustained growth in recent years. The base of downstream capacity continued to increase, and the consumption of cracking C5 continued to grow. Meanwhile, the price of its feedstock gained notably. Therefore, the price of cracking C5 ran at a high level in 2022, and the annual average price rose by 30.58% Y-O-Y.

2022 China Cracking C5 Market Annual Data

Remarks: Price spread refers to the spread between cracking C5 price and naphtha price.

1. Cracking C5 price gained by 30.58% Y-O-Y.

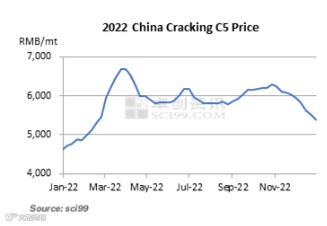

In 2022, cracking C5 prices trended sideways after rising, with three rounds of increases during the year. By the end of 2022, the annual average price of cracking C5 was RMB 5,865.18/mt, up RMB 1,373.39/mt from the end of last year. The highest price appeared in late March, which was RMB 6,550/mt, and the lowest price appeared in early January, which was RMB 4,533/mt. The spread between the highest price and the lowest price was RMB 2,017/mt.

The main factors driving the three rounds of price increases are the cost impetus brought about by rising naphtha prices and the price trend factor caused by supply-side structural reforms.

The price trend in 2022 was impacted by cost, demand and supply in combination. The cost was the first element that affected the market price trend. From January to May, prices of cracking C5 followed the price increase of crude oil and naphtha. In H1, 2022, the price of naphtha, the main feedstock for cracking, rose by nearly 60%, while the cracking C5 price only increased by 30%, far less than the price increase of feedstock. The impact of demand changes on the cracking C5 prices came second. Many separation units were shut down for maintenance in succession from June to August. The inventory at producers built up as the overall consumption declined. In addition, the high temperature made it difficult to store the cracking C5 resources. Then, the price of cracking C5 experienced a downside price correction. In terms of supply, the concentrated maintenance of several units from August to September made the market supply tight in stages, supporting the rise of cracking C5 prices.

2. C5-naphtha price spread gained by 207.76% Y-O-Y.

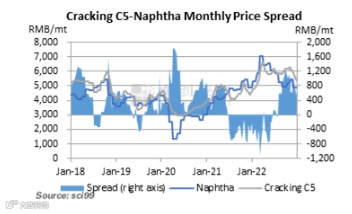

In H1, 2022, the price of cracking C5 showed an uptrend, but the spread between cracking C5 price and naphtha price narrowed as the increase in feedstock naphtha prices was greater than that of cracking C5. After June, with the rapid fall of feedstock prices, the spread rebounded significantly. By the end of September, the price spread turned from negative to positive.

According to SCI’s cracking C5 price spread model, by the end of December 2022, the price spread between C5 and naphtha at representative enterprises was RMB 167.33/mt, up 207.76% Y-O-Y. Taking Sinopec as an example, the highest price spread appeared in September, which was RMB 1,166.67/mt, the highest value since June 2020; the lowest value appeared at the end of May, which was RMB -760/mt, the lowest value since 2018.

3. C5 supply and demand both saw a Y-O-Y rise of over 10%.

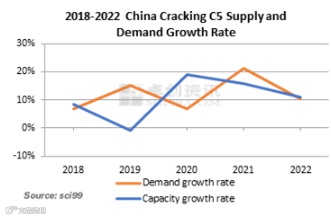

From 2010 to 2022, China’s cracking C5 capacity continued to expand, rising from 1,630kt/a in 2010 to 3,830.1kt/a in 2022, with a five-year CAGR of 10.57%. The growth rate of capacity in 2020 and 2021 both exceeded 15%, of which 2020 witnessed a Y-O-Y increase of 19.13%. From 2019 to 2022, the refining and chemical integration complexes hit fiercely, and the growth rate of cracking C5 capacity was significantly improved. In 2022, the capacity continued expanding, mainly as the units at Sinopec Zhenhai Refining and Chemical Phase II, ZPC, etc. were put into operation.

From 2018 to 2022, the demand for cracking C5 was in an uptrend in China. The CAGR of cracking C5 demand volume was 12.04% in the past five years, and the total demand volume was estimated to be 3,230.8kt in 2022, up 10.68% Y-O-Y. In recent years, the capacity kept expanding in downstream industries, such as isoprene, piperylene, DCPD and petroleum resin industries. Meanwhile, the operating rate of existing units was lifted, so the demand for cracking C5 kept rising.

Conclusion:

It is expected that the cracking C5 market will go under pressure in 2023. The macro-economy is expected to face pressure of destocking cycle. In terms of supply and demand fundamentals, the C5 supply growth is predicted to be higher than the demand growth. On the cost side, the feedstock naphtha price is expected to decline in 2023, which will support the cracking C5 price insufficiently. However, with the recovery of logistics efficiency and the improvement of the terminal demand, the overall confidence of the market is likely to continue to increase, thus improving the industry's cost transmission capacity.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.