Q1 PBR Market Changed Affected by Market Expectations Despite Positive Fundamentals

Key words: High tire operating rate; Supply declining; Disturbance from macro expectations

Snapshot: In Q1, 2023, China’s PBR market price trended up first and then fell. On the whole, the PBR fundamentals were positive in Q1. The market price changed mainly affected by the cost change and disturbance from market expectations. The support from fundamentals may turn weak in a short term. The cost and related products will possibly fail to underpin the PBR market. It is projected that PBR market price is highly possible to fluctuate at lows.

PBR price rose first and then fell, which was lower from the same period of 2022.

In Q1, 2023, the PBR market price first rose and then fell. Up to end-March, the HCBR 9000 market price closed in the range of RMB 10,700-10,850/mt, up 8.84% from the beginning of 2023, but 10.21% lower than the highest price in February. The average price in Q1 was RMB 11,124.59/mt, up 2.22% Q-O-Q, but down 17.16% Y-O-Y.

In Q1, the operating rate at PBR enterprises remained low, while the downstream demand recovered rapidly in February and March, although a large number of workers were absent at tire enterprises in January. Overall, the PBR fundamentals were positive in Q1. The PBR market price changed mainly affected by the cost change and disturbance from market expectations. Meanwhile, macro risks happened frequently and the commodity environment was relatively weak, weighing on the natural rubber market. Therefore, players held severe negative sentiment in the PBR price trend in the coming days. Thus, the PBR market price halt the rise in early March and then fell.

The price of natural rubber hit a yearly low, dragging down the demand for PBR.

In 2023, the price of natural rubber trended down after a brief rise after the Spring Festival holiday. In March, it further declined. The price of SCRWF in Shanghai market dropped to RMB 11,150/mt in mid-March, hitting a yearly low in 2023, which was also the lowest price since August 2020. The price falling was mainly caused by the weak situation of natural rubber industry and macro economy.

From Q4, 2022, the import volume of natural rubber surged. The port inventory rapidly piled up. The inventory in March reached the highest level since October 2020, dragging down the natural rubber price.

In mid-March, the bankruptcy of Silicon Valley Bank in the U.S. triggered turmoil in the European and American financial markets, resulting in increased global financial risks, which curbed the price of commodities. Thus, the price of natural rubber further declined. The price of SCRWF in Shanghai market decreased to around RMB 11,150/mt, which was the lowest price since August 2020. On March 22, the Federal Reserve increased the interest rate by 25 percentage points, negatively affecting the commodity market. Worries of risks caused by the increased interest rate weighed on the commodity market.

The operating rate of major downstream industry moved up from the same period in past years beyond expectations.

After the Spring Festival holiday, the operating rate at tire enterprises recovered rapidly. From mid and late February, the operating rate of all-steel tire industry climbed to around 68% and remained high in March. On the one hand, some previous orders needed to be delivered. On the other hand, the finished product inventory decreased to a low level. As enterprises showed high willingness in replenishment, the operating rate of tire industry stayed at a high level in March. The overall output kept rising. The rigid demand drove up the PBR price.

The operating rate at PBR enterprises crashed by expectations.

In Q1, 2023, the overall operating rate at PBR enterprises was low. The lowest operating rate was below 50%. In Q1, many units at Shandong Yihua Rubber& Plastic Technology, Shandong Wintter Chemical, Shandong Shengyu Chemical and Zhejiang Transfar Synthetic Materials were shut for maintenance. The PBR unit at Nanjing Yangzi Petrochemical and Rubber remained offline. Besides, the units at Zibo Qixiang Tengda Chemical and Zhenhua New Materials ran at lower loads. The 100kt/a PBR unit at Zhejiang Petroleum & Chemical was postponed to take a trial run. No substantial increase in the PBR supply was seen for a long time. The tight supply underpinned the PBR price to some extent.

China’s PBR price may be range-bound in a short term.

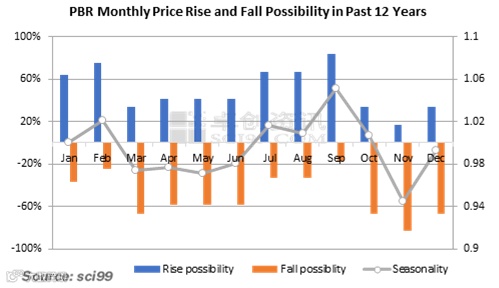

From the perspective of the PBR monthly price rise and fall possibility in past 12 years, the PBR price is more likely to trend down in Q2, due to the stable demand. Yet, as the operating rate at PBR enterprises is likely to recover intensively and newly added units may go into production, the PBR supply is expected to increase, dragging down the PBR price.

In Q2, the PBR units at Xinjiang Lande Fine Petrochemical, TSRC-UBE (Nantong) Chemical Industrial, Sinopec Shanghai Gaoqiao Petrochemical and Liaoning North Dynasol Synthetic Rubber are scheduled to take maintenance for around 20 days. However, as the PBR units at Shandong Wintter Chemical, Shandong Shengyu Chemical, Shandong Yihua Rubber & Plastic Technology and Zhejiang Transfar Synthetic Materials will resume normal production, and the newly added unit at Zhejiang Petroleum & Chemical may come on stream, the PBR supply in the market is expected to move up. Besides, the PBR unit at PetroChina Daqing Petrochemical is scheduled to take overhauls in June. But the unit at Nanjing Yangzi Petrochemical and Rubber may resume production in July. In addition, it may enter the industrial slack season in Q3. Thus, the fundamentals were expected to be relatively bearish. The natural rubber spot inventory will possibly continue to be high, failing to bolster the rise in natural rubber price. In Q2, the butadiene units may take maintenance intensively, driving up the butadiene price. On the whole, curbed by overall bearish factors, the PBR price is predicted to mainly fluctuate at lows in Q2.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.