Bamboo Pulp Tissue Prices Likely to Inch Down in H2 of May

Intro: In H1 of May, some tissue mills in Sichuan and Chongqing underwent maintenance downtime, leading to decreased supply. In addition, bamboo pulp prices ticked up, lending cost support to the tissue prices. Therefore, the bamboo pulp jumbo roll prices were relatively stable. For the H2 of May, downstream demand is mediocre, and the supply will gradually recover, some tissue mills may still attempt to destock, so it is predicted that the bamboo pulp jumbo roll prices will probably inch down in H2 of May.

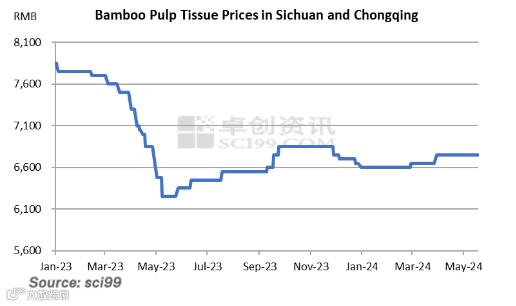

Bamboo pulp jumbo roll prices were steady in H1 of May.

In H1 of May, bamboo pulp prices inched up and were at a relatively high level, lending cost support to the bamboo pulp jumbo roll prices. Besides, some tissue mills experienced shutdown, leading to curtailed output. As a result, the bamboo pulp jumbo roll prices were relatively steady. However, downstream demand was sluggish, and some tissue mills suffered inventory pressure, so a few prices softened, while most prices showed no apparent fluctuations. As of May 17, the tax-inclusive average price of bamboo pulp jumbo roll in Sichuan and Chongqing was RMB 6,750/mt, flat compared with the end of April.

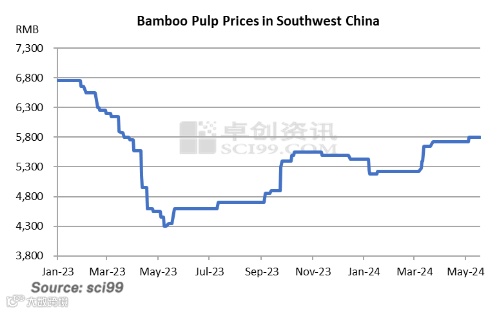

Steady prices were mainly backed by the cost factor.

In H1 of May, bamboo pulp prices still edged up. As of May 17, the mainstream dealing prices of bleached bamboo pulp board in Southwest China were in the range of RMB 5,500-6,100/mt, and the average price rose by RMB 75/mt or 1.31% from the end of April. The increase in bamboo pulp prices drove up the costs of bamboo pulp jumbo rolls. As of May 17, the tax-inclusive cost of bamboo pulp jumbo roll was RMB 7,390/mt, up 1.08% from the end of April, underpinning the jumbo roll prices from the cost side.

The tug-of-war between supply and demand resulted in varied market sentiments.

In April, due to decreased market demand and largely stable operating rates of tissue mills, the inventory at tissue mills in Southwest China ramped up. Entering May, tissue mills shut down for maintenance or arranged differentiated production to ease the supply pressure and buffer the tissue price downtrend. However, end demand remained lackluster, and end orders were insufficient, so some tissue mills slowly reduced inventory and some still faced destocking pressure. Given different cost structures and operation strategies, some tissue mills attempted to cut profits to destock while some intended to maintain firm prices.

Bamboo pulp jumbo roll prices are likely to correct downwards.

Supply: In H2 of May, tissue mills that went under downtime will gradually resume production, increasing the supply. Besides, tissue mills still have a slightly high level of inventory currently, and they still show destocking demand, which will be inconducive to the tissue prices.

Demand: Downstream converters show insufficient buying appetites amid lukewarm online orders. With the approach of the mid-year shopping fest, some converters will possibly show rigid restocking demand, and the overall demand is likely to marginally rebound, providing support to the tissue prices.

Cost: Wood pulp prices fluctuate at highs and are expected to rise for a long term. Although bamboo pulp transactions are insipid, the prices remain firm, lending cost support to the bamboo pulp jumbo roll prices.

On the whole, in H2 of May, the market supply of bamboo pulp tissue may increase, and some tissue mills will probably cut profits to destock, so it is predicted that the bamboo pulp jumbo roll prices may slightly move down.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.