ABS Market May Recover in Q4 2024

Introduction: The cost decline combined with the weakening supply and demand structure resulted in a slight decrease in the average price of ABS in the third quarter. The diminishing demand for household appliances and other products, coupled with the sustained abundant spot resources, was changing the replenishment methods of downstream players and traders, leading to a cooling market trading atmosphere. The fundamentals may continue to constrain the market’s upward trend in the later stage, but given the positive macroeconomic expectations, it is expected that the ABS market may recover amid the weak fluctuations.

The ABS market was soft in the third quarter of 2024. The prices in feedstock markets declined, but producers were unwilling to adjust the price downwards. Therefore, the profit improved. Downstream demand was mostly in the off-season, first decreasing and then slightly rebounding compared to the previous period. Downstream factories mainly purchased feedstock to cover the rigid demand, so producers faced higher inventory pressure.

Weak price fluctuation amid the insufficient unilateral driving force.

The ABS market continued to fluctuate within a narrow range in the third quarter, with a weak unilateral trend in the market. The cost first fell and then slightly recovered. More producers conducted maintenance, so sellers stood firm on the prices. Although the cost shifted downwards during the quarter, production of general ABS was still at a loss, and producers tended to stabilize prices. Summer was approaching, and planned maintenance was concentrated, resulting in a decrease in industry supply, which provided support to the prices. Downstream industries such as home appliances entered the traditional off-season, so demand showed seasonal weakness, hindering sales. Amid the impact of bullish and bearish factors at the same time, the market continued to weaken and stayed in a stalemate.

In July, the market price climbed and then decreased, with the supply side exerting more pressure. During the month, the supply first decreased and then increased, and the market price adjusted accordingly. The market was weak and narrowly fluctuated in August. The combination of low supply and demand, coupled with fluctuating costs, led to poor sales for sellers, and some market prices slightly weakened. As general ABS material producers still faced losses, the actual downward adjustment in price was limited. In September, the ABS market fluctuated and declined as the supply and demand structure improved less than expected. The decline in commodity markets put a damper on the market, causing a slight decline in ABS prices. At the end of September, ABS prices rebounded slightly due to the improving macroeconomic expectations. Overall, the mainstream market slightly declined in the third quarter. Because of production losses, the downwards space was limited. According to SCI, the average price of HI-121H in the East China market reached RMB 11,406.82/mt in the quarter, with an overall operating range of RMB 11,300-11,550/mt, a decrease of 0.91% compared to the average price of RMB 11,511.29/mt in the second quarter.

Chart 1 China ABS Price Trends

Production losses narrowed with cost pressure easing.

The average theoretical profit of ABS enterprises in the third quarter was RMB -298.40/mt, a decrease of 56.68% compared to the average profit of RMB -688.88/mt in the second quarter. In the third quarter, upstream feedstock prices fell from high levels, and ABS costs decreased by 2.23%. The price decline of ABS was not as significant as the cost decline, so the production losses eased. The main driving force behind the continuous decrease in cost transmission resistance came from the increase in maintenance. In addition, after consecutive months of losses, producers faced higher pressure, which is why the pace of the ABS price adjustment was slower than that of the feedstock price adjustment.

Chart 2 China ABS Cost and Profit Comparison

Output dropped in the slow season.

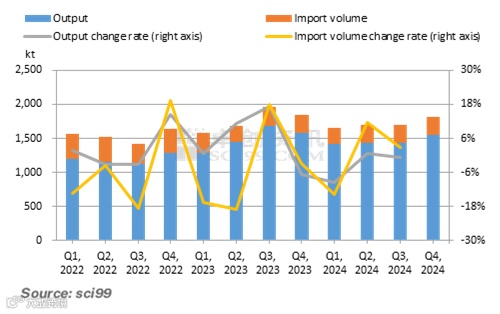

China’s ABS output was approximately 1,429kt in the third quarter, a decrease of 0.54% compared to the second quarter and a year-on-year decrease of 15.40% compared to the third quarter of 2023. In the third quarter, 300kt/a new capacity at Zhejiang Petroleum and Chemical went into production. China’s total ABS capacity reached 8,595kt/a.

The output of ABS from July to September was 479kt, 471.1kt, and 478.9kt, respectively. The monthly output first decreased and then increased narrowly. During this period, some production lines at Ineos, North Huajin Chemical Industry, LG Chem (Huizhou) Petrochemical, and PetroChina Jilin Petrochemical were undergoing maintenance. In addition, a few production lines were operating unstably. The industry operating rate was in the range of 58.94%-62.09%.

The import volume of ABS increased in the third quarter, thanks to the replenishment at low prices and the stimulus of RMB appreciation. The total import volume of ABS was estimated at 268.6kt in the third quarter, up 2.72% from last quarter and down 3.70% from last year. It is predicted that the supply volume of ABS will reach 1,697.6kt in the third quarter, down 13.74% from last year and down 0.04% from last quarter.

Chart 3 China ABS Supply Volume

Demand weakened with home appliance output decreasing.

The overall demand for ABS in China in the third quarter showed a weakening trend compared to the previous quarter. The home appliance industry, the ABS industry’s primary end-consumer sector, performed well in the first half of the year. However, entering the third quarter, due to the abundant inventory of some home appliance products and the demand release ahead of time, the monthly output of air conditioners, refrigerators, and automobiles showed a downward trend compared to the same period last month. Starting from July, the output of major consumer industries such as refrigerators and air conditioners deviated from this year’s peak, with air conditioning output in August being less than half of this year’s peak. The automobile output declined for two consecutive months. Affected by the weakening demand in the terminal home appliance industry and the holidays in downstream areas during summer, the ABS market has encountered certain resistance to price increases, and the pre-sale pace of ABS producers also significantly slowed down, leading to an increase in inventory pressure. In terms of the export market, it is expected that the total export volume of ABS in China in the third quarter will reach 645kt, an increase of 50.70% year-on-year. The proportion of exports to total consumption is less than 4.00%, and due to its small proportion, its impact on the current market price of ABS is limited.

……

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.