How will “Trump 2.0” Influence China’s PP Industry?

Preamble: Donald Trump officially starts his second term after the U.S. presidential election. The “Trump deal” has also gone from expectation to reality. The market players expect that the trade war 2.0 will start soon. SCI analyzes the possible influence on the PP market from the current situation of the industry and Donald Trump’s policy propositions.

On November 6, 2024, Beijing time, Trump officially confirmed his inauguration as the 47th president of the United States and started his second term. The “Trump deal” also followed, and market sentiment gradually began to ferment, affecting the polyolefin market as well.

1. The output of traditional energy, crude oil, is expected to increase.

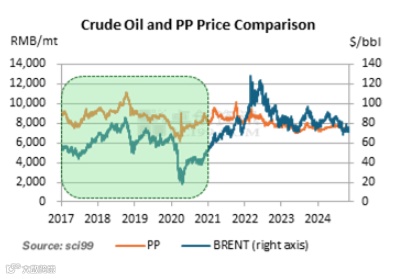

Crude oil is one of the feedstock sources of PP, and the fluctuation of crude oil prices has a positive correlation with the PP production cost and profit. Trump tends to support traditional industries and advocates increasing output to suppress oil prices, to ultimately achieve the goal of inflation reduction. This has also been embodied in the Trump 1.0 period. Crude oil prices hovered within $50-60/bbl from 2017 to 2020 accordingly. Therefore, it is expected that crude oil output will probably climb during the Trump 2.0 period. In addition, the OPEC+ policy may exert pressure on crude oil supply, jointly pulling crude oil prices. The cost support for the PP market may weaken.

2. Tariff barriers are likely to be raised, which may affect the PP import and export in China.

During Trump’s 1.0 term from 2017 to 2020, he advocated “low taxes, low interest rates and high tariffs”. It is expected that imposing tariffs during his 2.0 term is also one of the foreseeable economic measures. The high-tariff trade policy may further affect China’s polyolefin industry and the export business of finished products.

China’s overall PP import dependence is relatively low. From January to September 2024, the proportion of PP imported from the United States was only 1.13%, and the import volume decreased by 22.56% YOY. Although the export field has been expanding in recent years, the export destinations are mainly near-sea countries and areas, and Africa and South America are the new directions. The U.S. is located in North America, and North America and South America mainly supply PP cargoes to each other. China’s PP exports to the U.S. were relatively limited because of the geographical location and price level, which totaled 5.9kt from January to September 2024. Therefore, the impact of the U.S. tariff increase on the PP market in China will probably be limited.

3. High tariffs on finished products increased resistance of the export business in China.

On May 14, the U.S. launched the results of its four-year review of its Section 301 tariff imposed on China, increasing tariffs on Chinese imports, targeting a variety of imports from China, including electric vehicles, lithium batteries, photovoltaic cells, prominent minerals, semiconductors, harbor crane and personal protective equipment. As for PP application, downstream industries affected by this tariff adjustment are mainly electric vehicles, lithium batteries, medical equipment and sanitary material. Therein, the tariff on electric vehicles will rise notably from the current 25% to 100% in 2024 or up to 102.5% if the basic tariff is included. The export volume of China-origin electric vehicles to the U.S. was only 12,500 from January to September 2024. The export may be impacted narrowly in the short run. However, in the context of fierce competition among global electric vehicle companies, a 100% tariff basically blocks the possibility of exports to the U.S., weakens the future market share of Chinese electric vehicles in the U.S., and thus cuts back the possibility of the U.S. becoming dependent on the Chinese supply chain.

As an important part of total China’s export cargoes, electric vehicles, lithium batteries, medical equipment and sanitary materials account for a high proportion of exports to the U.S. It is expected that relevant policies on tariffs will be introduced one after another after Trump takes office, which may lead to further escalation of Sino-U.S. trade frictions, forcing Chinese companies to accelerate the internationalization process and avoid the impact of U.S. tariffs.

Overall, under the background of global economic pressure, Trump’s coming to power and policy propositions may exert certain pressure on China’s domestic trade. For the polyolefin industry, the U.S. is also China’s prominent trading partner, and the relevant measures taken after his coming to power will also pose certain challenges to the industry. Opportunities also come with challenges, and China’s internationalization of polyolefins will continue. China will relieve pressure by continuously exploring overseas markets. The “Trump deal” is still in the process of moving from expectations to reality, and the actual impact on the polyolefin industry may depend on the specific implementation of related policies in the future.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.