Some HDPE Varieties Saw Y-O-Y Price Decreases in H1, 2024

Introduction: In H1 of 2024, China’s HDPE market fluctuated upwards. The spot market prices were boosted by costs and supply, but some varieties saw Y-O-Y price decreases.

1. Prices fluctuated upwards in H1, but Y-O-Y decreases were seen in some varieties.

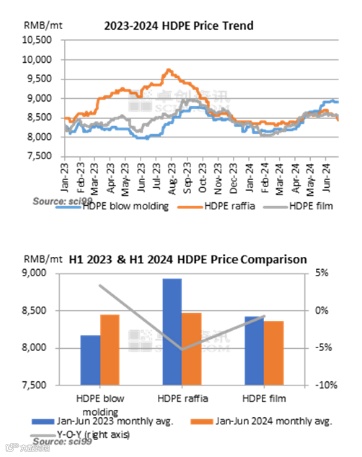

In H1 of 2024, China’s HDPE market witnessed upward fluctuations, and this trend aligns with our predictions in the 2023-2024 China HDPE Market Annual Report. Supported by costs and supply side, spot market prices increased. The prices of all HDPE varieties rose in Q2. However, compared to the same period last year, prices of some varieties fell. From January to June 2024, the average price of HDPE raffia in China was RMB 8,467.26/mt, down 5.20%Y-O-Y; the average price of HDPE blow molding was RMB 8,446.18/mt, up 3.41% Y-O-Y; and that of HDPE film was RMB 8,367.50/mt, down 0.70% Y-O-Y.

The peak of HDPE market prices in H1 of 2024 occurred in April and May. On one hand, macroeconomic positives boosted the commodity market, driving plastic futures higher and thus lifting HDPE market prices. On the other hand, HDPE units underwent intensive maintenance from April to May, indicating an earlier-than-usual maintenance period. As a result, the supply of some resources was relatively tight, leading to continuous price increases. However, April to June is traditionally the slack season for demand when the consumption of market resources is slow. Therefore, some traders faced significant inventory pressures, causing a narrowing in the price increase at the beginning of June, with some even showing a downward trend. Furthermore, as some downstream producers underwent maintenance or reduced operating rates, their consumption of feedstock showed a decreasing trend. As a result, downstream users only purchased feedstock at lows based on rigid demand, which dented the demand for HDPE. From June 4 to June 7, HDPE prices fell into a downward trajectory.

2. Supply Side: Maintenance Alleviated Supply Pressure

2.1 No newly added HDPE capacity in H1 of 2024, and the output loss due to maintenance increased.

There was no change in HDPE capacity in H1 of 2024 compared to 2023, mainly because projects such as that at a certain enterprise in Shandong, Shandong Yulong Island Refining and Chemical Integration Project, and Sinopec Tianjin Company Nangang Project that were originally planned to be started in H1 of 2024 were all delayed. Currently, China’s total HDPE capacity remains at 17,085kt/a.

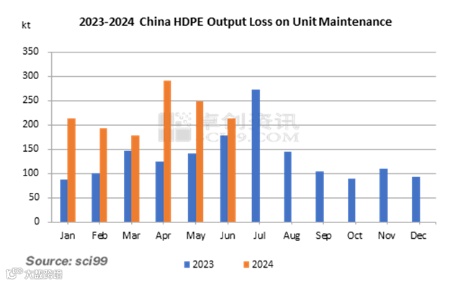

From January to June 2024, the HDPE output loss due to unit maintenance in China reached 1,134.6kt, up 89.45% Y-O-Y, and the output loss in every month was higher than that in the same period of 2023. Maintenance shutdowns increased due to compressed profits from producing HDPE, and the intensive maintenance period arrived earlier than usual. In April, the HDPE output loss due to maintenance reached 292kt, hitting the highest monthly loss for the year and setting a new historical record.

2.2 H1 output increased Y-O-Y, yet the supply pressure eased in Q2

Petrochemical enterprises’ HDPE output in China totaled 6,395.1kt from January to June 2024, which increased by 3.01% from H1 of 2023. In September 2023, the 400kt/a HDPE unit was added at Ningxia Baofeng Energy Group. Therefore, although there was no new capacity in Q1, 2024 and the monthly output loss increased Y-O-Y, the output gained growth. In Q2, the output was lower than that in the same period last year as the output loss due to maintenance notched a new high.

3. Demand side: It showed a tepid performance in H1 of 2024, but resilience remained.

3.1 Downstream industries registered varied performance, keeping the total demand stable.

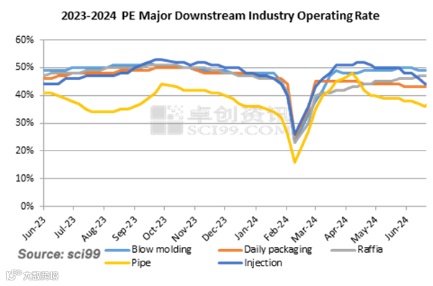

In H1 of 2024, China’s economy showed signs of improvement, with consumer spending improving. In Q1, China’s GDP grew by 5.3% Y-O-Y. As the economy continued to recover, employment conditions improved, and consumption scenarios increased, domestic demand continued its warming trend, further driving consumption growth. In June, China’s manufacturing PMI was 49.5%, and the prosperity remained at the same level as in May. This indicates that overall business operations remained expansionary, though at a slower pace. The GDP growth in Q2 was estimated at around 5.1%. In terms of daily packaging, HDPE film packaging benefited from its high frequency of renewal needs, showing strong demand resilience, and the overall operating rate stayed at the same level as in previous years. In terms of HDPE pipe, the downstream operating rates dropped from last year, affected by the continuous adjustments in the real estate industry and the lack of strong support from favorable policies. HDPE blow molding and HDPE injection, without clear positive drivers, witnessed minor decreases in the proportion of demand, and the operating rates in these fields remained largely stable.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.