Oct SBR Imports & Exports Rise MoM and YoY

Introduction: In October 2024, China’s SBR import volume was 34.8kt, up 17.59% MoM and up 22.67% YoY. The export volume was 14.7kt, up 4.77% MoM and up 20.41% YoY. The total import volume from January to October was 326.7kt, up 9.46% YoY, and the total export volume was 163.7kt, up 23.05% YoY.

In October, the SBR import volume climbed MoM and YoY.

According to GACC, the SBR import volume was 34.8kt in October 2024, up 17.59% MoM and up 22.67% YoY. From January to October 2024, the SBR import volume was 326.7kt, up 9.46% YoY. From the perspective of China’s SBR output and demand volume, from January to October, China’s SBR output was 1,042.1kt, up 0.53% YoY, and China’s total semi-steel tire output was 529.5474 million pieces, up 8.45% YoY. According to SCI’s data, the SBR supply in 2024 edged up YoY, while the semi-steel tire output rose notably YoY. Additionally, the import volume also trended up. Overall, the supply and demand were relatively balanced. There were price advantages for some trade partners, so traders showed some interest in participating in the market for arbitrage. There were stable SBR resources imported via processing trade with imported materials.

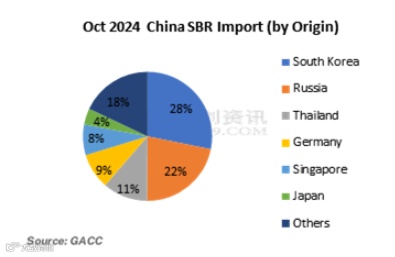

According to GACC, China’s top 5 trade partners for SBR imports in October were South Korea, Russia, Thailand, Germany, and Singapore. South Korea ranked first. The import volume of SBR from South Korea in October was 9.8kt, up 62.92% MoM and up 65.97% YoY. Russia ranked second. The import volume of SBR from Russia in October was 7.6kt, down 16.99% MoM but up 37.66% YoY. The import prices of SBR from South Korea, Russia, and Thailand were $2,432.13/mt, $1,604.17/mt, and $2,672.82/mt respectively. As seen from the trade mode in October, the volume of SBR imported via logistics goods in areas under special customs supervision accounted for 25.78% of the total. Those via general trade took up around 35.83%. Those via processing trade with imported materials accounted for around 35.02%. Processing trade with imported materials tended to choose customers with processing trade manuals, as their import volume was stable with relatively low import costs.

In October, the SBR exports moved up MoM and YoY.

According to GACC, the SBR export volume in October 2024 was 14.7kt, up 4.77% MoM and up 20.41% YoY. From January to October 2024, the total SBR export volume was 163.7kt, up 23.05% YoY. In October, the reason for the MoM rise in China’s SBR export volume was as follows. Downstream tire enterprises in Southeast Asia had some rigid demand for feedstock SBR. Besides, when the SBR price was falling, they showed higher interest in procurement. The overall SBR export volume was still at a high level in October.

Southeast Asia was still the major export destination.

According to GACC, China’s top 5 SBR export trade partners in October were Thailand, Vietnam, Cambodia, Indonesia, and Pakistan, with a total export volume of 13kt, which accounted for 88% of China’s total SBR export volume. Therein, the export volume to Thailand was 5.2kt, ranking first, which rose by 22.75% MoM. The operating rate at tire enterprises in Thailand was relatively high. Besides, there were some price advantages for China’s SBR. Thus, there was some rigid demand for SBR in Thailand. The mainstream export prices lingered at $1,750-1,900/mt.

As for SBR production in November and December, the SBR units at PetroChina Jilin Petrochemical and PetroChina Fushun Petrochemical may run at a higher load. The relocated 220kt/a ESBR unit at Shen Hua Chemical Industrial is expected to be restarted, and the existing 170kt/a ESBR unit may also operate. The other SBR units may see no obvious change. The SBR resources circulating in the market are expected to ramp up. The operating rate of China’s tire industry is predicted to slide. With high SBR prices, the demand for feedstock SBR at tire enterprises is likely to decline. The spot SBR may continue to be traded based on rigid demand. Thus, the supply-demand fundamentals are expected to drive the SBR market weakly.

Imports: The operating rate of China’s downstream tire industry is expected to edge down in November and December 2024. Yet, considering the import price, there are expected to be some SBR resources imported via processing trade with imported materials, and players may be cautious about operating via general trade. Based on China’s SBR supply-demand status, the SBR import volume is expected to be around 30-35kt from November to December 2024.

Exports: The downstream tire industry in Southeast Asia will possibly have some rigid demand and may maintain basic purchases of SBR. It is projected that China’s SBR exports are likely to remain high from November to December 2024, lingering at 13kt-16kt.

All information provided by SCI is for reference only, which shall not be reproduced without permission.

Please click "Read more" for the full article.