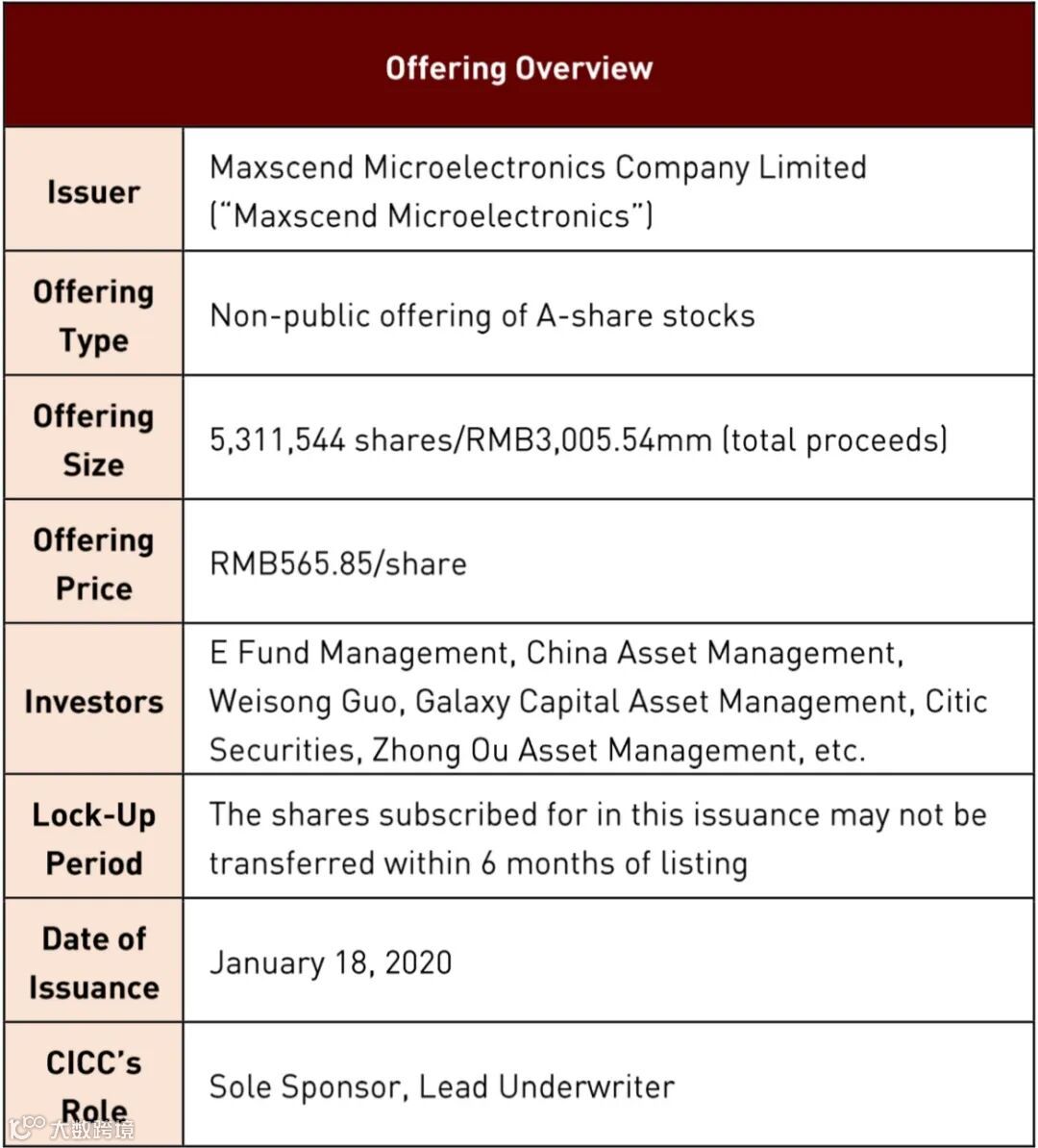

Maxscend Microelectronics Company Limited was established in 2012, and is a leading domestic chip manufacturer in RFFE niche market. It is mainly engaged in the design, manufacturing, and sales of RF IC devices, including solutions of various modules and RFFE discrete devices like RF switches, low noise RF amplifiers, and RF filters. The Company was listed on the ChiNext in 2019 and recorded a market cap of RMB 120.1bn as of January 18, 2020.

Based on the deep insight in semiconductor industry, CICC comprehensively considered the long-term development strategy of Maxscend Microelectronics, and made the specific plan for this project in advance. As a result, CICC helped the Company to submit the application of follow-on offering as soon as possible after the implementation of registration-based system. During the regulatory review process, CICC assisted the company to communicate with regulatory authorities for several times, which mainly focused on semiconductor industry outlook and business model, and finally successfully completed the registration. During the issuance process, CICC tapped into market demand and contributed all effective subscriptions which is dominated by mutual funds and QFII, forming an institutional investor-driven bookkeeping structure, highlighting the company's medium and long-term investment value. Even though the company's share price had risen by more than 100% since the announcement of the offering, CICC carried out multiple rounds in-depth roadshow in an efficient manner and covered more than 150 investors, which boosted market confidence for the successful issuance and finally achieved 3.8x over-subscription. The follow-up offering is a successful and meaningful second cooperation between CICC and Maxscend following the company’s A-share IPO on the ChiNext in 2019. CICC was highly recognized by the issuer for the capability of providing continuous services. CICC has deeply participated in the company’s multiple landmark transactions on the capital market.